Question: please answer these 5 questions 1. FastDrop economic value You are planning to place your money in safe government securities, which currently offer a 4%

please answer these 5 questions

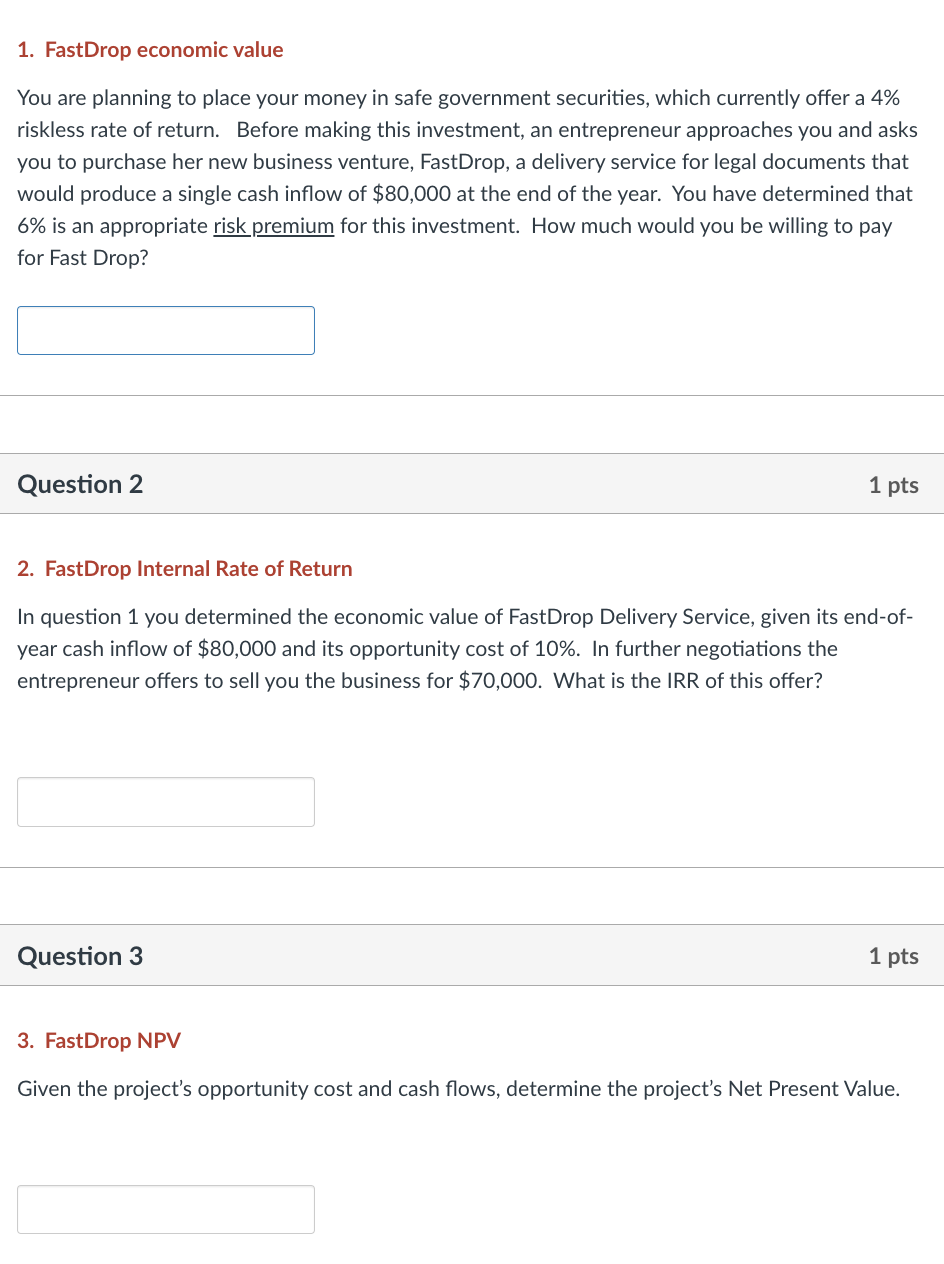

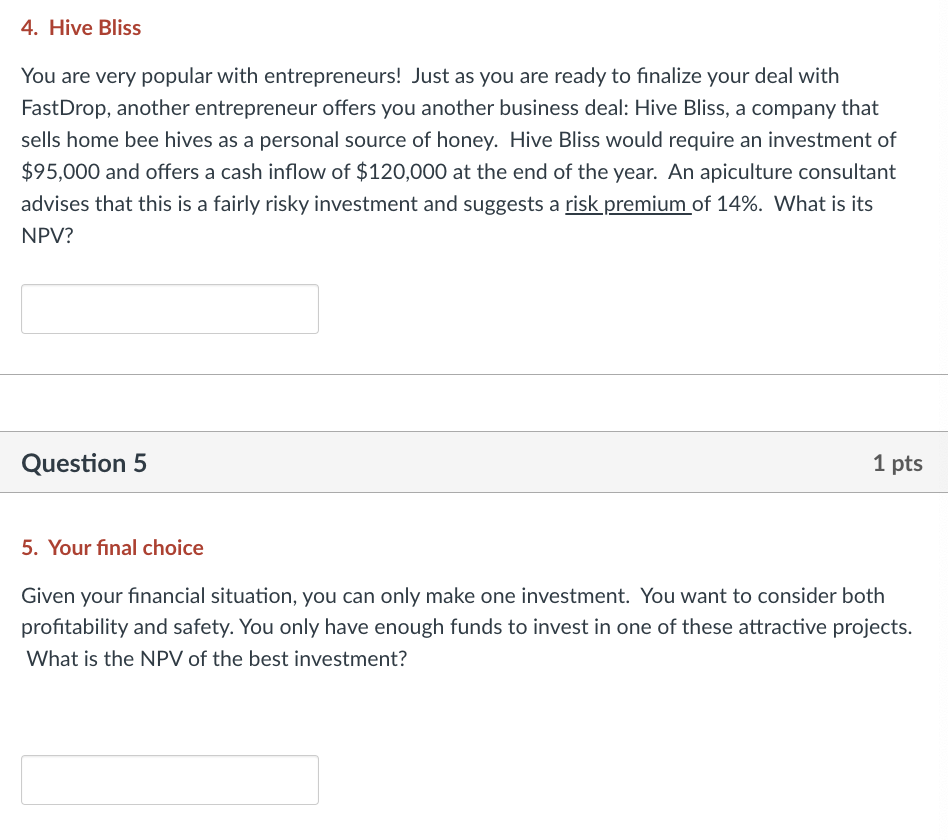

1. FastDrop economic value You are planning to place your money in safe government securities, which currently offer a 4% riskless rate of return. Before making this investment, an entrepreneur approaches you and asks you to purchase her new business venture, FastDrop, a delivery service for legal documents that would produce a single cash inflow of $80,000 at the end of the year. You have determined that 6% is an appropriate risk premium for this investment. How much would you be willing to pay for Fast Drop? Question 2 1 pts 2. FastDrop Internal Rate of Return In question 1 you determined the economic value of FastDrop Delivery Service, given its end-ofyear cash inflow of $80,000 and its opportunity cost of 10%. In further negotiations the entrepreneur offers to sell you the business for $70,000. What is the IRR of this offer? Question 3 1 pts 3. FastDrop NPV Given the project's opportunity cost and cash flows, determine the project's Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts