Question: please answer these five mutiple choice questions. thanks A call option is valuable if the price of the underlying asset the strike price. A put

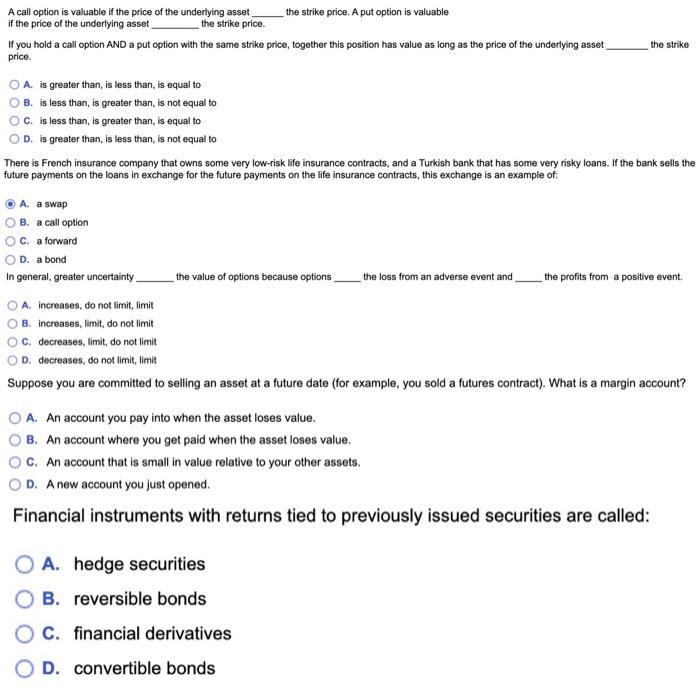

A call option is valuable if the price of the underlying asset the strike price. A put option is valuable if the price of the underlying asset the strike price If you hold a call option AND a put option with the same strike price, together this position has value as long as the price of the underlying asset the strike price A. is greater than, is less than, is equal to B. is less than, is greater than, is not equal to C. is less than, is greater than, is equal to D. is greater than, is less than, is not equal to There is French insurance company that owns some very low-risk life insurance contracts, and a Turkish bank that has some very risky loans. If the bank sells the future payments on the loans in exchange for the future payments on the life insurance contracts, this exchange is an example of A. a swap B. a call option C. a forward OD. a bond In general, greater uncertainty the value of options because options the loss from an adverse event and the profits from a positive event. A. increases, do not limit, limit B. increases, limit, do not limit C. decreases, limit, do not limit D. decreases, do not limit, limit Suppose you are committed to selling an asset at a future date (for example, you sold a futures contract). What is a margin account? O A. An account you pay into when the asset loses value. B. An account where you get paid when the asset loses value. C. An account that is small in value relative to your other assets. D. A new account you just opened. Financial instruments with returns tied to previously issued securities are called: A. hedge securities B. reversible bonds O C. financial derivatives OD. convertible bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts