Question: Please answer these four and explain how to get answer for #12 please. :) 12. You sold short 300 shares of common stock at $55

Please answer these four and explain how to get answer for #12 please. :)

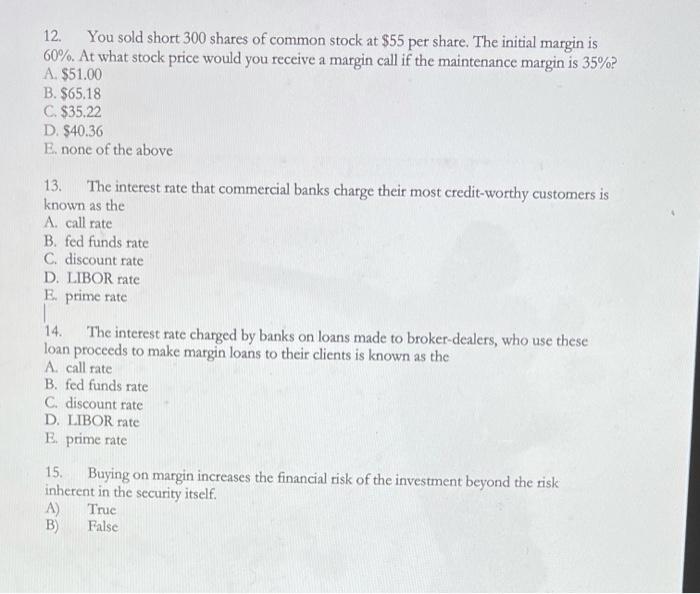

Please answer these four and explain how to get answer for #12 please. :)12. You sold short 300 shares of common stock at $55 per share. The initial margin is 60%. At what stock price would you receive a margin call if the maintenance margin is 35%? A. $51.00 B. $65.18 C. $35.22 D. $40.36 E none of the above 13. The interest rate that commercial banks charge their most credit-worthy customers is known as the A. call rate B. fed funds rate C. discount rate D. LIBOR rate E prime rate The interest rate charged by banks on loans made to broker-dealers, who use these loan proceeds to make margin loans to their clients is known as the A. call rate B. fed funds rate C. discount rate D. LIBOR rate E prime rate 14. 15 Buying on margin increases the financial risk of the investment beyond the risk inherent in the security itself. A) Truc B) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts