Question: PLEASE ANSWER THESE IN EXCEL! AND SHOW THE FORMULAS USED! Oslo Company prepared the following contribution format income statement based on a sales volume of

PLEASE ANSWER THESE IN EXCEL! AND SHOW THE FORMULAS USED!

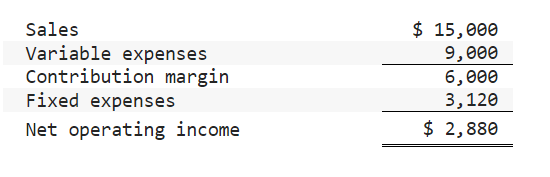

Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units):

1. What is the contribution margin per unit? (Round your answer to 2 decimal places.)

contribution margin per unit:______________

2. What is the contribution margin ratio?

contribution margin ratio:__________________%

3. What is the variable expense ratio?

variable expense ration:_______________%

4. If sales increase to 1,001 units, what would be the increase in net operating income? (Round your answer to 2 decimal places.)

increase in net operation income:__________________

5. If sales decline to 900 units, what would be the net operating income? (Round "Per Unit" calculations to 2 decimal places.)

net operation income:_____________

6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating income? (Round "Per Unit" calculations to 2 decimal places.)

net operating income:_______________

7. If the variable cost per unit increases by $1, spending on advertising increases by $1,050, and unit sales increase by 110 units, what would be the net operating income? (Round "Per Unit" calculations to 2 decimal places.)

net operating income:________________

8. What is the break-even point in unit sales? (Round intermediate calculations to 2 decimal places.)

break-even point:___________ units

9. What is the break-even point in dollar sales?

break-even point:____________

10. How many units must be sold to achieve a target profit of $3,600? (Round intermediate calculations to 2 decimal places.)

number of units:_____________

11. What is the margin of safety in dollars? What is the margin of safety percentage?

|

12. What is the degree of operating leverage? (Round your answer to 2 decimal places.)

degree of operating leverage:_______________

13. Using the degree of operating leverage, what is the estimated percent increase in net operating income that would result from a 5% increase in unit sales? (Round your intermediate calculations and final answer to 2 decimal places.)

increase in net operating income:____________________%

14. Assume that the amounts of the companys total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $3,120 and the total fixed expenses are $9,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)

degree of operating leverage:_______________

15. Assume that the amounts of the companys total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $3,120 and the total fixed expenses are $9,000. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in unit sales? (Round your intermediate calculations and final answer to 2 decimal places.)

increase in net operating income:____________________%

\begin{tabular}{lr} Sales & $15,000 \\ Variable expenses & 9,000 \\ Contribution margin & 6,000 \\ Fixed expenses & 3,120 \\ \hline Net operating income & $2,880 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts