Question: Please answer these questions 1 Identify the three significant dates of a cash dividend and identify what journal entries need to be made on that

Please answer these questions

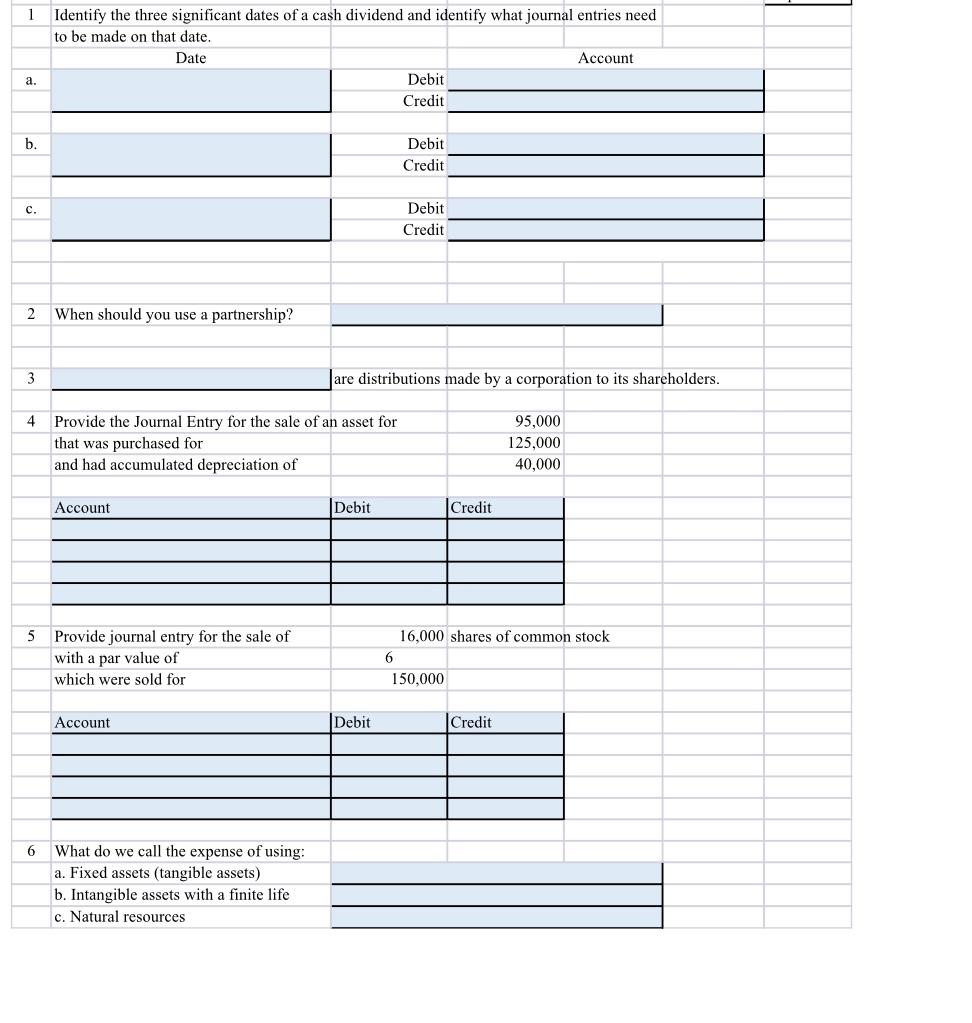

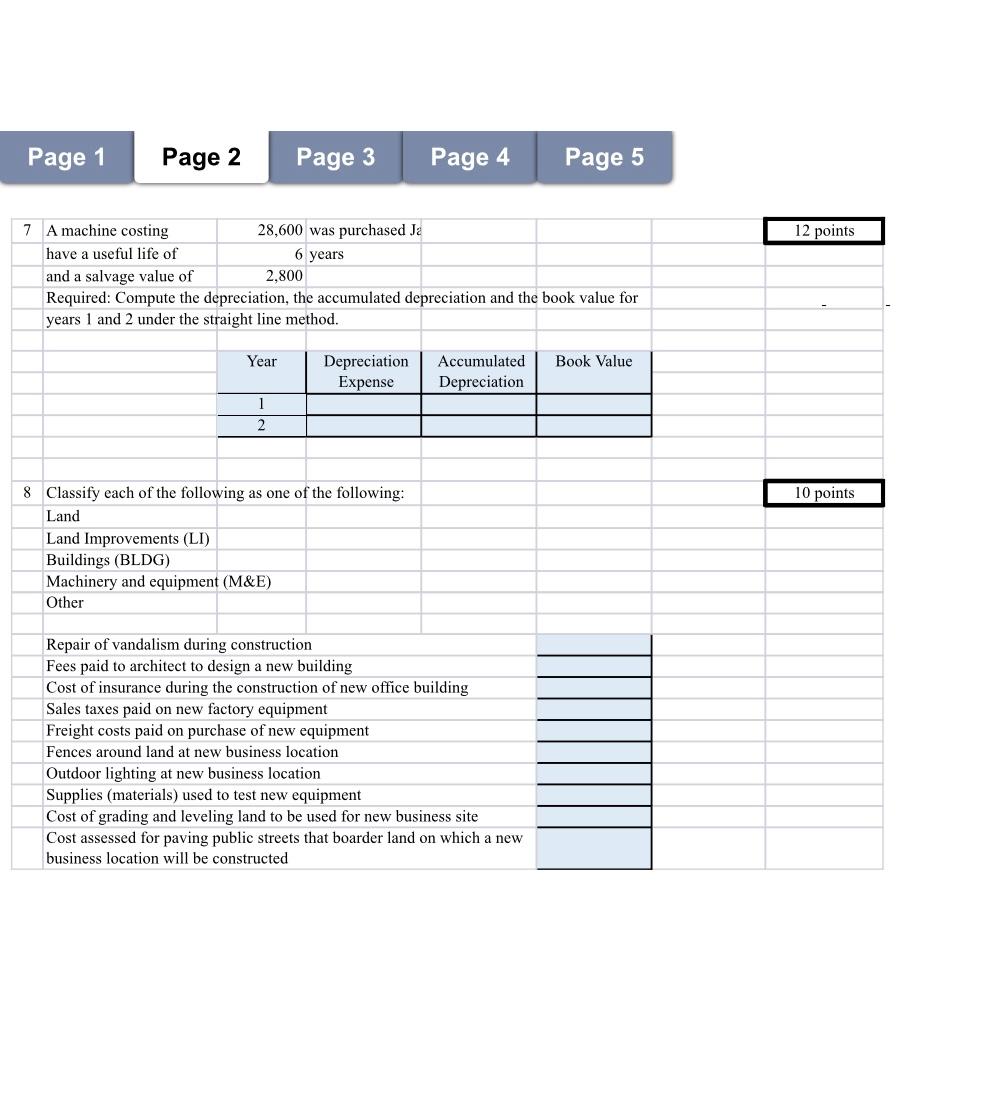

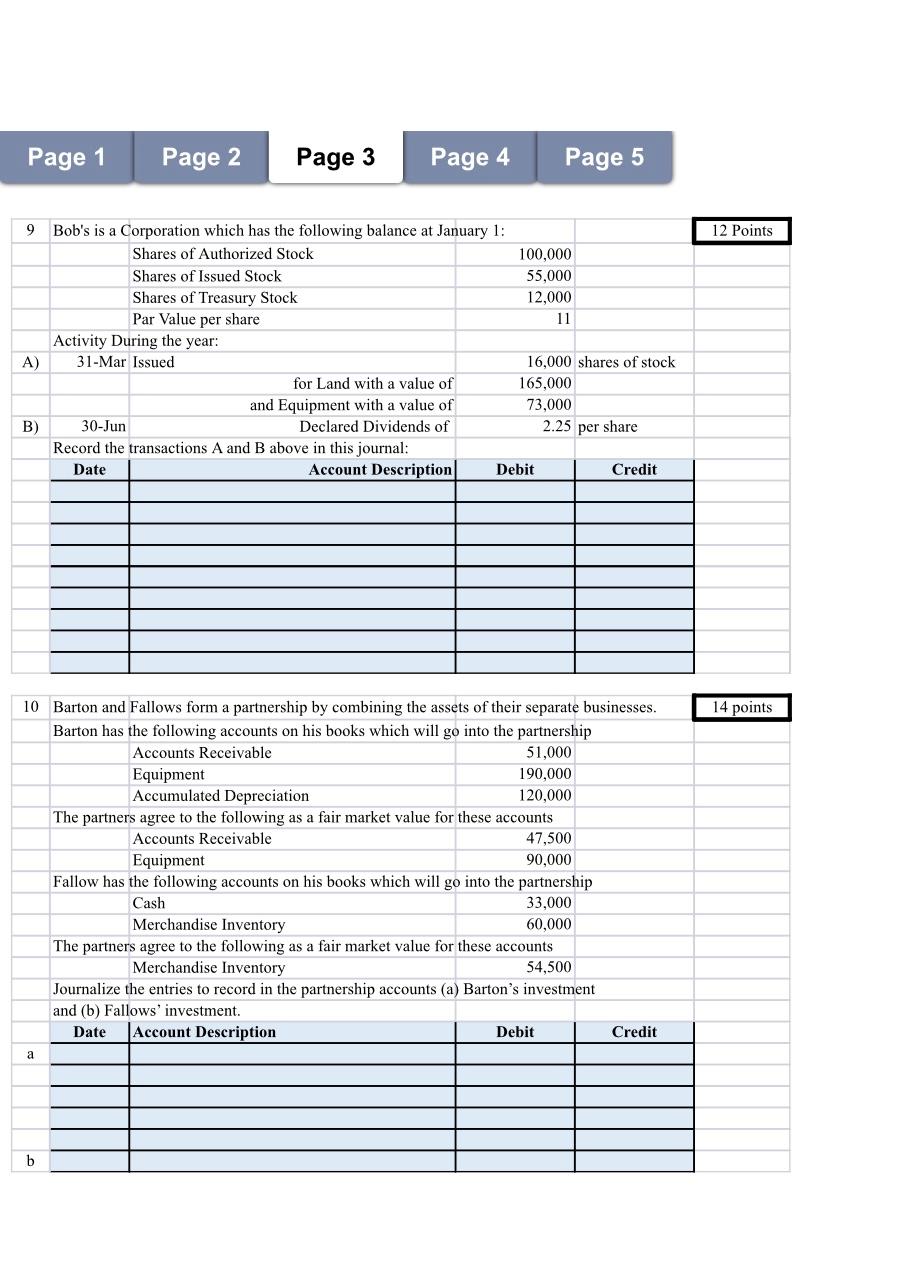

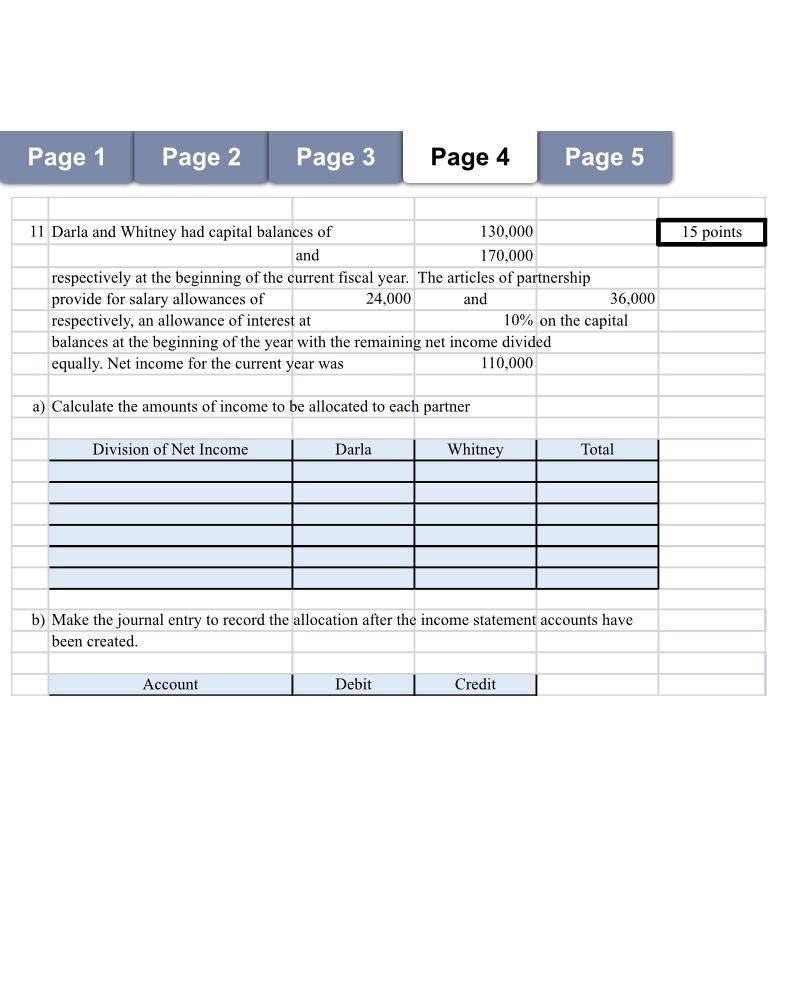

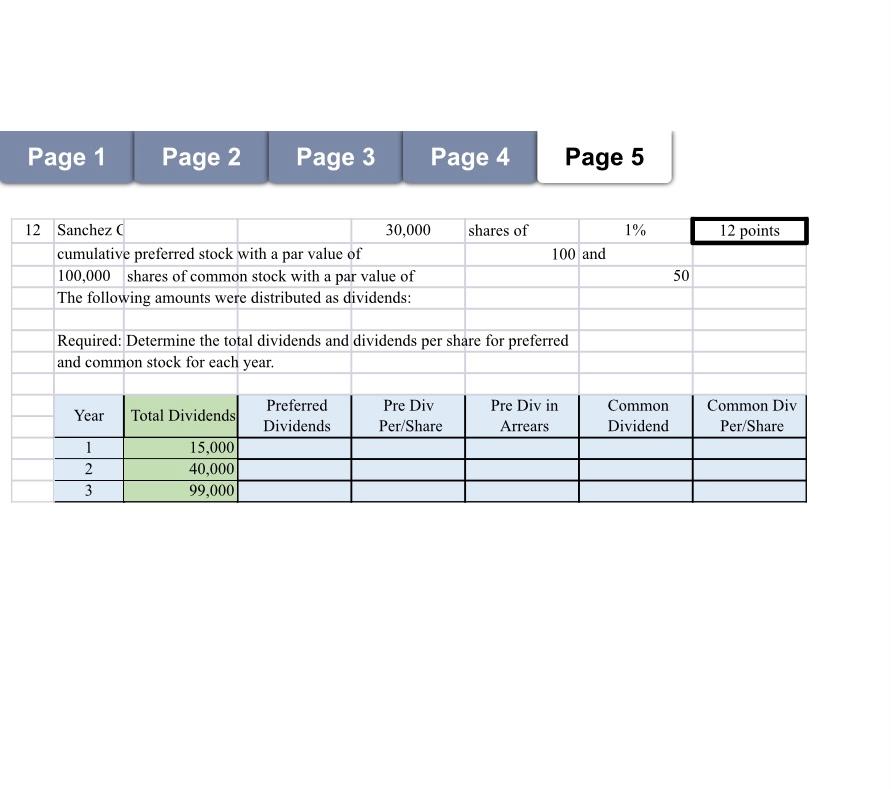

1 Identify the three significant dates of a cash dividend and identify what journal entries need to be made on that date. Date Account a. Debit Credit b. Debit Credit C. Debit Credit 2 When should you use a partnership? 3 are distributions made by a corporation to its shareholders. 4 Provide the Journal Entry for the sale of an asset for that was purchased for and had accumulated depreciation of 95,000 125,000 40,000 Account Debit Credit 5 Provide journal entry for the sale of with a par value of which were sold for 16,000 shares of common stock 6 150,000 Account Debit Credit 6 What do we call the expense of using: a. Fixed assets (tangible assets) b. Intangible assets with a finite life c. Natural resources Page 1 Page 2 Page 3 Page 4 Page 5 12 points 6 years 7 A machine costing 28,600 was purchased Ja have a useful life of and a salvage value of 2,800 Required: Compute the depreciation, the accumulated depreciation and the book value for years 1 and 2 under the straight line method. Year Book Value Depreciation Expense Accumulated Depreciation 1 2 10 points 8 Classify each of the following as one of the following: Land Land Improvements (LI) Buildings (BLDG) Machinery and equipment (M&E) Other Repair of vandalism during construction Fees paid to architect to design a new building Cost of insurance during the construction of new office building Sales taxes paid on new factory equipment Freight costs paid on purchase of new equipment Fences around land at new business location Outdoor lighting at new business location Supplies (materials) used to test new equipment Cost of grading and leveling land to be used for new business site Cost assessed for paving public streets that boarder land on which a new business location will be constructed Page 1 Page 2 Page 3 Page 4 Page 5 12 Points 12,000 9 Bob's is a Corporation which has the following balance at January 1: Shares of Authorized Stock 100,000 Shares of Issued Stock 55,000 Shares of Treasury Stock Par Value per share 11 Activity During the year: A) 31-Mar Issued 16,000 shares of stock for Land with a value of 165,000 and Equipment with a value of 73,000 B) 30-Jun Declared Dividends of 2.25 per share Record the transactions A and B above in this journal: Date Account Description Debit Credit 14 points 10 Barton and Fallows form a partnership by combining the assets of their separate businesses. Barton has the following accounts on his books which will go into the partnership Accounts Receivable 51,000 Equipment 190,000 Accumulated Depreciation 120,000 The partners agree to the following as a fair market value for these accounts Accounts Receivable 47,500 Equipment 90,000 Fallow has the following accounts on his books which will go into the partnership Cash 33,000 Merchandise Inventory 60,000 The partners agree to the following as a fair market value for these accounts Merchandise Inventory 54,500 Journalize the entries to record in the partnership accounts (a) Barton's investment and (b) Fallows' investment. Date Account Description Debit Credit a b Page 1 Page 2 Page 3 Page 4 Page 5 15 points 11 Darla and Whitney had capital balances of 130,000 and 170,000 respectively at the beginning of the current fiscal year. The articles of partnership provide for salary allowances of 24,000 and 36,000 respectively, an allowance of interest at 10% on the capital balances at the beginning of the year with the remaining net income divided equally. Net income for the current year was 110,000 a) Calculate the amounts of income to be allocated to each partner Division of Net Income Darla Whitney Total b) Make the journal entry to record the allocation after the income statement accounts have been created. Account Debit Credit Page 1 Page 2 Page 3 Page 4 Page 5 shares of 1% 12 points 100 and 12 Sanchez 30,000 cumulative preferred stock with a par value of 100,000 shares of common stock with a par value of The following amounts were distributed as dividends: 50 Required: Determine the total dividends and dividends per share for preferred and common stock for each year. Year Total Dividends Preferred Dividends Pre Div Per/Share Pre Div in Arrears Common Dividend Common Div Per/Share 1 2 3 15,000 40,000 99,000 1 Identify the three significant dates of a cash dividend and identify what journal entries need to be made on that date. Date Account a. Debit Credit b. Debit Credit C. Debit Credit 2 When should you use a partnership? 3 are distributions made by a corporation to its shareholders. 4 Provide the Journal Entry for the sale of an asset for that was purchased for and had accumulated depreciation of 95,000 125,000 40,000 Account Debit Credit 5 Provide journal entry for the sale of with a par value of which were sold for 16,000 shares of common stock 6 150,000 Account Debit Credit 6 What do we call the expense of using: a. Fixed assets (tangible assets) b. Intangible assets with a finite life c. Natural resources Page 1 Page 2 Page 3 Page 4 Page 5 12 points 6 years 7 A machine costing 28,600 was purchased Ja have a useful life of and a salvage value of 2,800 Required: Compute the depreciation, the accumulated depreciation and the book value for years 1 and 2 under the straight line method. Year Book Value Depreciation Expense Accumulated Depreciation 1 2 10 points 8 Classify each of the following as one of the following: Land Land Improvements (LI) Buildings (BLDG) Machinery and equipment (M&E) Other Repair of vandalism during construction Fees paid to architect to design a new building Cost of insurance during the construction of new office building Sales taxes paid on new factory equipment Freight costs paid on purchase of new equipment Fences around land at new business location Outdoor lighting at new business location Supplies (materials) used to test new equipment Cost of grading and leveling land to be used for new business site Cost assessed for paving public streets that boarder land on which a new business location will be constructed Page 1 Page 2 Page 3 Page 4 Page 5 12 Points 12,000 9 Bob's is a Corporation which has the following balance at January 1: Shares of Authorized Stock 100,000 Shares of Issued Stock 55,000 Shares of Treasury Stock Par Value per share 11 Activity During the year: A) 31-Mar Issued 16,000 shares of stock for Land with a value of 165,000 and Equipment with a value of 73,000 B) 30-Jun Declared Dividends of 2.25 per share Record the transactions A and B above in this journal: Date Account Description Debit Credit 14 points 10 Barton and Fallows form a partnership by combining the assets of their separate businesses. Barton has the following accounts on his books which will go into the partnership Accounts Receivable 51,000 Equipment 190,000 Accumulated Depreciation 120,000 The partners agree to the following as a fair market value for these accounts Accounts Receivable 47,500 Equipment 90,000 Fallow has the following accounts on his books which will go into the partnership Cash 33,000 Merchandise Inventory 60,000 The partners agree to the following as a fair market value for these accounts Merchandise Inventory 54,500 Journalize the entries to record in the partnership accounts (a) Barton's investment and (b) Fallows' investment. Date Account Description Debit Credit a b Page 1 Page 2 Page 3 Page 4 Page 5 15 points 11 Darla and Whitney had capital balances of 130,000 and 170,000 respectively at the beginning of the current fiscal year. The articles of partnership provide for salary allowances of 24,000 and 36,000 respectively, an allowance of interest at 10% on the capital balances at the beginning of the year with the remaining net income divided equally. Net income for the current year was 110,000 a) Calculate the amounts of income to be allocated to each partner Division of Net Income Darla Whitney Total b) Make the journal entry to record the allocation after the income statement accounts have been created. Account Debit Credit Page 1 Page 2 Page 3 Page 4 Page 5 shares of 1% 12 points 100 and 12 Sanchez 30,000 cumulative preferred stock with a par value of 100,000 shares of common stock with a par value of The following amounts were distributed as dividends: 50 Required: Determine the total dividends and dividends per share for preferred and common stock for each year. Year Total Dividends Preferred Dividends Pre Div Per/Share Pre Div in Arrears Common Dividend Common Div Per/Share 1 2 3 15,000 40,000 99,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts