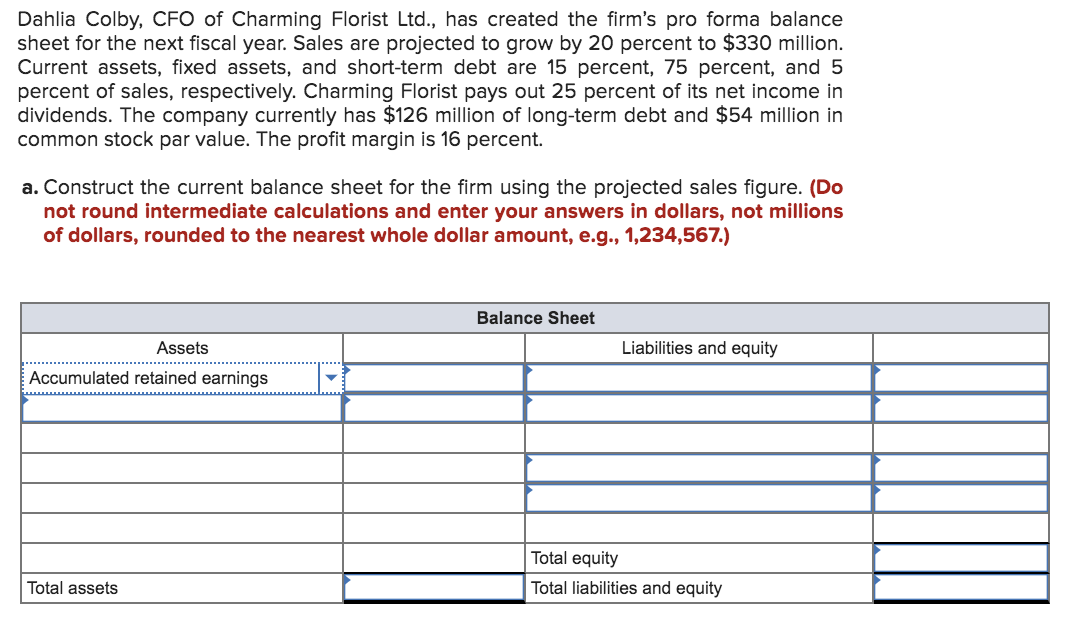

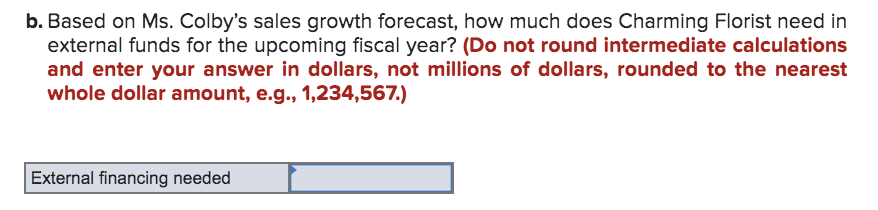

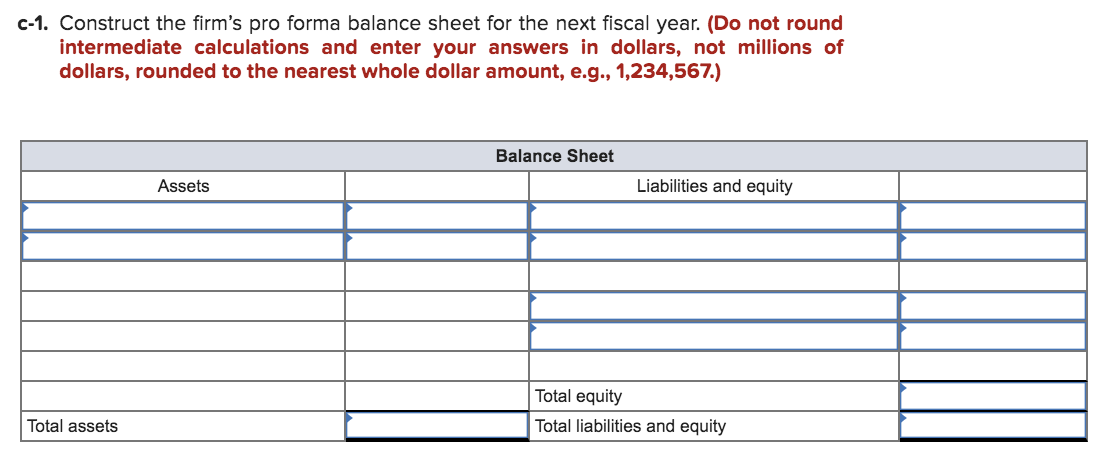

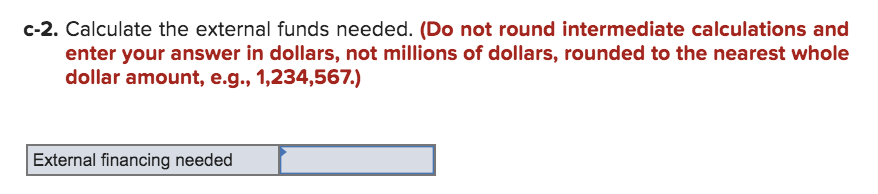

Question: Please answer these questions and explain how Dahlia Colby, CFO of Charming Florist Ltd., has created the rm's pro forma balance sheet for the next

Please answer these questions and explain how

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock