Question: please, answer these questions below. 2 Roman Destinations issues bonds due in 12 years with a stated interest rate of 8% and a face value

please, answer these questions below.

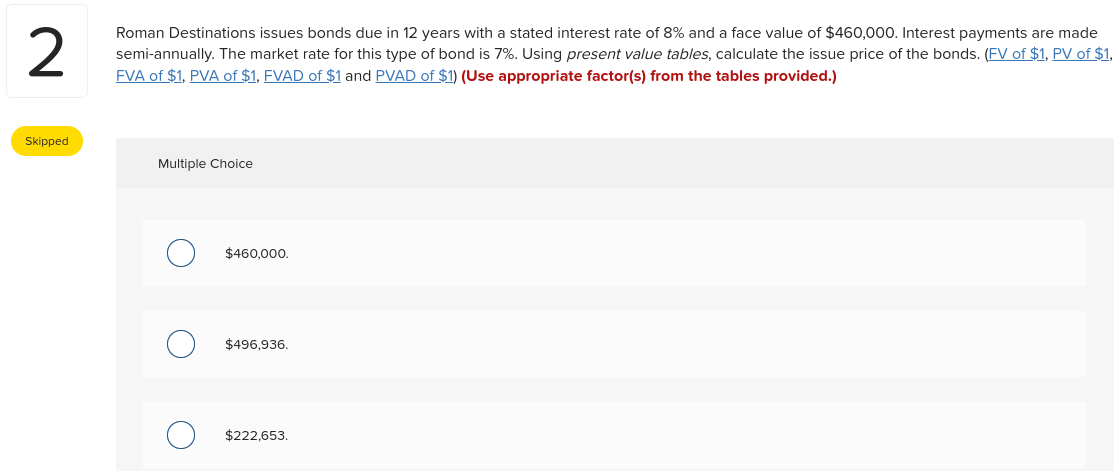

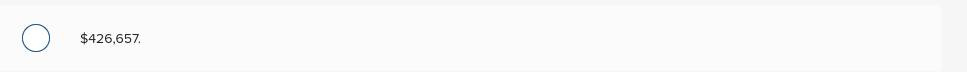

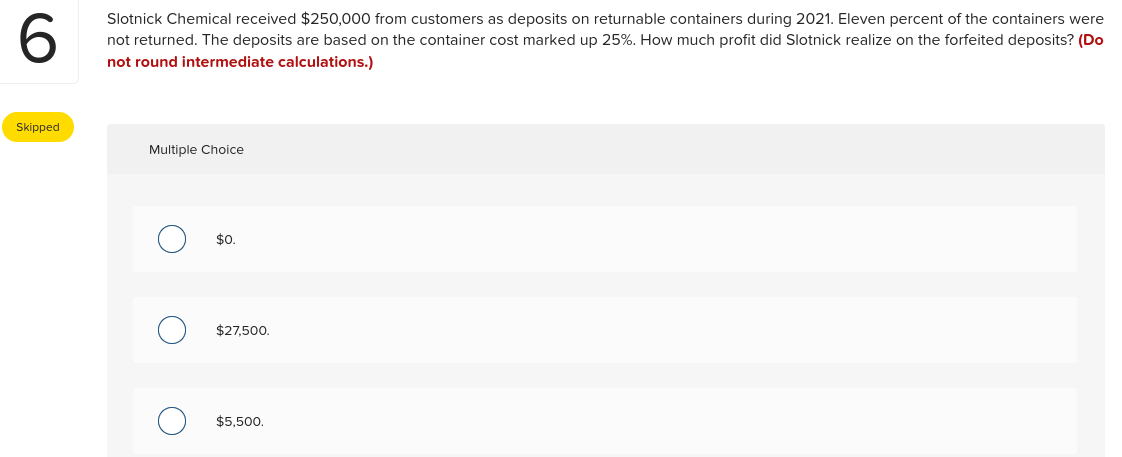

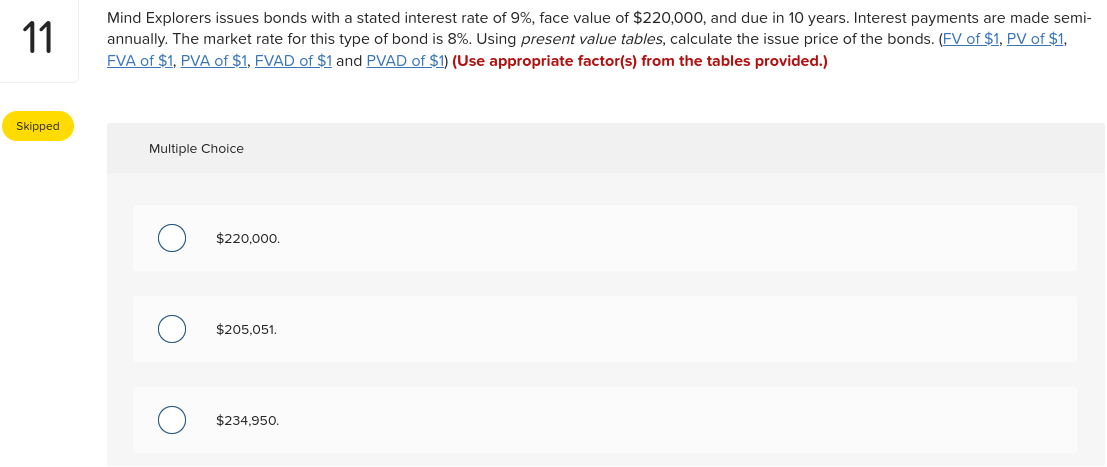

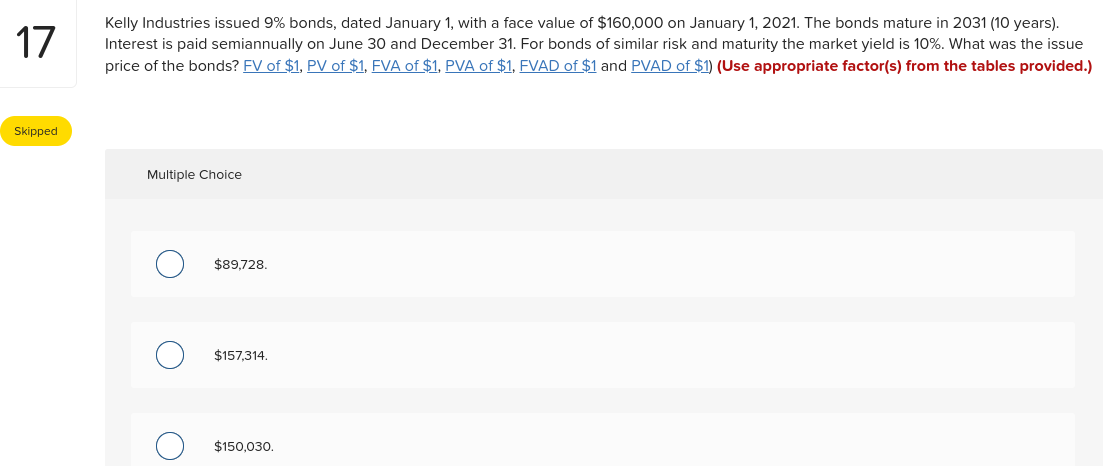

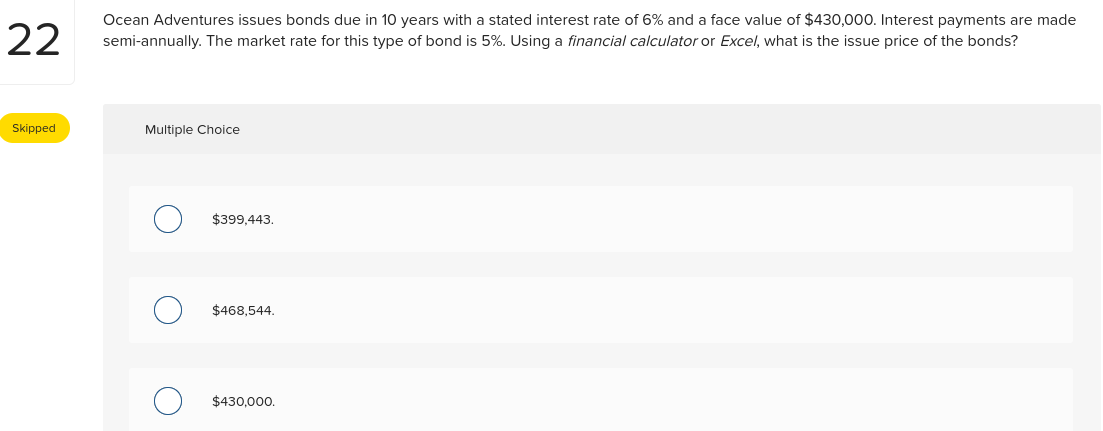

2 Roman Destinations issues bonds due in 12 years with a stated interest rate of 8% and a face value of $460,000. Interest payments are made semi-annually. The market rate for this type of bond is 7%. Using present value tables, calculate the issue price of the bonds. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Skipped Multiple Choice $460,000 $496,936. $222,653 $426,657 6 Slotnick Chemical received $250,000 from customers as deposits on returnable containers during 2021. Eleven percent of the containers were not returned. The deposits are based on the container cost marked up 25%. How much profit did Slotnick realize on the forfeited deposits? (Do not round intermediate calculations.) Skipped Multiple Choice $0. o $27.500. o $5,500. O $6,875. 9 Scottie Adams Bird Supplies issued 9% bonds, dated January 1, with a face amount of $260,000 on January 1, 2021. The bonds mature in 2031 (10 years). For bonds of similar risk and maturity the market yield is 8%. Interest is paid semiannually on June 30 and December 31. What is the price of the bonds at January 1, 2021? Some relevant and irrelevant present value factors: Skipped * PV of annuity due of $1: n = 20; i = 4% is 14.13394 * PV of ordinary annuity of $1: n = 20; i = 4% is 13.59033 **PV of $1: n= 20; i = 4% is 0.45639 Multiple Choice $184,498. O $277,668. $436.675. $292,804 11 Mind Explorers issues bonds with a stated interest rate of 9%, face value of $220,000, and due in 10 years. Interest payments are made semi- annually. The market rate for this type of bond is 8%. Using present value tables, calculate the issue price of the bonds. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Skipped Multiple Choice $220,000 $205,051 $234.950 O $178,445. 17 Kelly Industries issued 9% bonds, dated January 1, with a face value of $160,000 on January 1, 2021. The bonds mature in 2031 (10 years). Interest is paid semiannually on June 30 and December 31. For bonds of similar risk and maturity the market yield is 10%. What was the issue price of the bonds? FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Skipped Multiple Choice $89,728. O $157,314 O $150,030. O $113,793. 22 Ocean Adventures issues bonds due in 10 years with a stated interest rate of 6% and a face value of $430,000. Interest payments are made semi-annually. The market rate for this type of bond is 5%. Using a financial calculator or Excel, what is the issue price of the bonds? Skipped Multiple Choice $399,443. $468,544. $430,000. O $463,517 33 Hillside Excursions issues bonds due in 12 years with a stated interest rate of 12% and a face value of $100,000. Interest payments are made semi-annually. The market rate for this type of bond is 10%. Using a financial calculator or Excel, calculate the issue price of the bonds. Skipped Multiple Choice $98,723 $113,799. O O $86,431. O $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts