Question: please answer these questions During the year, Wright Company sells 505 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for

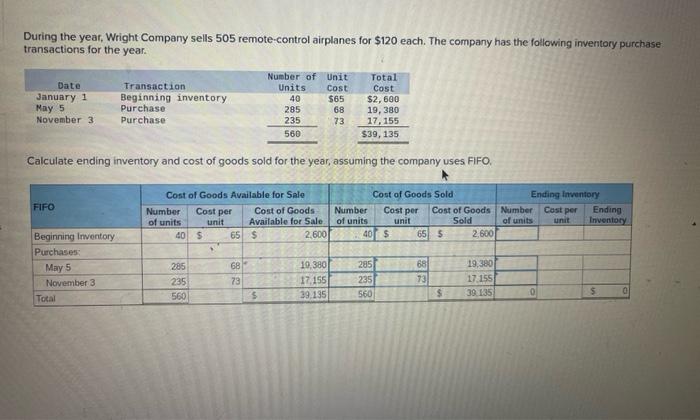

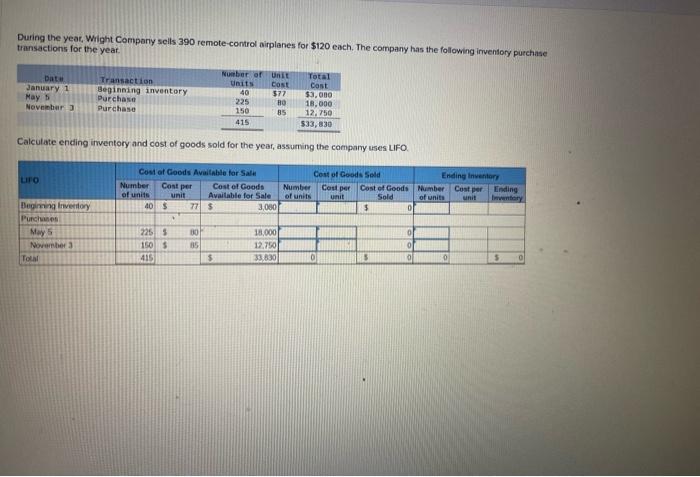

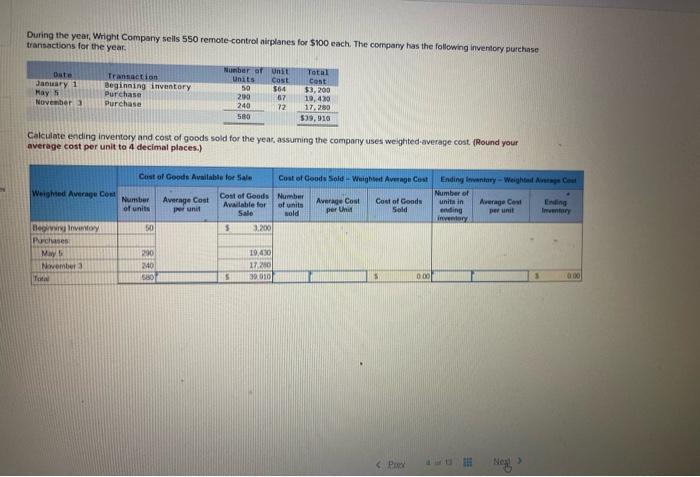

During the year, Wright Company sells 505 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO. During the yeat, Wight Company sells 390 remote-control airplanes for $120 each. The company has the following irventory purchase trinsactions for the year. Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. During the year, Whight Company sells 550 remote control airplanes for $100 each. The company has the following inventory purchase transactions for the year. Calculate enting inventory and cost of goods soid for the year, assuming the compony uses weighted averape cost (Round your average cost per unit to 4 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts