Question: Please answer these questions P4.7 (LO4, 5) (Retained Earnings Statement, Prior Period Adjustment) The following is the retained earnings account for the year 2019 for

Please answer these questions

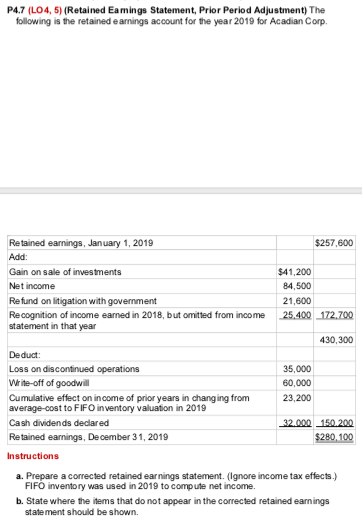

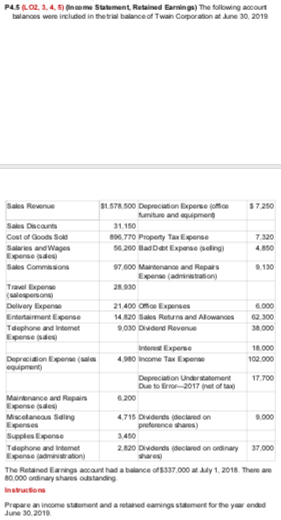

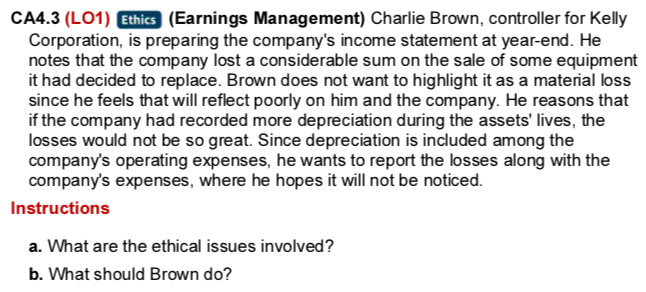

P4.7 (LO4, 5) (Retained Earnings Statement, Prior Period Adjustment) The following is the retained earnings account for the year 2019 for Acadian Corp. Retained earnings, January 1, 2019 $257,600 Add: Gain on sale of investments $41,200 Net income 84,500 Re fund on litigation with government 21,600 Recognition of income earned in 2018, but omitted from income 25,400 172,700 statement in that year 430,300 Deduct: Loss on discontinued operations 35,000 Write-off of goodwill 60,000 Cumulative effect on income of prior years in changing from 23,200 average cost to FIFO inventory valuation in 2019 Cash dividends declared 32.000 150.200 Retained earnings, December 31, 2019 $280, 100 Instructions a. Prepare a corrected retained earnings statement. (Ignore income tax effects.) FIFO inventory was used in 2019 to compute net income. b. State where the items that do not appear in the corrected retained earnings statement should be shown.PAS LOL 1. 4. Ofhome Submint Retained Earnings) The following ancourt bolanos want included in the trial balance of Twain Corporation at June 30, 2018 11,870.800 Depreciation Expone jomon fumiture and equipment 31.180 Cost of Goods Sold Wil.770 Property Tax Expense 7 170 Salaries and Wagon 1 310 Bad Dot Expanse (cling) Sales Commissions #7/400 Maintenance and Repairs 8.130 Expense ( administration) Delivery Expense 31400 Ofon Expenses 14130 Salad Returns and Alowances Tdophone and Intomet 1030 Dividend Revenue Intoroot Expanse 4:410 Mooma Tax Expense 103 030 equipming Doprociation Understatement 17 700 Due to Frfor 3017 (not of bag Maintenance and Ropain Misiclangan Saling 4.718 Dividends (declared on Supples Ilxponse 1.480 Tdophone and Intomet 2.130 Dividends (declared on ordinary Expanse (administration) The Retained anings account had a balance of 1:137 030 at July 1, 3018. There are 80.030 ordinary shares outstanding Propare an income s brioment and or the your ondid June 30 3010CA4.3 (LO1) Ethics (Earnings Management) Charlie Brown, controller for Kelly Corporation, is preparing the company's income statement at year-end. He notes that the company lost a considerable sum on the sale of some equipment it had decided to replace. Brown does not want to highlight it as a material loss since he feels that will reflect poorly on him and the company. He reasons that if the company had recorded more depreciation during the assets' lives, the losses would not be so great. Since depreciation is included among the company's operating expenses, he wants to report the losses along with the company's expenses, where he hopes it will not be noticed. Instructions a. What are the ethical issues involved? b. What should Brown do