Question: Please answer these questions Patton Paints Corporation has a target capital structure of 40% debt and 60% common e preferred stock. Its before-tax cost of

Please answer these questions

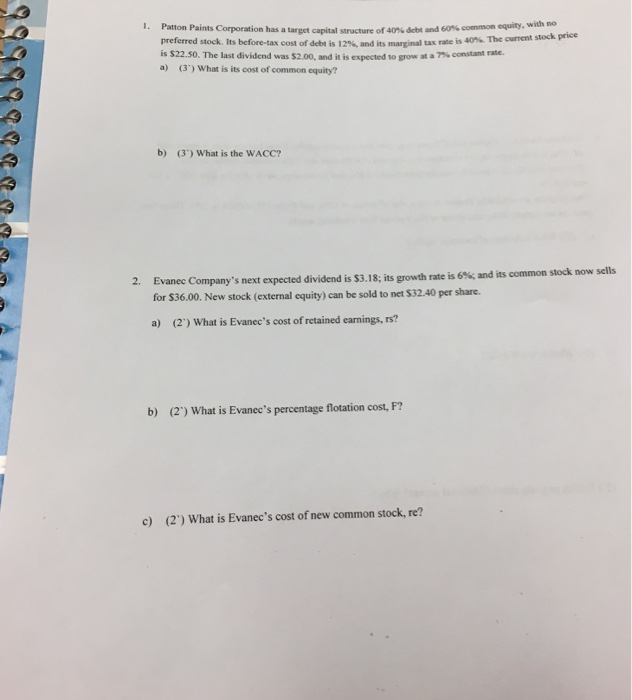

Please answer these questions Patton Paints Corporation has a target capital structure of 40% debt and 60% common e preferred stock. Its before-tax cost of debt is 12%, and its marginal tax rate is 40%. The current stock price is $22.50. The last dividend was $2.00, and it is expected to grow at a 7% constant rate. What is its cost of common equity? What is the WACC? Evanee Company's next expected dividend is $3.18; its growth rate is 6%; and its common stock now sells for $36.00. New stock (external equity) can be sold to net $32.40 per share. What is Evanee's cost of retained earnings, rs? What is Evanee's percentage flotation cost, F? What is Evanee's cost of new common stock, re

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts