Question: Please answer these questions showing steps and formulas Credit analyst John Adams is considering a $1,000 order from a new customer. The cost of filling

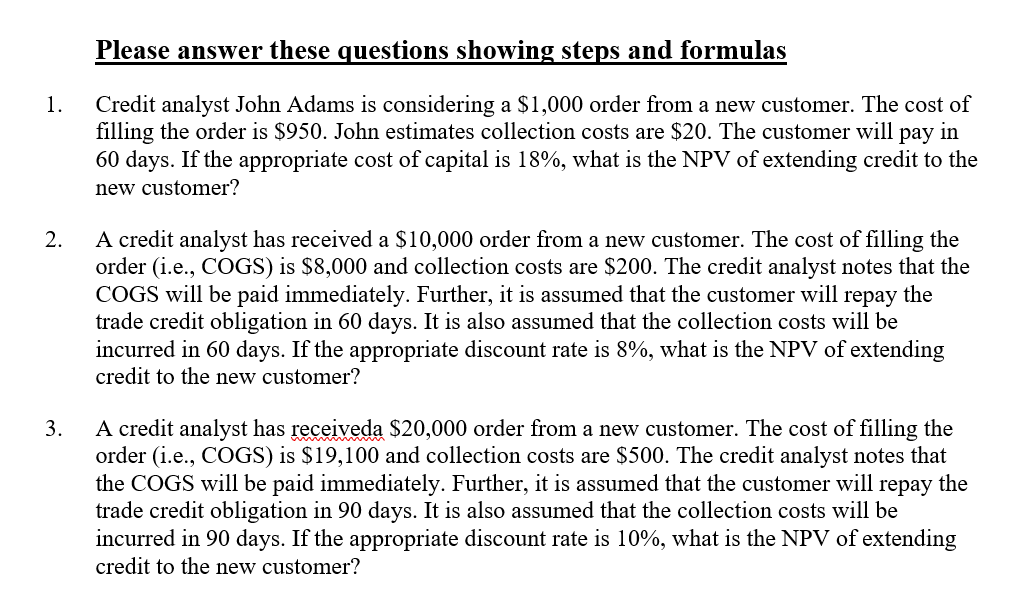

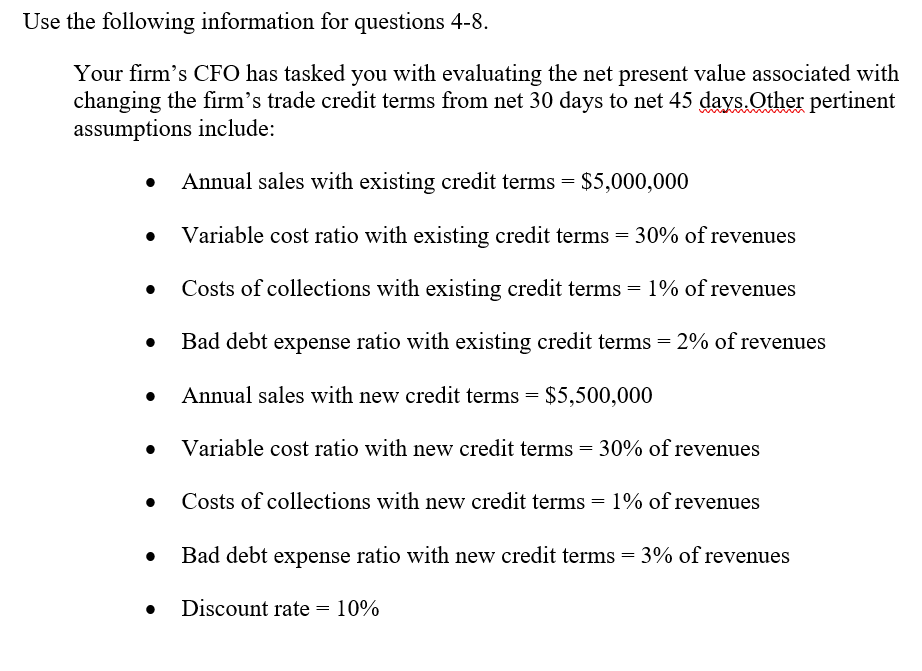

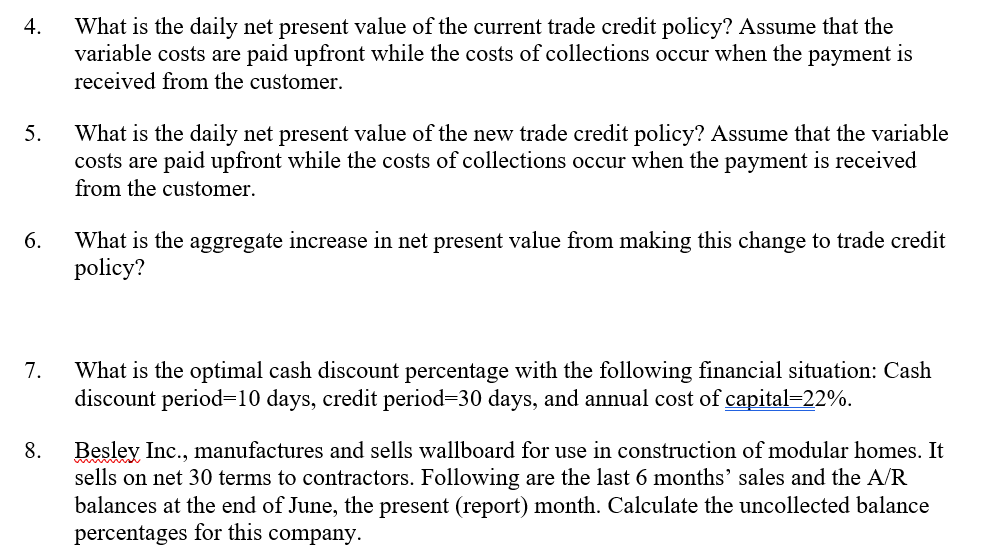

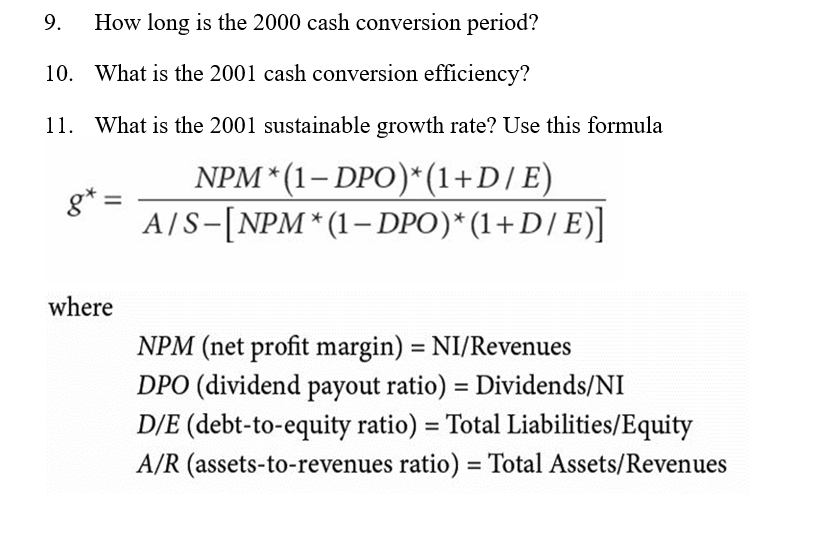

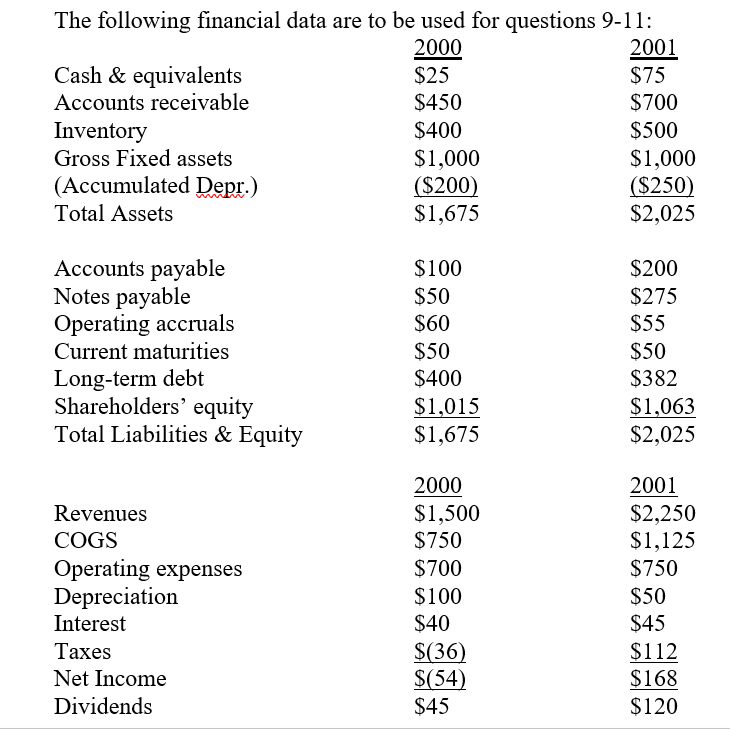

Please answer these questions showing steps and formulas Credit analyst John Adams is considering a $1,000 order from a new customer. The cost of filling the order is $950. John estimates collection costs are $20. The customer will pay in 60 days. If the appropriate cost of capital is 18%, what is the NPV of extending credit to the new customer? 2. A credit analyst has received a $10,000 order from a new customer. The cost of filling the order (i.e., COGS) is $8,000 and collection costs are $200. The credit analyst notes that the COGS will be paid immediately. Further, it is assumed that the customer will repay the trade credit obligation in 60 days. It is also assumed that the collection costs will be incurred in 60 days. If the appropriate discount rate is 8%, what is the NPV of extending credit to the new customer? A credit analyst has receiveda $20,000 order from a new customer. The cost of filling the order (i.e., COGS) is $19,100 and collection costs are $500. The credit analyst notes that the COGS will be paid immediately. Further, it is assumed that the customer will repay the trade credit obligation in 90 days. It is also assumed that the collection costs will be incurred in 90 days. If the appropriate discount rate is 10%, what is the NPV of extending credit to the new customer? Use the following information for questions 4-8. Your firm's CFO has tasked you with evaluating the net present value associated with changing the firm's trade credit terms from net 30 days to net 45 days.Other pertinent assumptions include: Annual sales with existing credit terms = $5,000,000 Variable cost ratio with existing credit terms = 30% of revenues Costs of collections with existing credit terms = 1% of revenues Bad debt expense ratio with existing credit terms = 2% of revenues Annual sales with new credit terms = $5,500,000 Variable cost ratio with new credit terms = 30% of revenues Costs of collections with new credit terms = 1% of revenues Bad debt expense ratio with new credit terms = 3% of revenues Discount rate = 10% What is the daily net present value of the current trade credit policy? Assume that the variable costs are paid upfront while the costs of collections occur when the payment is received from the customer. 5. What is the daily net present value of the new trade credit policy? Assume that the variable costs are paid upfront while the costs of collections occur when the payment is received from the customer. 6. What is the aggregate increase in net present value from making this change to trade credit policy? 7. What is the optimal cash discount percentage with the following financial situation: Cash discount period=10 days, credit period=30 days, and annual cost of capital=22%. 8. Besley Inc., manufactures and sells wallboard for use in construction of modular homes. It sells on net 30 terms to contractors. Following are the last 6 months' sales and the A/R balances at the end of June, the present (report) month. Calculate the uncollected balance percentages for this company. 9. How long is the 2000 cash conversion period? 10. What is the 2001 cash conversion efficiency? 11. What is the 2001 sustainable growth rate? Use this formula otr NPM*(1- DPO)*(1+D/E) A/S-[NPM*(1 DPO)*(1+D/ E)] where NPM (net profit margin) = NI/Revenues DPO (dividend payout ratio) = Dividends/NI D/E (debt-to-equity ratio) = Total Liabilities/Equity A/R (assets-to-revenues ratio) = Total Assets/Revenues The following financial data are to be used for questions 9-11: 2000 2001 Cash & equivalents $25 $75 Accounts receivable $450 $700 Inventory $400 $500 Gross Fixed assets $1,000 $1,000 (Accumulated Depr.) ($200) ($250) Total Assets $1,675 $2,025 Accounts payable Notes payable Operating accruals Current maturities Long-term debt Shareholders' equity Total Liabilities & Equity $100 $50 $60 $50 $400 $1,015 $1,675 $200 $275 $55 $50 $382 $1,063 $2,025 Revenues COGS Operating expenses Depreciation Interest Taxes Net Income Dividends 2000 $1,500 $750 $700 $100 $40 $(36) $(54) $45 2001 $2,250 $1,125 $750 $50 $45 $112 $168 $120

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts