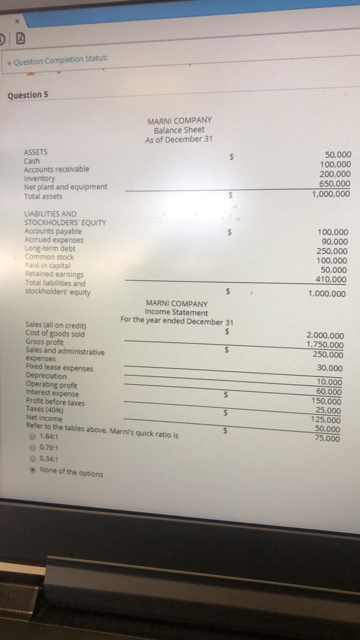

Question: Please answer these questions w Question Completion Status: Question 5 MARNI COMPANY Balance Sheet As of December 31 ASSETS 50,000 Cash 100,000 Accounts receivable 200,000

Please answer these questions

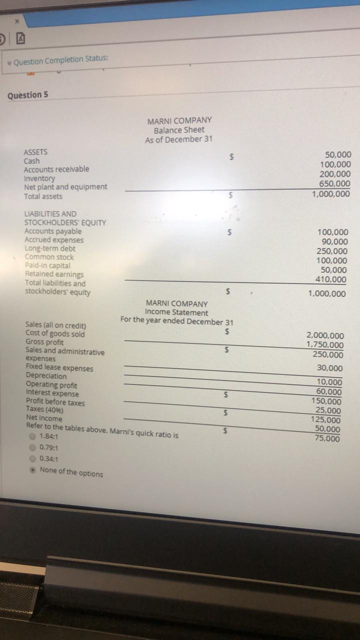

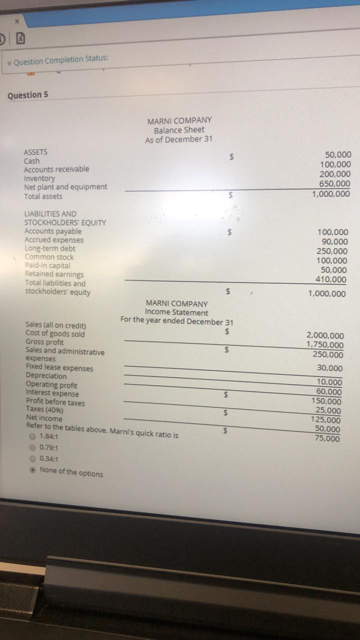

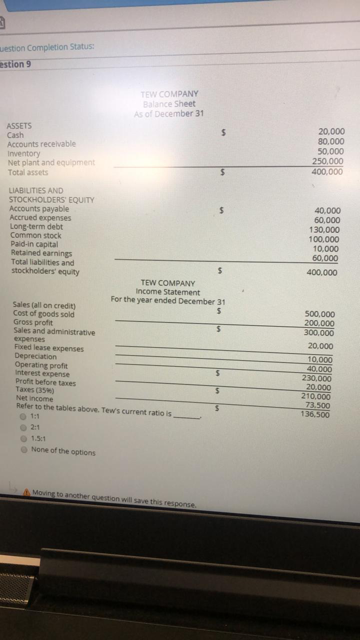

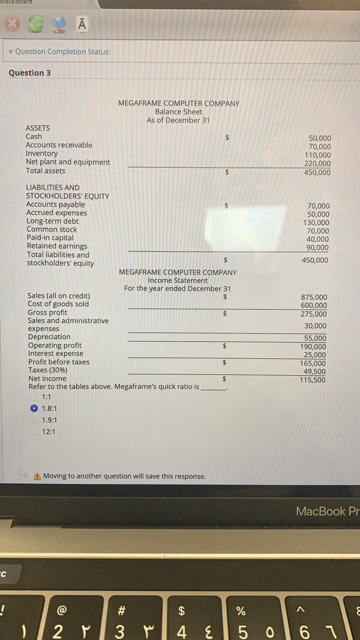

w Question Completion Status: Question 5 MARNI COMPANY Balance Sheet As of December 31 ASSETS 50,000 Cash 100,000 Accounts receivable 200,000 inventory 650,000 Net plant and equipment 1,000,000 Total assets LIABILITIES AND STOCKHOLDERS EQUITY Accounts payable 100,000 Accrued expenses 90.000 Long-term debt 250,000 Common Mock 100,000 Pald In capital 50/000 Retained earnings 410,000 Total liabilities and stockholders equity 1,000.000 MARNI COMPANY Income Statement Sales fall on credit) For the year ended December 31 Cost of goods sold 2.000,000 Gross profit 1.750.000 Sales and administrative 250.000 Eperson Fixed leave expenses 30.000 Depreciation 10.000 Operating profit 60,000 Interest expande Profit before taxes 150/000 Taxes (404] 25,090 Net income 125.000 Refer to the tables above. Marril's quick ratio is 50.000 0 1841 75,000 0 0.341 None of the optionsw Question Completion Status: Question 5 MARNI COMPANY Balance Sheet As of December 31 ASSETS 50,000 Cash 100,000 Accounts receivable 200,000 inventory 650,000 Net plant and equipment 1,000,000 Total assets LIABILITIES AND STOCKHOLDERS EQUITY Accounts payable 100,000 Accrued expenses 90.000 Long-term debt 250,000 Common Mock 100,000 Pald In capital 50/000 Retained earnings 410,000 Total liabilities and stockholders equity 1,000.000 MARNI COMPANY Income Statement Sales fall on credit) For the year ended December 31 Cost of goods sold 2.000,000 Gross profit 1.750.000 Sales and administrative 250.000 Eperson Fixed leave expenses 30.000 Depreciation 10.000 Operating profit 60,000 Interest expande Profit before taxes 150/000 Taxes (404] 25,090 Net income 125.000 Refer to the tables above. Marril's quick ratio is 50.000 0 1841 75,000 0 0.341 None of the optionsw Question Completion Status: Question 5 MARNI COMPANY Balance Sheet As of December 31 ASSETS 50,000 Cash 100,000 Accounts receivable 200,000 inventory 650,000 Net plant and equipment 1,000,000 Total assets LIABILITIES AND STOCKHOLDERS EQUITY Accounts payable 100,000 Accrued expenses 90.000 Long-term debt 250,000 Common Mock 100,000 Pald In capital 50/000 Retained earnings 410,000 Total liabilities and stockholders equity 1,000.000 MARNI COMPANY Income Statement Sales fall on credit) For the year ended December 31 Cost of goods sold 2.000,000 Gross profit 1.750.000 Sales and administrative 250.000 Eperson Fixed leave expenses 30.000 Depreciation 10.000 Operating profit 60,000 Interest expande Profit before taxes 150/000 Taxes (404] 25,090 Net income 125.000 Refer to the tables above. Marril's quick ratio is 50.000 0 1841 75,000 0 0.341 None of the optionsLestion Completion Status: estion 9 TEW COMPANY Balance Sheet As of December 31 ASSETS 20,000 Cash 80,000 Accounts receivable 50,000 Inventory Net plant and equipment 250,000 Total assets 400.000 LIABILITIES AND STOCKHOLDERS EQUITY Accounts payable 40.000 Accrued expenses 60,000 Long-term debt 130.000 Common stock 100,000 Pald-in capital 10.000 Retained earnings 60,000 Total liabilities and stockholders' equity 400,000 TEW COMPANY Income Statement Sales [all on credit] For the year ended December 31 Cost of goods sold 500.000 Gross profit 200.000 Sales and administrative 300,000 Fixed lease expenses 20/000 Depreciation 10.000 Operating profit 40.000 Interest expense 230,000 Profit before Lines 20/000 Net Income 210,000 73.500 Refer to the tables abow. Tew's current ratio is 0 1:1 136,500 0 2:1 0 1.5:1 None of the options Moving to another question will save this response.A w Question Completion Status: Question 3 MEGAFRAME COMPUTER COMPANY Balance Sheet As of December 31 ASSETS Cash 50,000 Accounts receivable 70.000 Inventory 110,000 Net plant and equipment 220,000 Total assets 450,000 LIABILITIES AND STOCKHOLDERS EQUITY Accounts payable 70,000 Accrued expenses 50,000 Long-term debt 130,000 Common stock 70,000 Fald-in capital 40,000 Retained earnings 90.000 Total liabilities and stockholders' equity 450,000 MEGAFRAME COMPUTER COMPANY Income Statement For the year ended December 31 Sales fall on credit) 875,000 Cost of goods sold 600 000 Gross profit 275,000 Sales and administrative expenses 30,000 Depreciation 557000 Operating profit 190 000 Interest expense 25,000 Prof before taxes 165,000 Taxes (BOW] 49,500 Net Income 115,500 Refer to the tables above. Megaframe's quick ratio is 1:1 0 1.8:1 1.9:1 12:1 Moving to another question will save this response. MacBook Pr % 2 3 Y 4 50 6 7