Question: Please answer these three questions fully , its from the book Corporate Finance core principles and applications, Ross, Westerfield, Jaffe, Jordan 6th edition CASH FLOWS

Please answer these three questions fully , its from the book Corporate Finance core principles and applications, Ross, Westerfield, Jaffe, Jordan 6th edition

Please answer these three questions fully , its from the book Corporate Finance core principles and applications, Ross, Westerfield, Jaffe, Jordan 6th edition

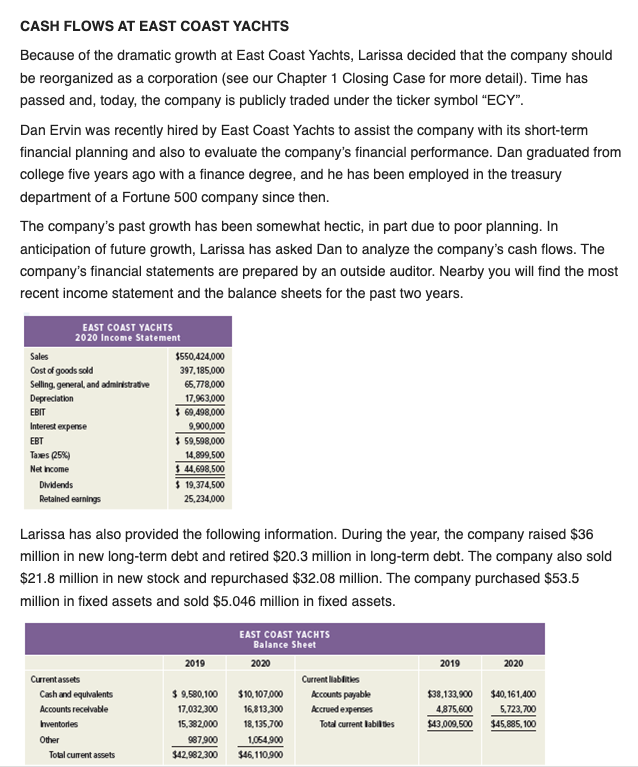

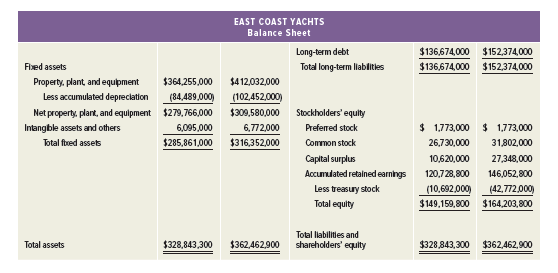

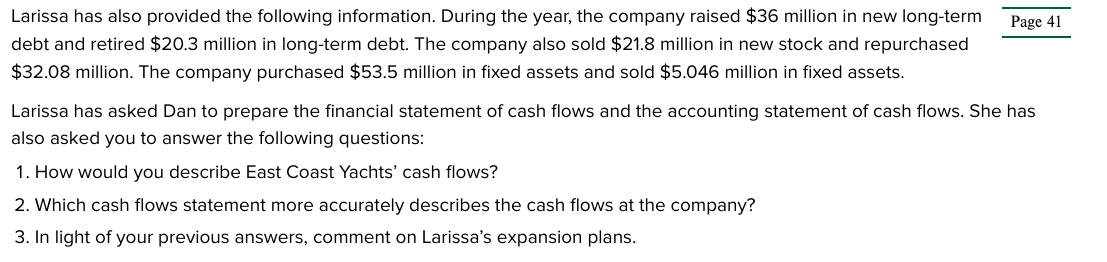

CASH FLOWS AT EAST COAST YACHTS Because of the dramatic growth at East Coast Yachts, Larissa decided that the company should be reorganized as a corporation (see our Chapter 1 Closing Case for more detail). Time has passed and, today, the company is publicly traded under the ticker symbol "ECY". Dan Ervin was recently hired by East Coast Yachts to assist the company with its short-term financial planning and also to evaluate the company's financial performance. Dan graduated from college five years ago with a finance degree, and he has been employed in the treasury department of a Fortune 500 company since then. The company's past growth has been somewhat hectic, in part due to poor planning. In anticipation of future growth, Larissa has asked Dan to analyze the company's cash flows. The company's financial statements are prepared by an outside auditor. Nearby you will find the most recent income statement and the balance sheets for the past two years. EAST COAST YACHTS 2020 Income Statement Sales $550,424,000 Cost of goods sold 397,185,000 Selling general, and administrative 65,778,000 Depreciation 17,963,000 EBIT $ 69,498,000 Interest expense 9.900,000 EBT $ 59,598,000 Taxes (25%) 14.899,500 Net Income $44.698.500 Dividends $ 19,374,500 Retained earnings 25.234,000 Larissa has also provided the following information. During the year, the company raised $36 million in new long-term debt and retired $20.3 million in long-term debt. The company also sold $21.8 million in new stock and repurchased $32.08 million. The company purchased $53.5 million in fixed assets and sold $5.046 million in fixed assets. 2019 2019 2020 Current assets Cash and equivalents Accounts receivable Inventories Other Total current assets $ 9,580,100 17.032,300 15,382,000 987.900 $42.982,300 EAST COAST YACHTS Balance Sheet 2020 Current liabilities $10,107.000 Accounts payable 16,813,300 Accrued expenses 18,135,700 Total current labil des 1,054.900 $46, 110,900 $38,133,900 4,875,600 $43,000.500 $40,161,400 5.723.700 $45,885, 100 $ 136,674,000 $136,674,000 $152,374,000 $152,374,000 Fixed assets Property, plant and equipment $364,255,000 Less accumulated depreciation (84.489,000) Net property, plant, and equipment $279,766,000 Intangble assets and others 6,095,000 Total freed assets $285,861,000 EAST COAST YACHTS Balance Sheet Long-term debt Total long-term liablities $412,032,000 (102,452,000) $309,580,000 Stockholders' equity 6,772,000 Preferred stock $316,352,000 Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity $ 1,773,000 $ 1,773,000 26,730,000 31,802,000 10,620,000 27,348,000 120,728,800 146,052,800 (10,692.000) (42.772.000) $149,159,800 $164.203.800 Total assets $328,843,300 Total liabilities and shareholders' equity $362,462,900 $328,843,300 $362,462.900 Page 41 Larissa has also provided the following information. During the year, the company raised $36 million in new long-term debt and retired $20.3 million in long-term debt. The company also sold $21.8 million in new stock and repurchased $32.08 million. The company purchased $53.5 million in fixed assets and sold $5.046 million in fixed assets. Larissa has asked Dan to prepare the financial statement of cash flows and the accounting statement of cash flows. She has also asked you to answer the following questions: 1. How would you describe East Coast Yachts' cash flows? 2. Which cash flows statement more accurately describes the cash flows at the company? 3. In light of your previous answers, comment on Larissa's expansion plans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts