Question: please answer these. When applying the Black-Scholes modely you must first estimate the volatility of the underlying asset. What is the effect of errors in

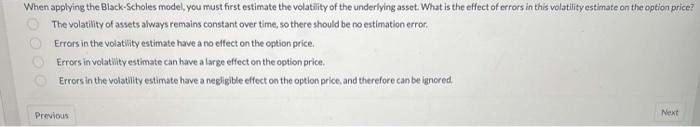

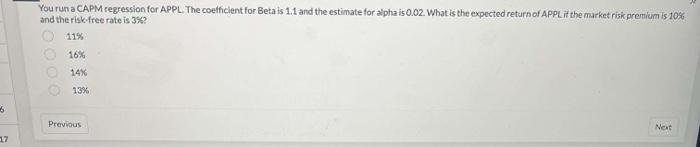

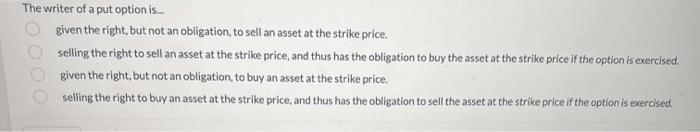

When applying the Black-Scholes modely you must first estimate the volatility of the underlying asset. What is the effect of errors in this volatiinty estimate on the option price? The volatility of assets always remains constant over time, so there should be no estimation error. Errors in the volatility estimate have a no effect on the option price. Eirrors in volatility estimate can have a large effect on the option price. Errors in the volatility estimate have a negligible effect on the option price. and therefore can be igncred. You run a CAPM regression for APPL. The coetficient for Beta is 1.1 and the estimate for alpha is 0.02. What is the expected return of APPL if the market risk aremiem is 10s and the risk-free rate is 3\%? 11% 16% 14 13% The writer of a put option is... given the right, but not an obligation, to sell an asset at the strike price. selling the right to sell an asset at the strike price, and thus has the obligation to buy the asset at the strike price if the option is exercised. given the right, but not an obligation, to buy an asset at the strike price. selling the right to buy an asset at the strike price, and thus has the obligation to sell the asset at the strike price if the option is exercised

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts