Question: Please answer this accurately and pace yourself, I will thumbs up or down depending on results A bank agrees to buy from a customer a

Please answer this accurately and pace yourself, I will thumbs up or down depending on results

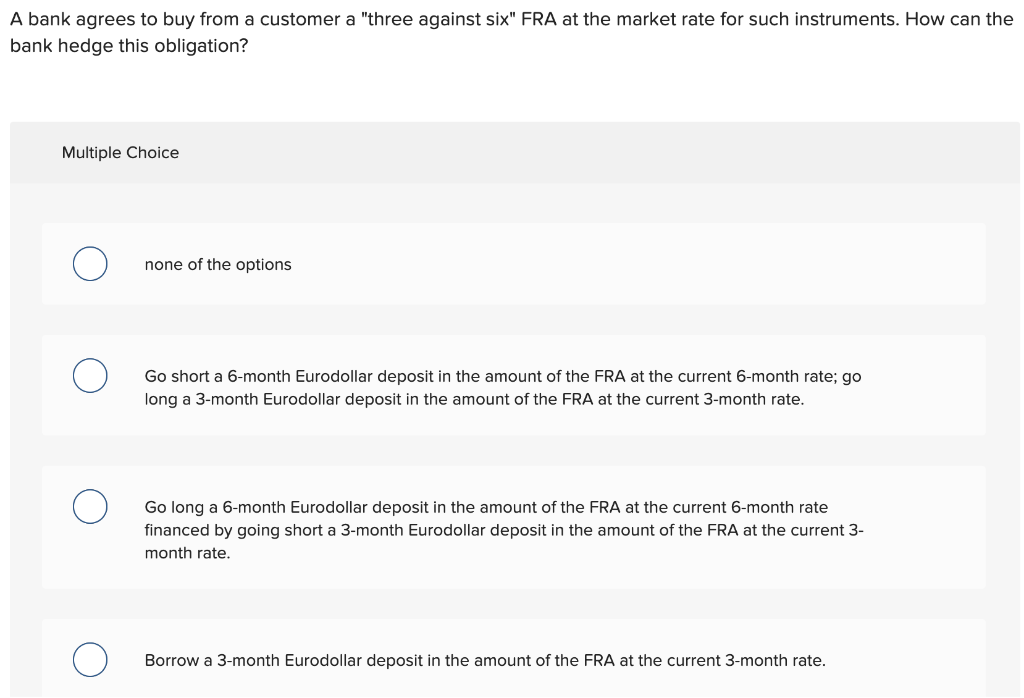

A bank agrees to buy from a customer a "three against six" FRA at the market rate for such instruments. How can the bank hedge this obligation? Multiple Choice none of the options Go short a 6-month Eurodollar deposit in the amount of the FRA at the current 6-month rate; go long a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate. Go long a 6-month Eurodollar deposit in the amount of the FRA at the current 6-month rate financed by going short a 3-month Eurodollar deposit in the amount of the FRA at the current 3month rate. Borrow a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts