Question: please answer this ASAP Transistor Group issued 20-year bonds 8 years ago at par, when the yield-to-maturity on the issue was 10.0 percent. Since then,

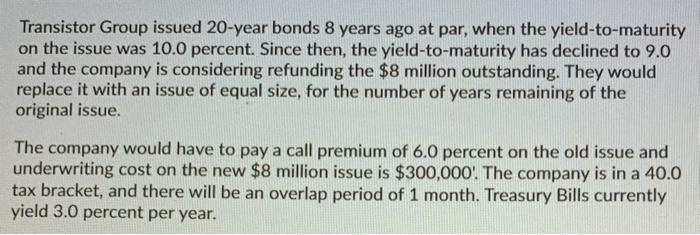

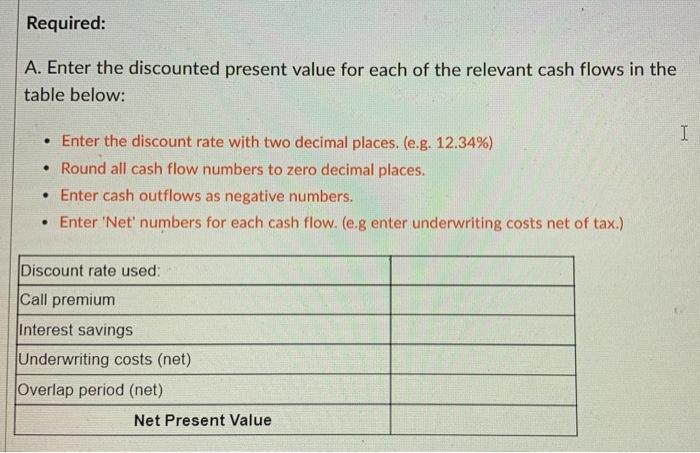

Transistor Group issued 20-year bonds 8 years ago at par, when the yield-to-maturity on the issue was 10.0 percent. Since then, the yield-to-maturity has declined to 9.0 and the company is considering refunding the $8 million outstanding. They would replace it with an issue of equal size, for the number of years remaining of the original issue The company would have to pay a call premium of 6.0 percent on the old issue and underwriting cost on the new $8 million issue is $300,000. The company is in a 40.0 tax bracket, and there will be an overlap period of 1 month. Treasury Bills currently yield 3.0 percent per year. Required: A. Enter the discounted present value for each of the relevant cash flows in the table below: I Enter the discount rate with two decimal places. (e.g. 12.34%) Round all cash flow numbers to zero decimal places. Enter cash outflows as negative numbers. Enter 'Net' numbers for each cash flow. (e.g enter underwriting costs net of tax.) . Discount rate used: Call premium Interest savings Underwriting costs (net) Overlap period (net) Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts