Question: Please answer this by 10PM EST (in 1.5 hours) I will thumbs up if correct! On January 1, 2025, Blue Ridge Company has the following

Please answer this by 10PM EST (in 1.5 hours) I will thumbs up if correct!

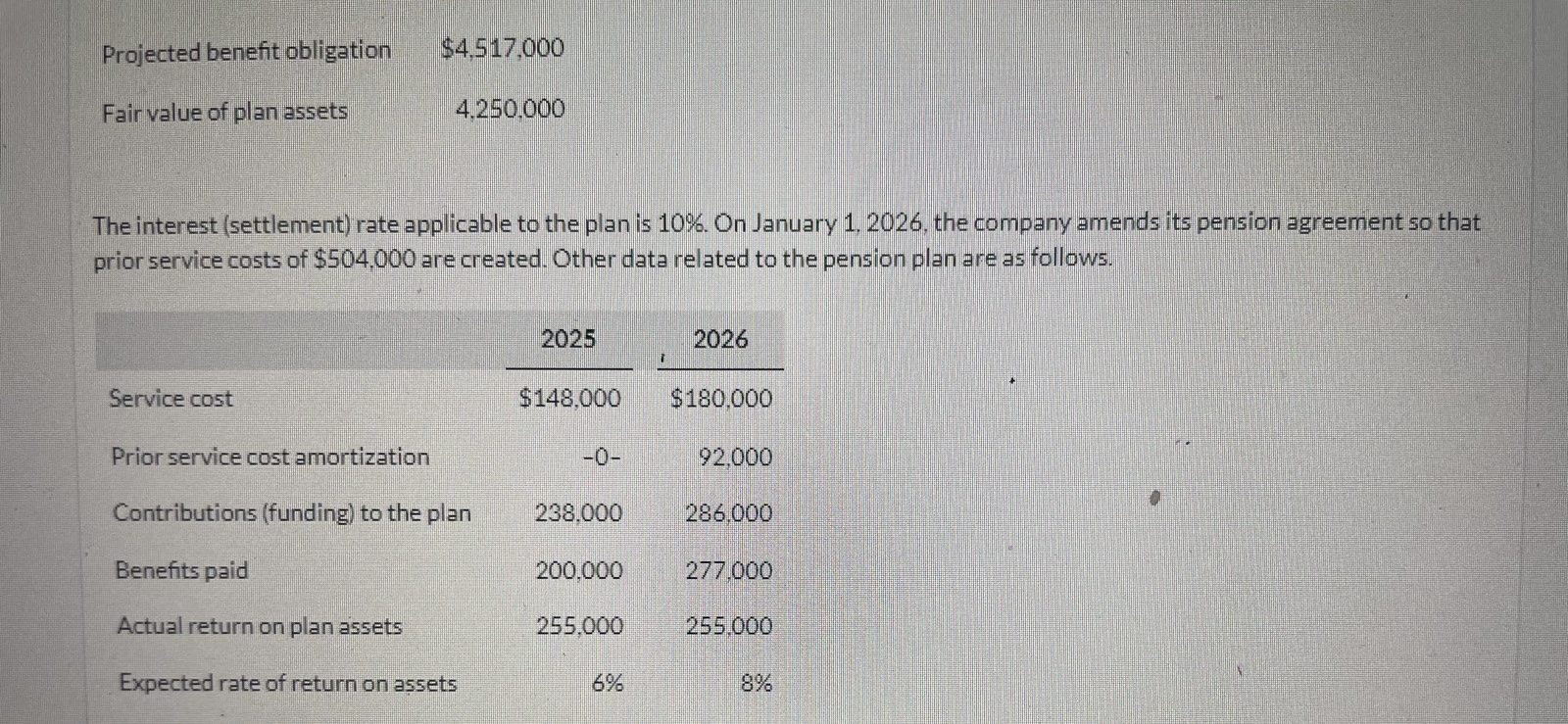

On January 1, 2025, Blue Ridge Company has the following defunded benefit pension plan balances.

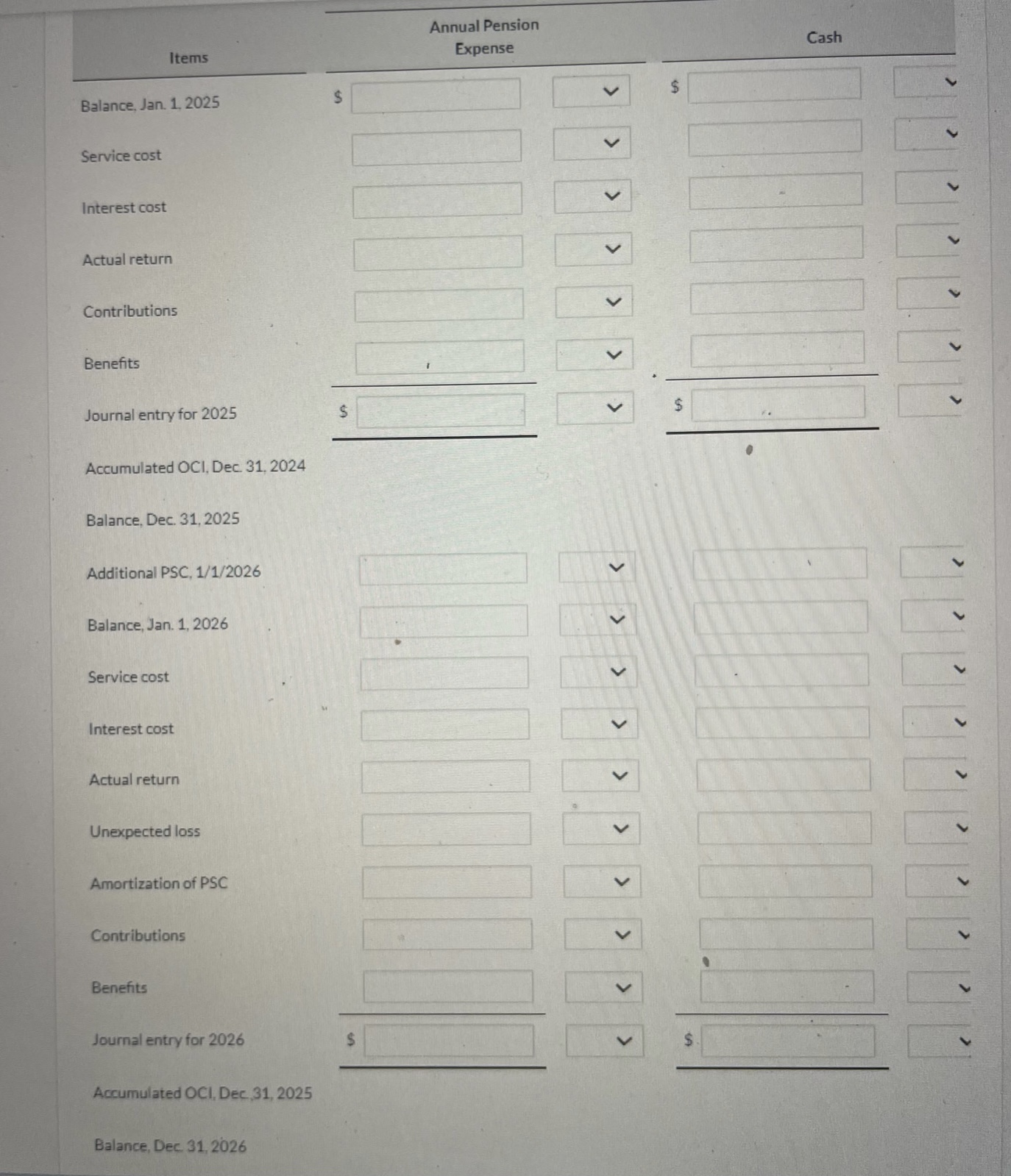

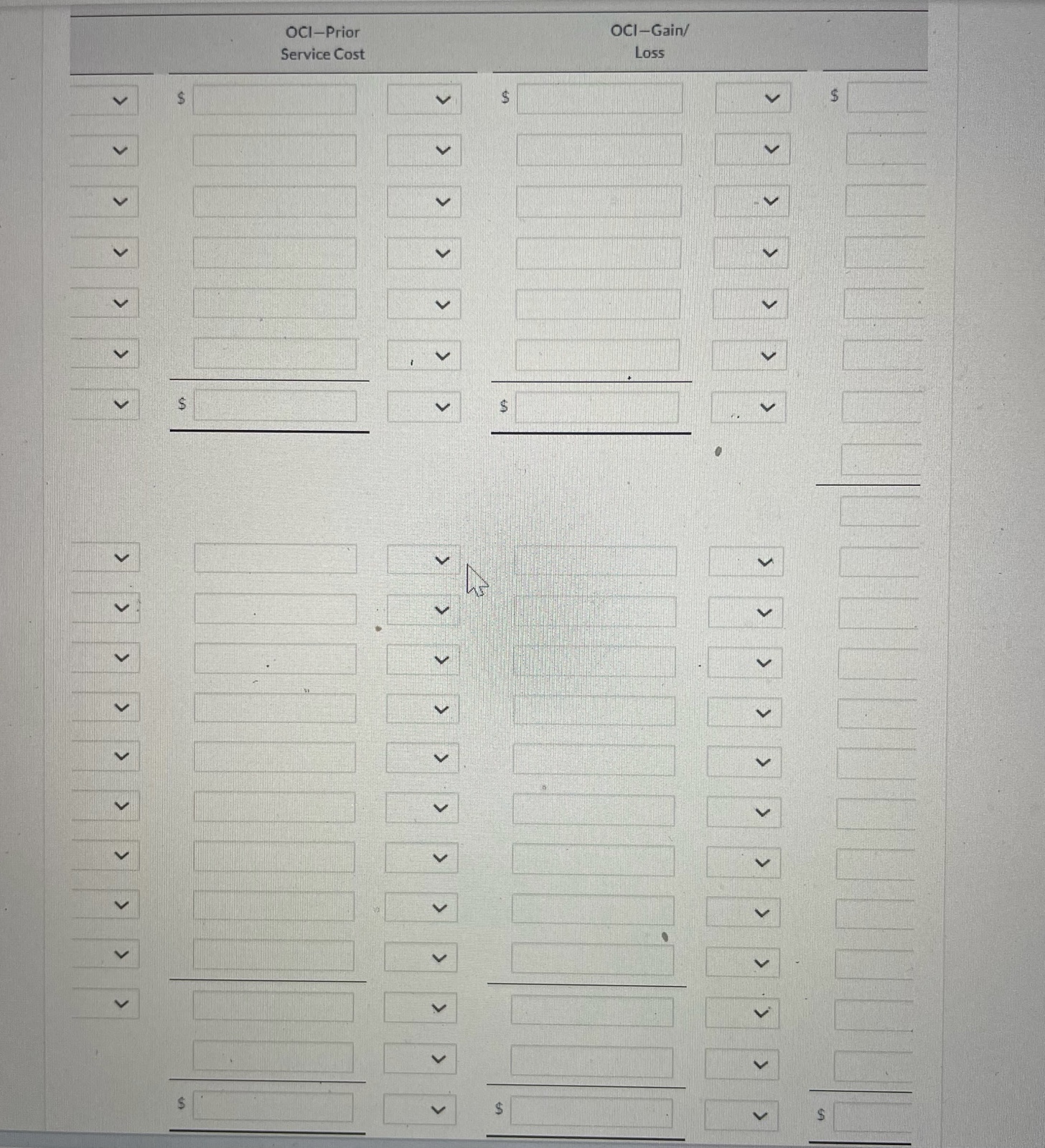

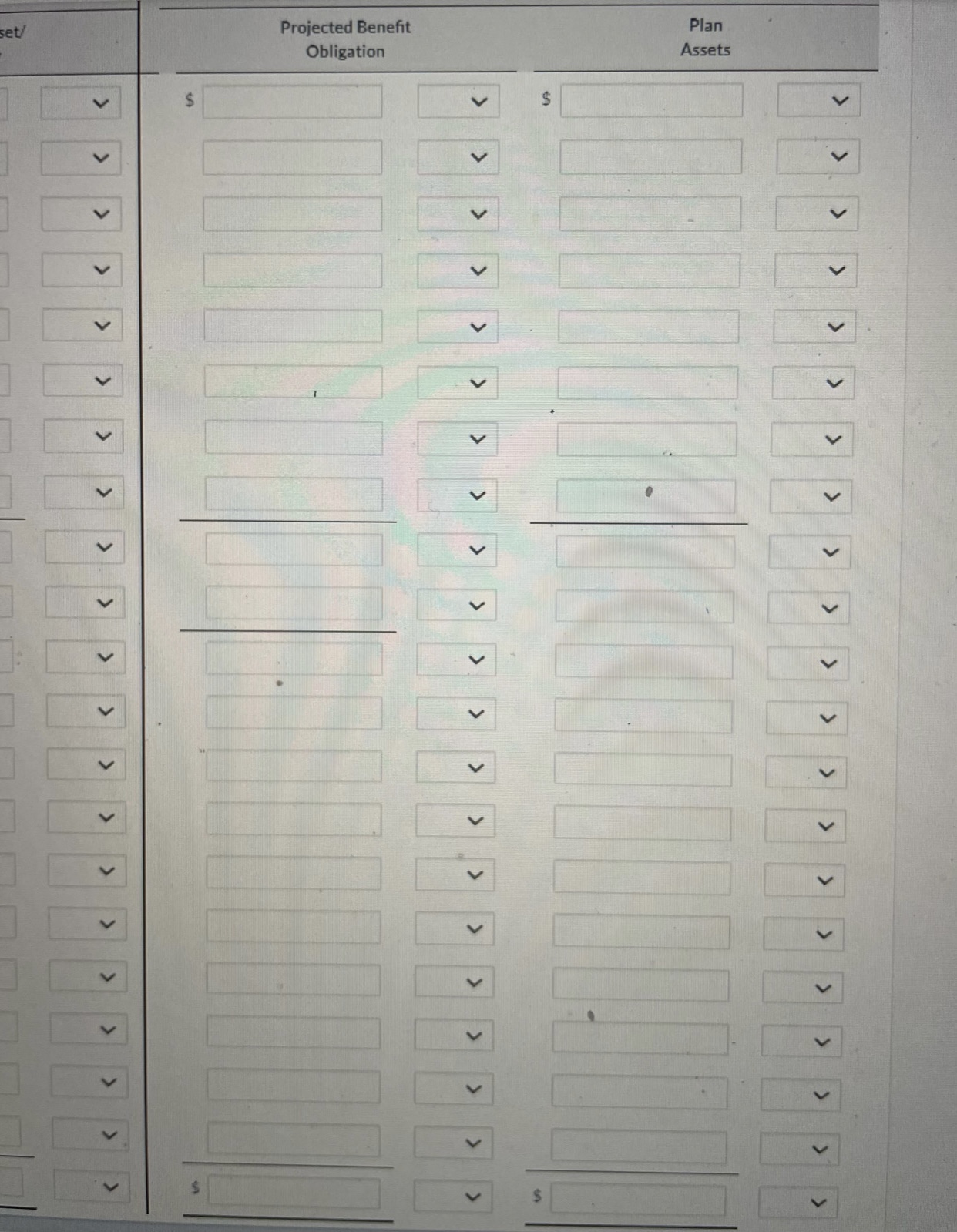

Prepare a pension worksheet for the pension plan for 2025 and 2026.

(The drop-down boxes have the options of Dr. and Cr.)

The interest (settlement) rate applicable to the plan is 10%. On January 1,2026, the company amends its pension agreement so that prior service costs of $504,000 are created. Other data related to the pension plan are as follows. Items Annual Pension Expense Cash Balance, Jan. 1, 2025 $ Service cost Interest cost Actual return Contributions Benefits Journal entry for 2025 Accumulated OCI, Dec 31, 2024 Balance, Dec. 31, 2025 Additional PSC, 1/1/2026 Balance, Jan. 1, 2026 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Journal entry for 2026 Accumulated OCI, Dec, 31, 2025 Balance, Dec. 31, 2026 The interest (settlement) rate applicable to the plan is 10%. On January 1,2026, the company amends its pension agreement so that prior service costs of $504,000 are created. Other data related to the pension plan are as follows. Items Annual Pension Expense Cash Balance, Jan. 1, 2025 $ Service cost Interest cost Actual return Contributions Benefits Journal entry for 2025 Accumulated OCI, Dec 31, 2024 Balance, Dec. 31, 2025 Additional PSC, 1/1/2026 Balance, Jan. 1, 2026 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Journal entry for 2026 Accumulated OCI, Dec, 31, 2025 Balance, Dec. 31, 2026

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts