Question: Please answer this completely from A to D. As chegg policy, tutor can answer 4 subpart question thanks QUESTION 3 On January 2013, Warehouse issued

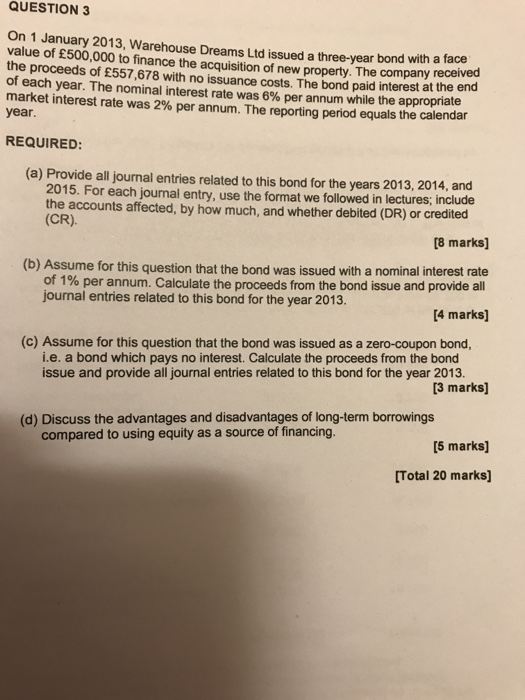

QUESTION 3 On January 2013, Warehouse issued a three-year bond with a face the of 500,000 to finance acquisition of new property. The company received the proceeds of 557,678 with no costs. The bond paid interest at the end of each year. The nominal interest rate was 6% per annum while the appropriate market interest rate was 2% per annum. The reporting period equals calendar year. REQUIRED: (a) Provide all journal entries related to this bond for the years 2013, 2014, and 2015. For each journal entry, use the format we followed in lectures, include the accounts affected, by how much, and whether debited (DR) or credited (CR) [8 marks] (b) Assume for this question that the bond was issued with a nominal interest rate of 1% per annum. Calculate the proceeds from the bond issue and provide all journal entries related to this bond for the year 2013. [4 marks] (c) Assume for this question that the bond was issued as a zero-coupon bond, i.e. a bond which pays no interest. Calculate the proceeds from the bond issue and provide all journal entries related to this bond for the year 2013. [3 marks] (d) Discuss the advantages and disadvantages of long-term borrowings compared to using equity as a source of financing. 15 marksl [Total 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts