Question: Please answer this for me in Excel. You work at a private equity firm that is considering investing in the green - technology sector. You

Please answer this for me in Excel.

You work at a private equity firm that is considering investing in the greentechnology sector.

You are trying to calculate the cost of capital to apply to valuing greentechnology firms.

Unfortunately, there are currently no publicly traded companies that are only in the greentechnology

sector. However, you have the following information about two publicly traded

companies.

Company Lambda has two divisions, a nanotechnology division, and a greentechnology

division.

Company Lambdas nanotechnology division has an estimated value of $ billion.

Company Lambdas other division, its greentechnology division, has an estimated value

of $ billion.

Company Lambdas debtvalue ratio is

Company Lambdas equity beta is very high, at and its debt beta is

Company Gamma is only in nanotechnology, the same nanotechnology sector as company

Lambda.

Company Gamma has no cash or debt.

Company Gammas equity beta is

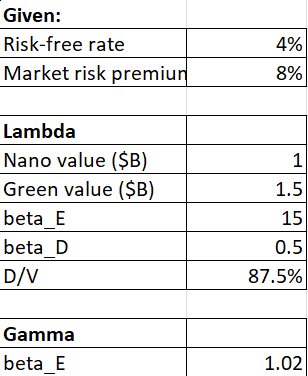

Assume that the CAPM holds. The riskfree rate is and the market risk premium is

What is the asset beta for company Lambda? Point

What is the cost of capital that you should use to value greentechnology projects?

Point Given:

begintabularll

hline Riskfree rate &

hline Market risk premiun &

hline

endtabular

begintabularlr

hline Lambda &

hline Nano value $ B &

hline Green value $ B &

hline betaE &

hline betaD &

hline DV &

hline

endtabular

begintabularlr

hline Gamma &

hline betaE &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock