Question: please answer this multiple question 6. All else equal, a project's operating cash flow will decrease when the A.) net working capital requirement decreases. B.)

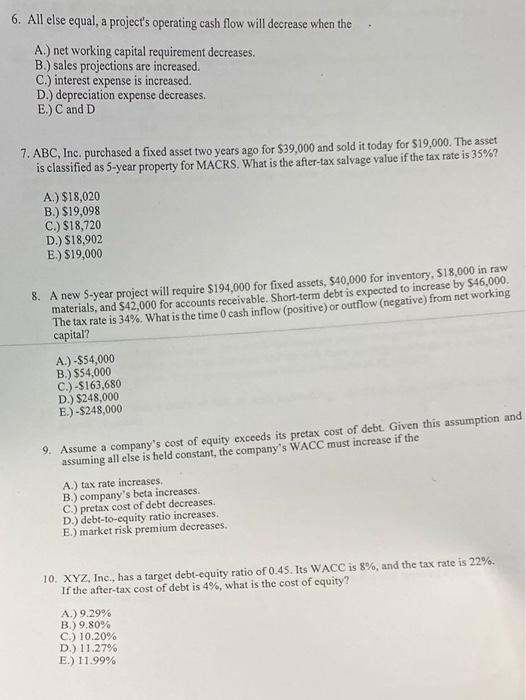

6. All else equal, a project's operating cash flow will decrease when the A.) net working capital requirement decreases. B.) sales projections are increased. C.) interest expense is increased. D.) depreciation expense decreases. E.) C and D 7. ABC, Inc. purchased a fixed asset two years ago for $39,000 and sold it today for $19.000. The asset is classified as 5-year property for MACRS. What is the after-tax salvage value if the tax rate is 35%? A.) $18,020 B.) $19,098 C.) $18,720 D.) $18,902 E.) $19,000 8. A new 5-year project will require $194,000 for fixed assets, 540,000 for inventory, 518,000 in raw materials, and $42,000 for accounts receivable. Short-term debt is expected to increase by $46,000. The tax rate is 34%. What is the time 0 cash inflow (positive) or outflow (negative) from net working capital? A.)-SS4,000 B.) $54,000 C.)-S163,680 D.) $248,000 E.)-$248,000 9. Assume a company's cost of equity exceeds its pretax cost of debt. Given this assumption and assuming all else is held constant, the company's WACC must increase if the A.) tax rate increases B.) company's beta increases. C.) pretax cost of debt decreases. D.) debt-to-equity ratio increases. E.) market risk premium decreases. 10. XYZ, Inc., has a target debt-equity ratio of 0.45. Its WACC is 8%, and the tax rate is 22%. If the after-tax cost of debt is 4%, what is the cost of equity? A.) 9.29% B.) 9.80% C.) 10.20% D.) 11.27% E.) 11.99%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts