Question: Please answer this problem and show steps that were taken. Check my work Porter Inc, acquired a machine that cost $361,000 on October 1, 2019.

Please answer this problem and show steps that were taken.

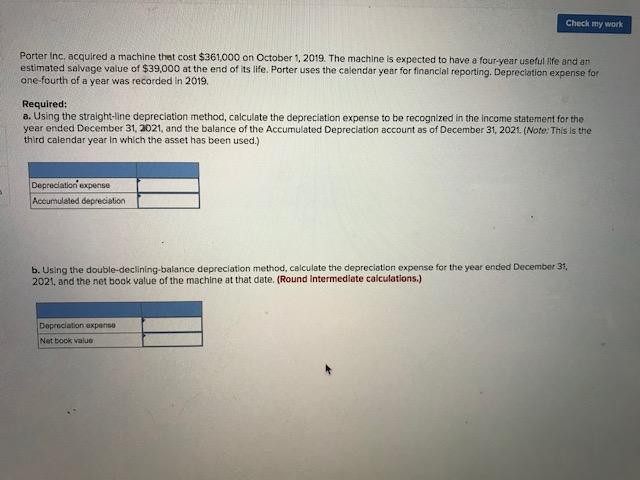

Check my work Porter Inc, acquired a machine that cost $361,000 on October 1, 2019. The machine is expected to have a four-year useful life and an estimated salvage value of $39,000 at the end of its life. Porter uses the calendar year for financial reporting. Depreciation expense for one-fourth of a year was recorded in 2019, Required: a. Using the straight-line depreciation method, calculate the depreciation expense to be recognized in the income statement for the year ended December 31, 2021, and the balance of the Accumulated Depreciation account as of December 31, 2021 (Note: This is the third calendar year in which the asset has been used.) Depreciation expense Accumulated depreciation b. Using the double-declining balance depreciation method, calculate the depreciation expense for the year ended December 31, 2021, and the net book value of the machine at that date. (Round Intermediate calculations.) Depreciation expense Net book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts