Question: Please answer this !! QUESTION 3: Jensen and Murphy (1990) found that for every $1,000 change in shareholder wealth, CEO wealth changes $3.25, taking into

Please answer this !!

Please answer this !!

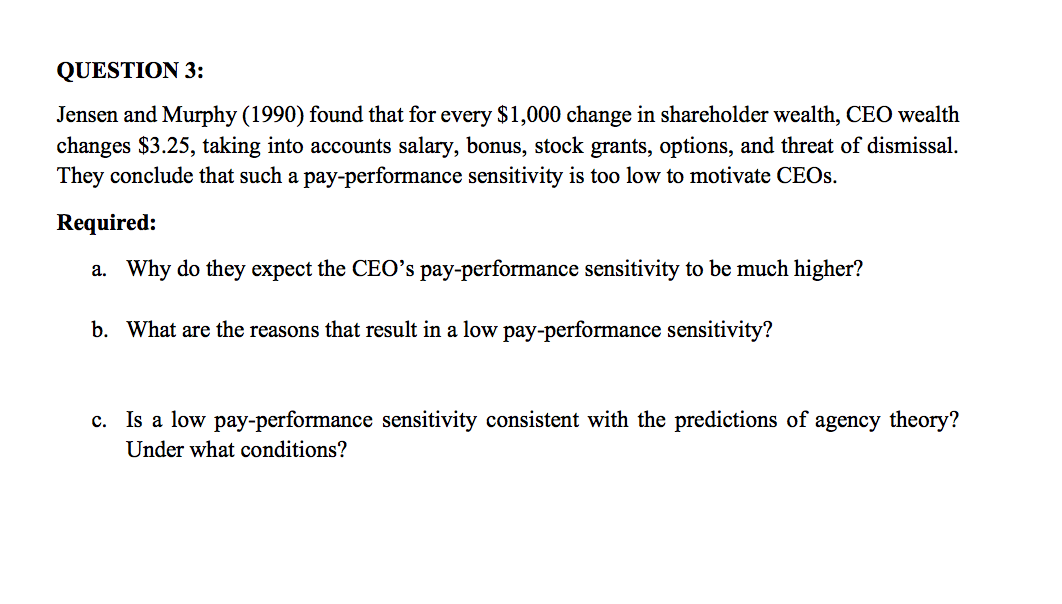

QUESTION 3: Jensen and Murphy (1990) found that for every $1,000 change in shareholder wealth, CEO wealth changes $3.25, taking into accounts salary, bonus, stock grants, options, and threat of dismissal. They conclude that such a pay-performance sensitivity is too low to motivate CEOs. Required: a. Why do they expect the CEO's pay-performance sensitivity to be much higher? b. What are the reasons that result in a low pay-performance sensitivity? c. Is a low pay-performance sensitivity consistent with the predictions of agency theory? Under what conditions? QUESTION 3: Jensen and Murphy (1990) found that for every $1,000 change in shareholder wealth, CEO wealth changes $3.25, taking into accounts salary, bonus, stock grants, options, and threat of dismissal. They conclude that such a pay-performance sensitivity is too low to motivate CEOs. Required: a. Why do they expect the CEO's pay-performance sensitivity to be much higher? b. What are the reasons that result in a low pay-performance sensitivity? c. Is a low pay-performance sensitivity consistent with the predictions of agency theory? Under what conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts