Question: Please answer this question, and I will report it shortly on DUE! Thank you very much! Question 3 (25 marks): Suppose your parents ask for

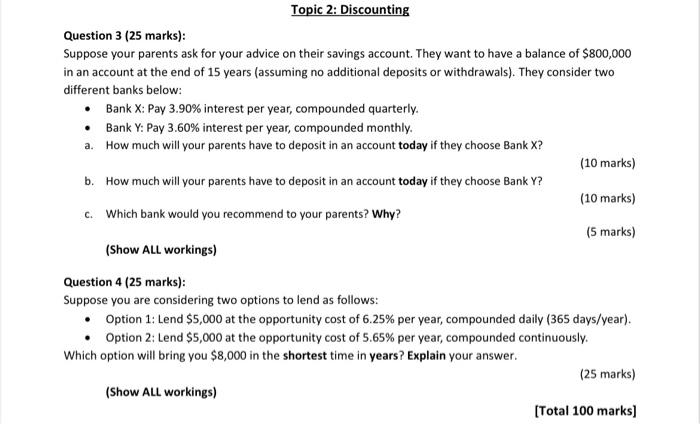

Question 3 (25 marks): Suppose your parents ask for your advice on their savings account. They want to have a balance of $800,000 in an account at the end of 15 years (assuming no additional deposits or withdrawals). They consider two different banks below: - Bank X: Pay 3.90\% interest per year, compounded quarterly. - Bank Y: Pay 3.60% interest per year, compounded monthly. a. How much will your parents have to deposit in an account today if they choose Bank X? (10 marks) b. How much will your parents have to deposit in an account today if they choose Bank Y? (10 marks) c. Which bank would you recommend to your parents? Why? (5 marks) (Show ALL workings) Question 4 (25 marks): Suppose you are considering two options to lend as follows: - Option 1: Lend $5,000 at the opportunity cost of 6.25% per year, compounded daily (365 days/year). - Option 2: Lend $5,000 at the opportunity cost of 5.65% per year, compounded continuously. Which option will bring you $8,000 in the shortest time in years? Explain your answer. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts