Question: PLEASE ANSWER THIS QUESTION AND MOST ANSWER TO QUANTITATIVE PROBLEM THANKS YOU Different compounding periods, are used for different types of investments. In order to

PLEASE ANSWER THIS QUESTION AND MOST ANSWER TO QUANTITATIVE PROBLEM THANKS YOU

PLEASE ANSWER THIS QUESTION AND MOST ANSWER TO QUANTITATIVE PROBLEM THANKS YOU

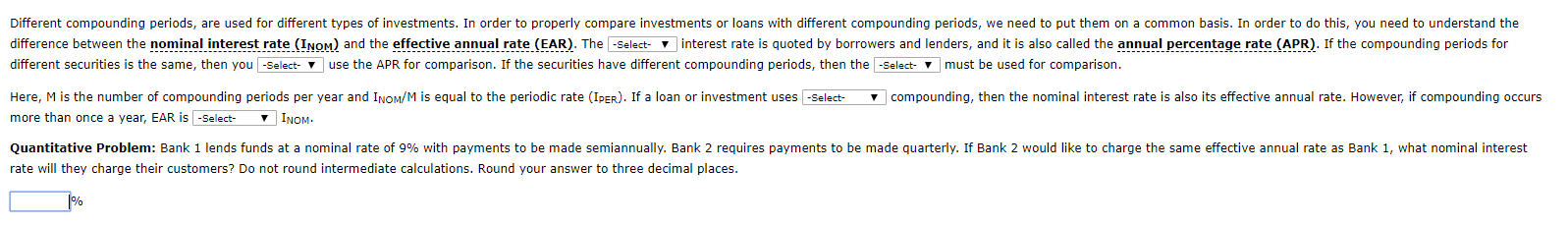

Different compounding periods, are used for different types of investments. In order to properly compare investments or loans with different compounding periods, we need to put them on a common basis. In order to do this, you need to understand the difference between the nominal interest rate (INOM) and the effective annual rate (EAR). The -Select- v interest rate is quoted by borrowers and lenders, and it is also called the annual percentage rate (APR). If the compounding periods for different securities is the same, then you -Select- use the APR for comparison. If the securities have different compounding periods, then the -Select- must be used for comparison. compounding, then the nominal interest rate is also its effective annual rate. However, if compounding occurs Here, M is the number of compounding periods per year and INOM/M is equal to the periodic rate (IPER). If a loan or investment uses -Select- more than once a year, EAR is -Select- INOM. Quantitative Problem: Bank 1 lends funds at a nominal rate of 9% with payments to be made semiannually. Bank 2 requires payments to be made quarterly. If Bank 2 would like to charge the same effective annual rate as Bank 1, what nominal interest rate will they charge their customers? Do not round intermediate calculations. Round your answer to three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts