Question: Please answer this question and show all your work down to the algebra used to find the fraction. Thank you very much +rep for good

Please answer this question and show all your work down to the algebra used to find the fraction. Thank you very much +rep for good work

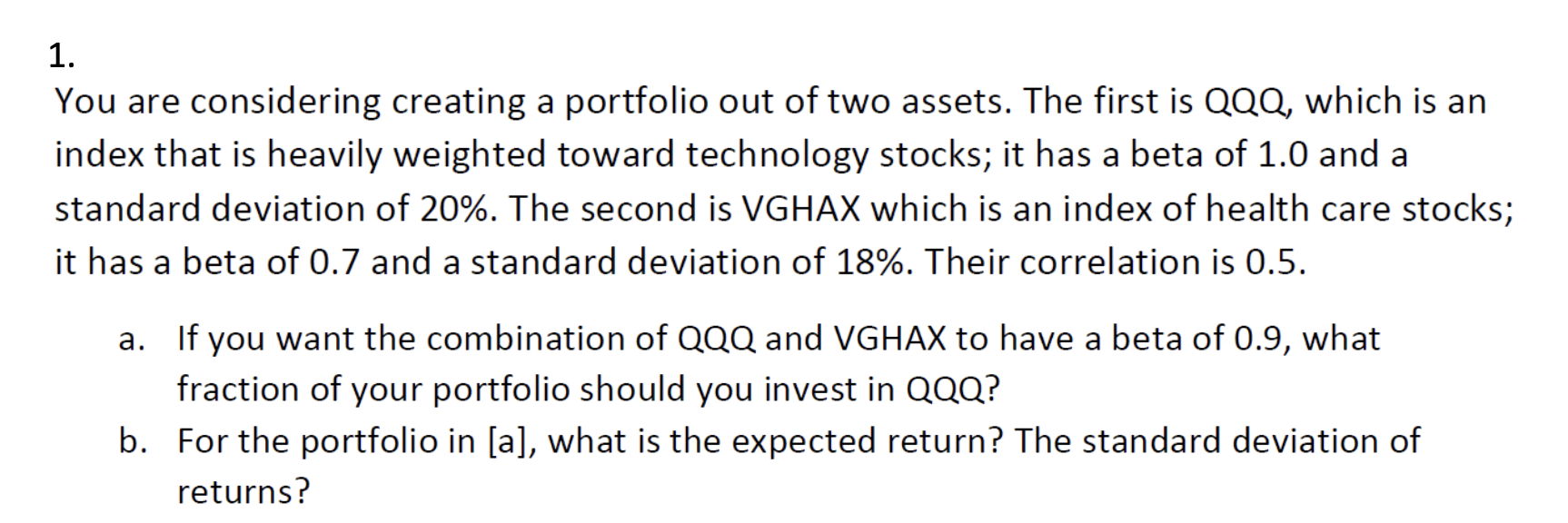

1. You are considering creating a portfolio out of two assets. The first is QQQ, which is an index that is heavily weighted toward technology stocks; it has a beta of 1.0 and a standard deviation of 20%. The second is VGHAX which is an index of health care stocks; it has a beta of 0.7 and a standard deviation of 18%. Their correlation is 0.5 . a. If you want the combination of QQQ and VGHAX to have a beta of 0.9 , what fraction of your portfolio should you invest in QQQ? b. For the portfolio in [a], what is the expected return? The standard deviation of returns? - The corporate tax rate is 21%. - The risk-free rate is 2%. - The market risk premium is 7%. - The beta of debt is zero. PV=(1+r)nFVFV=PV(1+r)nr=[(PVFV)n11]n=[ln(1+r)ln(PVFV)]PV=rCF[1(1+r)n1]PV=rgCF1PV(taxshield)=TcD R=P0Div1+(P1Po)=P0Div1+P11R=TR1+R2+RTRp=wARA+wBRB 2=T1(R1R)2+(R2R)2+(R3R)2P2=wA2A2+wB2B2+2wAwBABAB A=EVE+DVDE=A(1+ED)P=1w1+2w2+ WACC with common stock, preferred stock, and debt E[Ri]=rf+i(E[Rm]rf) WACCaftertax=rEVE+rPVP+rD(1Tc)VD Dividends/share = Earnings / Share Dividend Payout Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts