Question: please answer this question as per instructions SECTION C: Question from this section is COMPULSORY. Question 6 Required: (1) Calculate the gross employment income that

please answer this question as per instructions

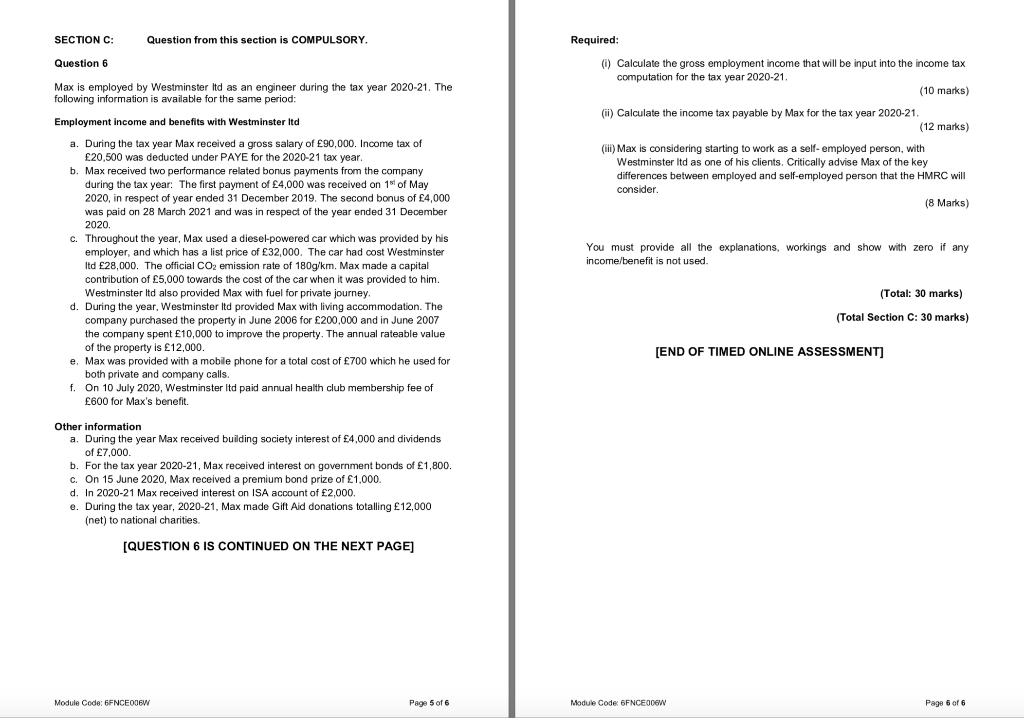

SECTION C: Question from this section is COMPULSORY. Question 6 Required: (1) Calculate the gross employment income that will be input into the income tax computation for the tax year 2020-21. (10 marks) (ii) Calculate the income tax payable by Max for the tax year 2020-21. (12 marks) (iii) Max is considering starting to work as a self-employed person, with Westminster ltd as one of his clients. Critically advise Max of the key differences between employed and self-employed person that the HMRC will consider (8 Marks) Max is employed by Westminster Itd as an engineer during the tax year 2020-21. The following information is available for the same period: Employment income and benefits with Westminster Itd a. During the tax year Max received a gross salary of 90,000. Income tax of 20,500 was deducted under PAYE for the 2020-21 tax year. b. Max received two performance related bonus payments from the company during the tax year: The first payment of 4,000 was received on 16 of May 2020, in respect of year ended 31 December 2019. The second bonus of 4,000 was paid on 28 March 2021 and was in respect of the year ended 31 December 2020 c. Throughout the year, Max used a diesel-powered car which was provided by his employer, and which has a list price of 32,000. The car had cost Westminster Itd 28,000. The official CO2 emission rate of 180g/km. Max made a capital contribution of 5,000 towards the cost of the car when it was provided to him. Westminster Itd also provided Max with fuel for private journey. d. During the year, Westminster Itd provided Max with living accommodation. The company purchased the property in June 2006 for 200,000 and in June 2007 the company spent 10,000 to improve the property. The annual rateable value of the property is 12,000. e. Max was provided with a mobile phone for a total cost of 700 which he used for both private and company calls. f. On 10 July 2020, Westminster Itd paid annual health club membership fee of 600 for Max's benefit. You must provide all the explanations, workings and show with zero if any income/benefit is not used. (Total: 30 marks) (Total Section C: 30 marks) [END OF TIMED ONLINE ASSESSMENT] Other information a. During the year Max received building society interest of 4,000 and dividends of 7,000. b. For the tax year 2020-21, Max received interest on government bonds of 1,800. c. On 15 June 2020, Max received a premium bond prize of 1,000 d. In 2020-21 Max received interest on ISA account of 2,000. e. During the tax year, 2020-21, Max made Gift Aid donations totalling 12,000 (net) to national charities [QUESTION 6 IS CONTINUED ON THE NEXT PAGE] Module Code: 6FNCE006W Page 5 of 6 Module Code: 6FNCE0C6W Page 6 of SECTION C: Question from this section is COMPULSORY. Question 6 Required: (1) Calculate the gross employment income that will be input into the income tax computation for the tax year 2020-21. (10 marks) (ii) Calculate the income tax payable by Max for the tax year 2020-21. (12 marks) (iii) Max is considering starting to work as a self-employed person, with Westminster ltd as one of his clients. Critically advise Max of the key differences between employed and self-employed person that the HMRC will consider (8 Marks) Max is employed by Westminster Itd as an engineer during the tax year 2020-21. The following information is available for the same period: Employment income and benefits with Westminster Itd a. During the tax year Max received a gross salary of 90,000. Income tax of 20,500 was deducted under PAYE for the 2020-21 tax year. b. Max received two performance related bonus payments from the company during the tax year: The first payment of 4,000 was received on 16 of May 2020, in respect of year ended 31 December 2019. The second bonus of 4,000 was paid on 28 March 2021 and was in respect of the year ended 31 December 2020 c. Throughout the year, Max used a diesel-powered car which was provided by his employer, and which has a list price of 32,000. The car had cost Westminster Itd 28,000. The official CO2 emission rate of 180g/km. Max made a capital contribution of 5,000 towards the cost of the car when it was provided to him. Westminster Itd also provided Max with fuel for private journey. d. During the year, Westminster Itd provided Max with living accommodation. The company purchased the property in June 2006 for 200,000 and in June 2007 the company spent 10,000 to improve the property. The annual rateable value of the property is 12,000. e. Max was provided with a mobile phone for a total cost of 700 which he used for both private and company calls. f. On 10 July 2020, Westminster Itd paid annual health club membership fee of 600 for Max's benefit. You must provide all the explanations, workings and show with zero if any income/benefit is not used. (Total: 30 marks) (Total Section C: 30 marks) [END OF TIMED ONLINE ASSESSMENT] Other information a. During the year Max received building society interest of 4,000 and dividends of 7,000. b. For the tax year 2020-21, Max received interest on government bonds of 1,800. c. On 15 June 2020, Max received a premium bond prize of 1,000 d. In 2020-21 Max received interest on ISA account of 2,000. e. During the tax year, 2020-21, Max made Gift Aid donations totalling 12,000 (net) to national charities [QUESTION 6 IS CONTINUED ON THE NEXT PAGE] Module Code: 6FNCE006W Page 5 of 6 Module Code: 6FNCE0C6W Page 6 of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts