Question: please answer this question as soon as possible George Nickson is a finance Manager for Quick Machines which is a Canadian manufacturer of heavy industrial

please answer this question as soon as possible

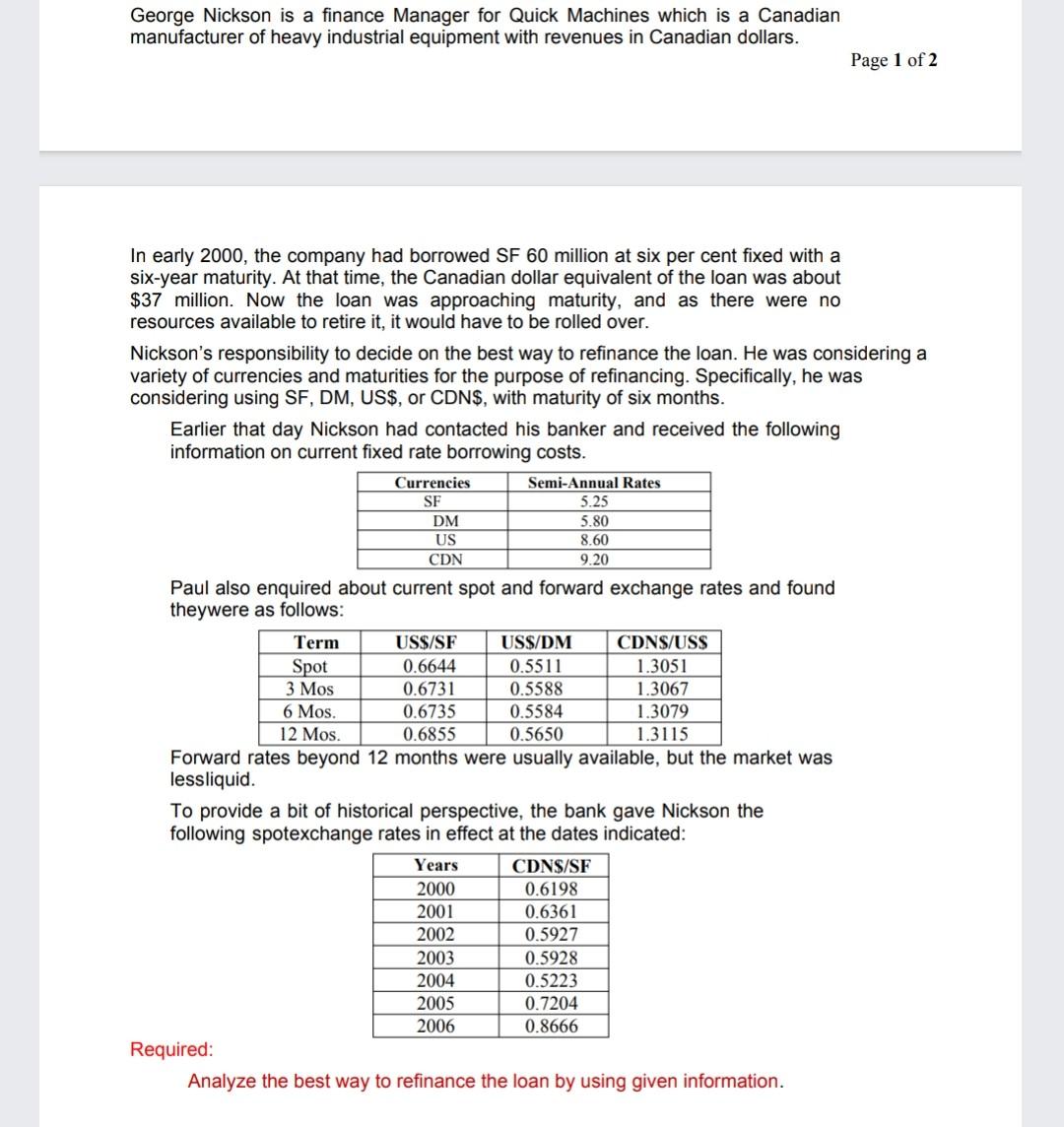

George Nickson is a finance Manager for Quick Machines which is a Canadian manufacturer of heavy industrial equipment with revenues in Canadian dollars. Page 1 of 2 In early 2000, the company had borrowed SF 60 million at six per cent fixed with a six-year maturity. At that time, the Canadian dollar equivalent of the loan was about $37 million. Now the loan was approaching maturity, and as there were no resources available to retire it, it would have to be rolled over. Nickson's responsibility to decide on the best way to refinance the loan. He was considering a variety of currencies and maturities for the purpose of refinancing. Specifically, he was considering using SF, DM, US$, or CDN$, with maturity of six months. Earlier that day Nickson had contacted his banker and received the following information on current fixed rate borrowing costs. Currencies SF DM US CDN Semi-Annual Rates 5.25 5.80 8.60 9.20 Paul also enquired about current spot and forward exchange rates and found theywere as follows: Term US$/SF US$/DM CDNS/US$ Spot 0.6644 0.5511 1.3051 3 Mos 0.6731 0.5588 1.3067 6 Mos. 0.6735 0.5584 1.3079 12 Mos. 0.6855 0.5650 1.3115 Forward rates beyond 12 months were usually available, but the market was lessliquid. To provide a bit of historical perspective, the bank gave Nickson the following spotexchange rates in effect at the dates indicated: Years 2000 2001 2002 CDNS/SF 0.6198 0.6361 0.5927 0.5928 0.5223 0.7204 0.8666 2003 2004 2005 2006 Required: Analyze the best way to refinance the loan by using given information. George Nickson is a finance Manager for Quick Machines which is a Canadian manufacturer of heavy industrial equipment with revenues in Canadian dollars. Page 1 of 2 In early 2000, the company had borrowed SF 60 million at six per cent fixed with a six-year maturity. At that time, the Canadian dollar equivalent of the loan was about $37 million. Now the loan was approaching maturity, and as there were no resources available to retire it, it would have to be rolled over. Nickson's responsibility to decide on the best way to refinance the loan. He was considering a variety of currencies and maturities for the purpose of refinancing. Specifically, he was considering using SF, DM, US$, or CDN$, with maturity of six months. Earlier that day Nickson had contacted his banker and received the following information on current fixed rate borrowing costs. Currencies SF DM US CDN Semi-Annual Rates 5.25 5.80 8.60 9.20 Paul also enquired about current spot and forward exchange rates and found theywere as follows: Term US$/SF US$/DM CDNS/US$ Spot 0.6644 0.5511 1.3051 3 Mos 0.6731 0.5588 1.3067 6 Mos. 0.6735 0.5584 1.3079 12 Mos. 0.6855 0.5650 1.3115 Forward rates beyond 12 months were usually available, but the market was lessliquid. To provide a bit of historical perspective, the bank gave Nickson the following spotexchange rates in effect at the dates indicated: Years 2000 2001 2002 CDNS/SF 0.6198 0.6361 0.5927 0.5928 0.5223 0.7204 0.8666 2003 2004 2005 2006 Required: Analyze the best way to refinance the loan by using given information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts