Question: Please answer this question as soon as you can please. I will give you positive rating instantly. Thank you Analytical question: Total marks 30 1.

Please answer this question as soon as you can please. I will give you positive rating instantly. Thank you

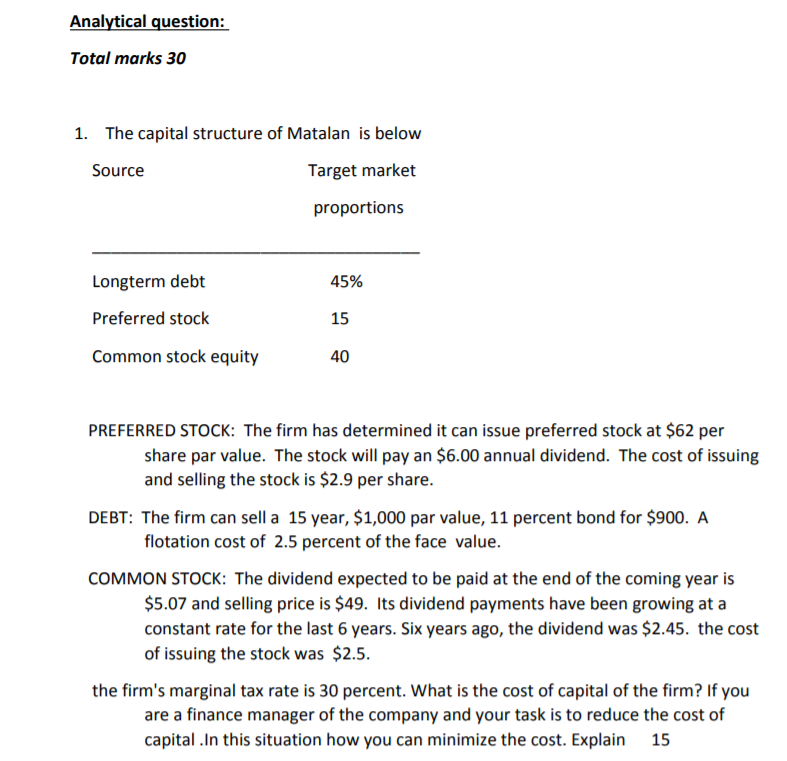

Analytical question: Total marks 30 1. The capital structure of Matalan is below Source Target market proportions 45% Longterm debt Preferred stock Common stock equity 15 40 PREFERRED STOCK: The firm has determined it can issue preferred stock at $62 per share par value. The stock will pay an $6.00 annual dividend. The cost of issuing and selling the stock is $2.9 per share. DEBT: The firm can sell a 15 year, $1,000 par value, 11 percent bond for $900. A flotation cost of 2.5 percent of the face value. COMMON STOCK: The dividend expected to be paid at the end of the coming year is $5.07 and selling price is $49. Its dividend payments have been growing at a constant rate for the last 6 years. Six years ago, the dividend was $2.45. the cost of issuing the stock was $2.5. the firm's marginal tax rate is 30 percent. What is the cost of capital of the firm? If you are a finance manager of the company and your task is to reduce the cost of capital.In this situation how you can minimize the cost. Explain 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts