Question: please answer this question fully and show calculations so that I understand where everything is coming from please. the past few chegg questions ive posted

please answer this question fully and show calculations so that I understand where everything is coming from please. the past few chegg questions ive posted seemed not to answer the questions correct or ignored the required questions completely and just explained what the questions were asking. if you could answer these questions required it would be greatly appreciated.

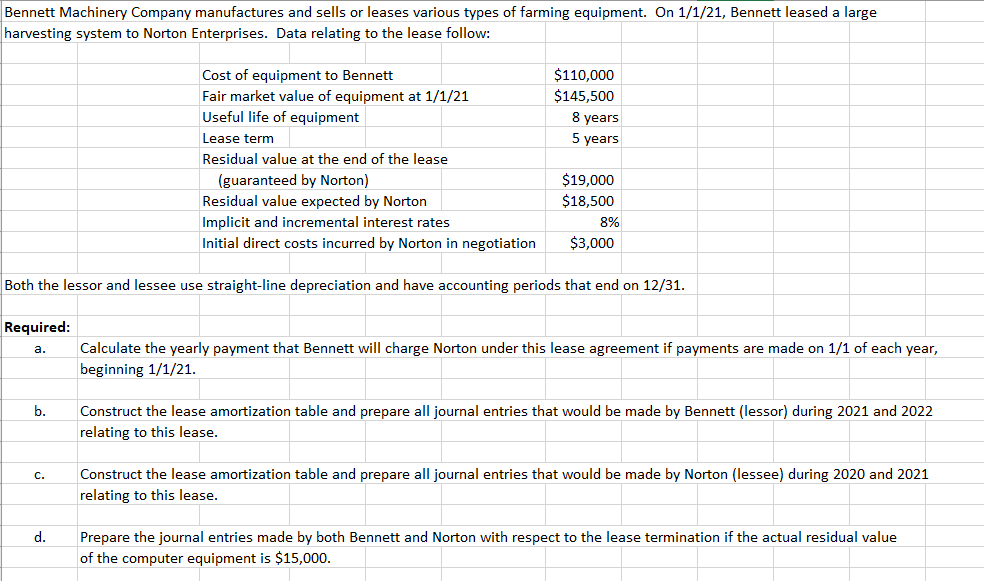

Bennett Machinery Company manufactures and sells or leases various types of farming equipment. On 1/1/21, Bennett leased a large harvesting system to Norton Enterprises. Data relating to the lease follow: Both the lessor and lessee use straight-line depreciation and have accounting periods that end on 12/31. Required: a. Calculate the yearly payment that Bennett will charge Norton under this lease agreement if payments are made on 1/1 of each year, beginning 1/1/21. b. Construct the lease amortization table and prepare all journal entries that would be made by Bennett (lessor) during 2021 and 2022 relating to this lease. c. Construct the lease amortization table and prepare all journal entries that would be made by Norton (lessee) during 2020 and 2021 relating to this lease. d. Prepare the journal entries made by both Bennett and Norton with respect to the lease termination if the actual residual value of the computer equipment is $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts