Question: Please answer this question in Excel 1. Suppose the world only consists of two risky assets: IBM and Walmart (MSFT) and a risk free asset.

Please answer this question in Excel

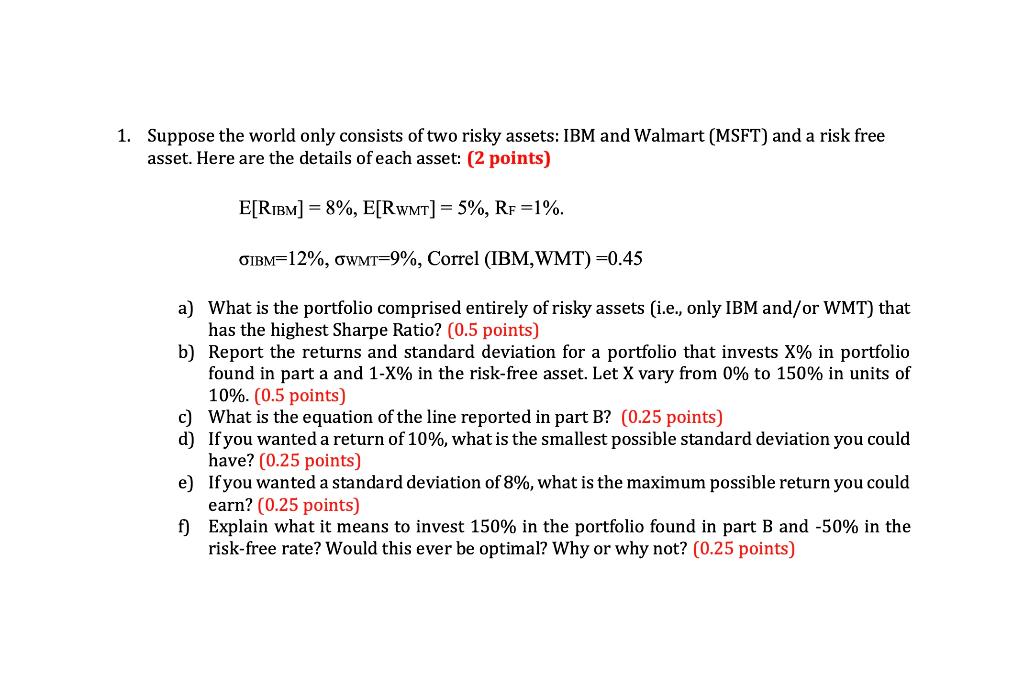

1. Suppose the world only consists of two risky assets: IBM and Walmart (MSFT) and a risk free asset. Here are the details of each asset: ( 2 points) E[RIBM]=8%,E[RWMT]=5%,RF=1%.IBM=12%,WMT=9%,Correl(IBM,WMT)=0.45 a) What is the portfolio comprised entirely of risky assets (i.e., only IBM and/or WMT) that has the highest Sharpe Ratio? ( 0.5 points) b) Report the returns and standard deviation for a portfolio that invests X% in portfolio found in part a and 1-X\% in the risk-free asset. Let X vary from 0% to 150% in units of 10%.(0.5 points) c) What is the equation of the line reported in part B? ( 0.25 points) d) If you wanted a return of 10%, what is the smallest possible standard deviation you could have? (0.25 points ) e) If you wanted a standard deviation of 8%, what is the maximum possible return you could earn? 0.25 points) f) Explain what it means to invest 150% in the portfolio found in part B and 50% in the risk-free rate? Would this ever be optimal? Why or why not? ( 0.25 points) 1. Suppose the world only consists of two risky assets: IBM and Walmart (MSFT) and a risk free asset. Here are the details of each asset: ( 2 points) E[RIBM]=8%,E[RWMT]=5%,RF=1%.IBM=12%,WMT=9%,Correl(IBM,WMT)=0.45 a) What is the portfolio comprised entirely of risky assets (i.e., only IBM and/or WMT) that has the highest Sharpe Ratio? ( 0.5 points) b) Report the returns and standard deviation for a portfolio that invests X% in portfolio found in part a and 1-X\% in the risk-free asset. Let X vary from 0% to 150% in units of 10%.(0.5 points) c) What is the equation of the line reported in part B? ( 0.25 points) d) If you wanted a return of 10%, what is the smallest possible standard deviation you could have? (0.25 points ) e) If you wanted a standard deviation of 8%, what is the maximum possible return you could earn? 0.25 points) f) Explain what it means to invest 150% in the portfolio found in part B and 50% in the risk-free rate? Would this ever be optimal? Why or why not? ( 0.25 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts