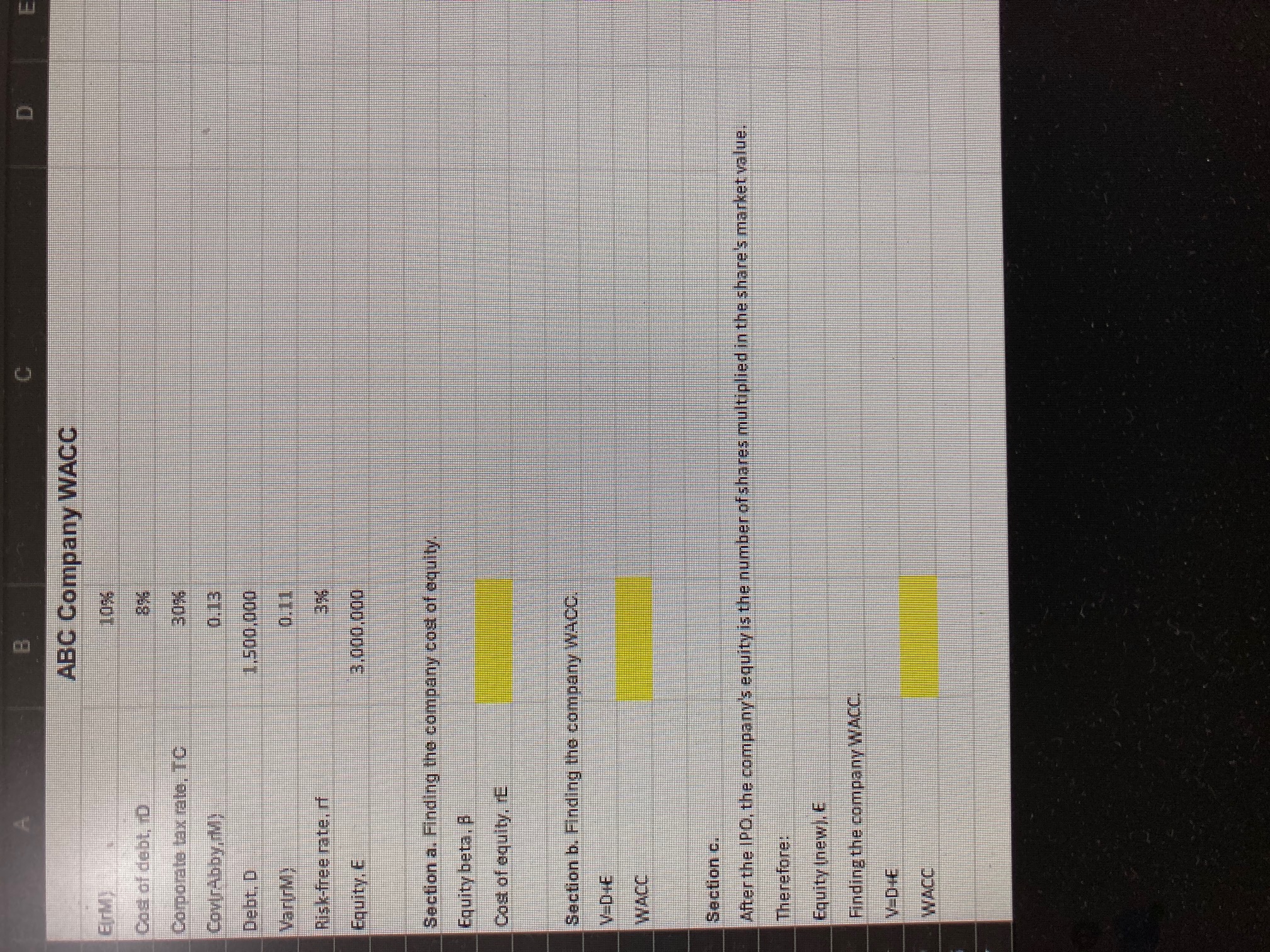

Question: Please answer this question in Excel format with the proper formula being displayed Calculate cost of equity Calculate WACC ABC's stocks are not currently listed

Please answer this question in Excel format with the proper formula being displayed

- Calculate cost of equity

- Calculate WACC

- ABC's stocks are not currently listed on a stock exchange. Suppose ABC issues all its stocks in an IPO. After the IPO the company has 3.5 million shares, worth $2.5 each. What is the WACC after the IPO?

C D ABC Company WACC Erk dog at debt, iD Comporate tax rate. TG CovlrAbby, M) Debt. D 1.500.000 Varr; Risk-free rate. of Equity. E 3,000,000 Section a. Finding the company cost of oquity. Equity beta. B Cost of equity, IE Section b. Finding the company W4CC. WACC Section c. After the IPO, the company's equity is the number of shares multiplied in the share's market value. Therefore: Equity Inew). E Finding the company WACC. C D ABC Company WACC Erk dog at debt, iD Comporate tax rate. TG CovlrAbby, M) Debt. D 1.500.000 Varr; Risk-free rate. of Equity. E 3,000,000 Section a. Finding the company cost of oquity. Equity beta. B Cost of equity, IE Section b. Finding the company W4CC. WACC Section c. After the IPO, the company's equity is the number of shares multiplied in the share's market value. Therefore: Equity Inew). E Finding the company WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts