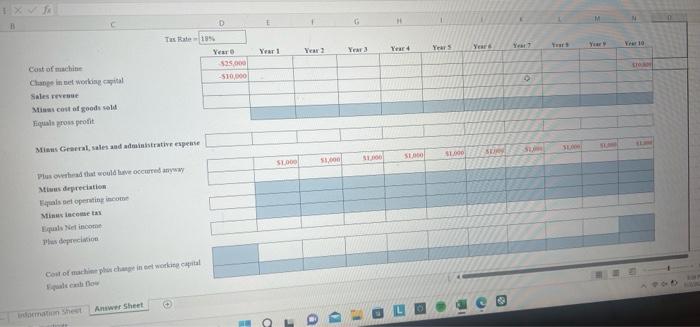

Question: Please answer this question in the excel format with the labels listed on the second picture! A: Given the available information, what are the free

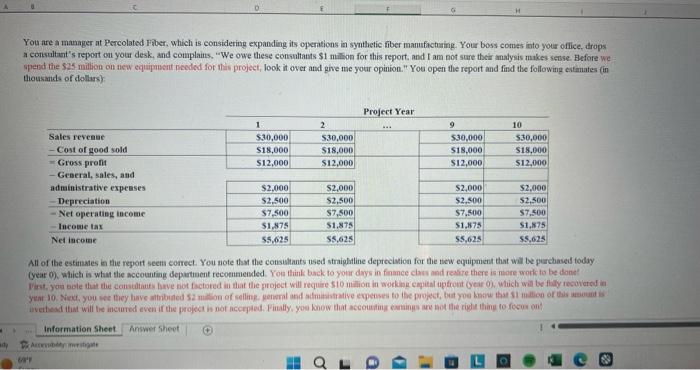

- Calculate the gross profit for Year 1-10 (10 pt.).

- Calculate the net operating income for Year 1-10 (10 pt.).

- Calculate the income tax for Year 1-10 (10 pt.).

- Calculate the net income for Year 1-10 (10 pt.).

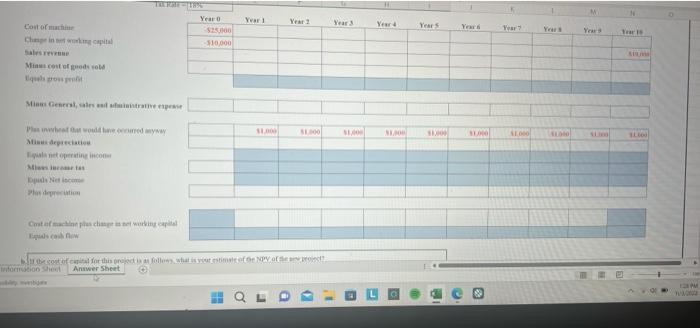

- Calculate the sum of the cost of the machine and the change in the net working capital (happens in Year 0 and 10) (10 pt.)

- Calculate the cash flow in Year 0 - 10 (20 pt.).

- Use the information on Cost of Capital, calculate the NPV of this project (10 pt.).

You tire a mannger at Rercolated Fober, which is considering expanding its operntions in syuthetic fiber manuficturing. Your boss cotnes into your office, teraps a consultant's report on your desk, and complaints, "We owe these consuitants $1 minison for this report, and I ama not sure their analyeis mikes sesse. Before We spend the 525 millien on tecw equipusent needed for this project, look it over and give me your opinion." You open the report and find the following estanates (in Hiousands of dolliss All of the estinstes in the report seet comect. You note that the consiltants nsed straighitline deprecistion for the new equipment that will ke perchased todidy Hion Minul

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts