Question: please answer this question Marks: 20 Q B1: a) A financial institution owns a portfolio of options on the US dollar-sterling exchange rate. The delta

please answer this question

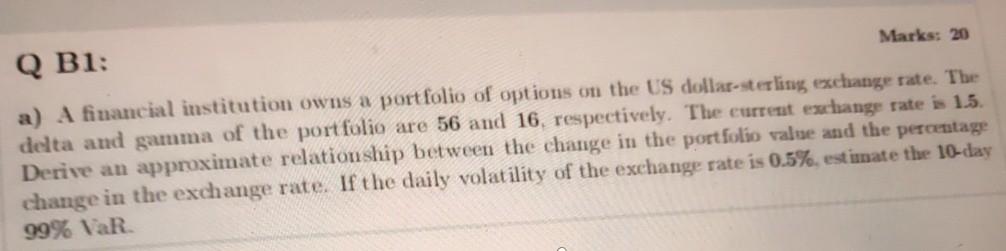

Marks: 20 Q B1: a) A financial institution owns a portfolio of options on the US dollar-sterling exchange rate. The delta and gamma of the portfolio are 56 and 16, respectively. The current exchange rate is 1.5. Derive an approximate relationship between the change in the portfolio value and the percentage change in the exchange rate. If the daily volatility of the exchange rate is 0.5%, estimate the 10-day 99% VaR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts