Question: Please answer this question on urgent Question 2 Bravo Builders Ltd are in the process of procuring a new digger. Your Operations Director has informed

Please answer this question on urgent

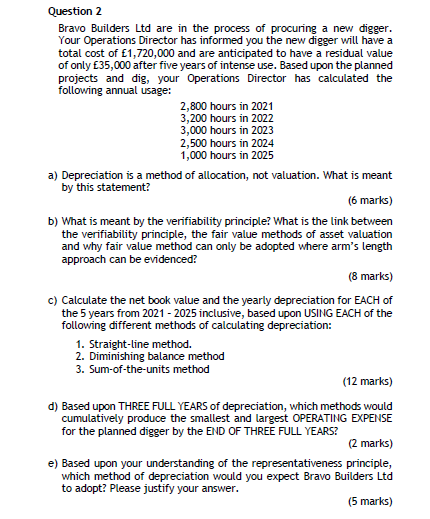

Question 2 Bravo Builders Ltd are in the process of procuring a new digger. Your Operations Director has informed you the new digger will have a total cost of 1,720,000 and are anticipated to have a residual value of only 35,000 after five years of intense use. Based upon the planned projects and dig, your Operations Director has calculated the following annual usage: 2,800 hours in 2021 3,200 hours in 2022 3,000 hours in 2023 2,500 hours in 2024 1,000 hours in 2025 a) Depreciation is a method of allocation, not valuation. What is meant by this statement? (6 marks) b) What is meant by the verifiability principle? What is the link between the verifiability principle, the fair value methods of asset valuation and why fair value method can only be adopted where arm's length approach can be evidenced? (8 marks) c) Calculate the net book value and the yearly depreciation for EACH of the 5 years from 2021 - 2025 inclusive, based upon USING EACH of the following different methods of calculating depreciation: 1. Straight-line method. 2. Diminishing balance method 3. Sum-of-the-units method (12 marks) d) Based upon THREE FULL YEARS of depreciation, which methods would cumulatively produce the smallest and largest OPERATING EXPENSE for the planned digger by the END OF THREE FULL YEARS? (2 marks) e) Based upon your understanding of the representativeness principle, which method of depreciation would you expect Bravo Builders Ltd to adopt? Please justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts