Question: Please answer this question only Part 2: The calculated values of part 1 cost per equivalent units is (Material 0.31 Transfered in 0.86 Conversion 1.05)

Please answer this question only Part 2: The calculated values of part 1 cost per equivalent units is (Material 0.31 Transfered in 0.86 Conversion 1.05) and cost of ending wip is 6400 and cost of units completed and transfered out is 222000.

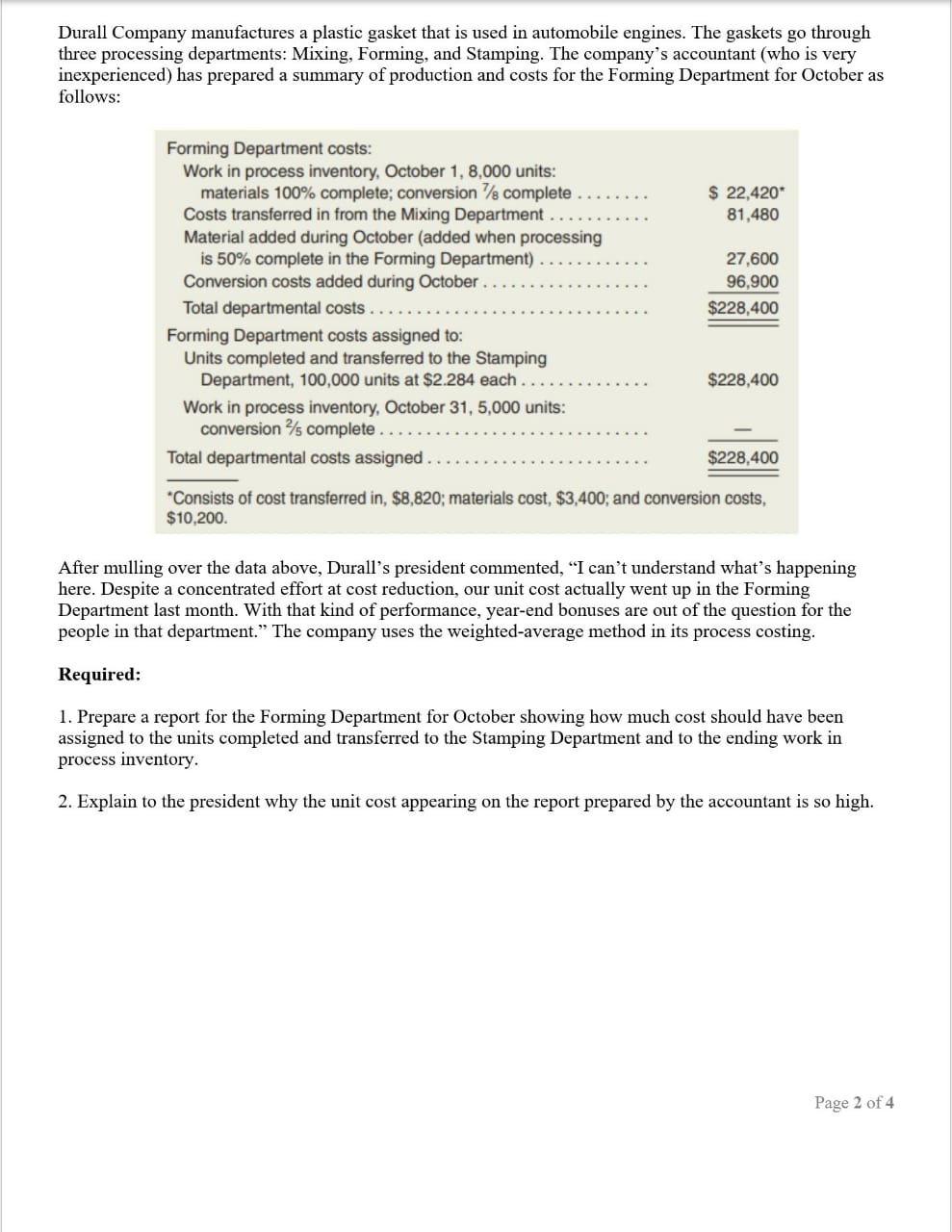

Durall Company manufactures a plastic gasket that is used in automobile engines. The gaskets go through three processing departments: Mixing, Forming, and Stamping. The company's accountant (who is very inexperienced) has prepared a summary of production and costs for the Forming Department for October as follows: Forming Department costs: Work in process inventory, October 1, 8,000 units: materials 100% complete; conversion /8 complete . ... . . .. $ 22,420" Costs transferred in from the Mixing Department . . Material added during October (added when processing . . . . . . ... 81,480 is 50% complete in the Forming Department) 27,600 Conversion costs added during October . . . . 96,900 Total departmental costs . . . $228,400 Forming Department costs assigned to: Units completed and transferred to the Stamping Department, 100,000 units at $2.284 each . . . $228,400 Work in process inventory, October 31, 5,000 units: conversion 2/s complete . .. . Total departmental costs assigned . . $228,400 Consists of cost transferred in, $8,820; materials cost, $3,400; and conversion costs, $10,200. After mulling over the data above, Durall's president commented, "I can't understand what's happening here. Despite a concentrated effort at cost reduction, our unit cost actually went up in the Forming Department last month. With that kind of performance, year-end bonuses are out of the question for the people in that department." The company uses the weighted-average method in its process costing. Required: 1. Prepare a report for the Forming Department for October showing how much cost should have been assigned to the units completed and transferred to the Stamping Department and to the ending work in process inventory. 2. Explain to the president why the unit cost appearing on the report prepared by the accountant is so high. Page 2 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts