Question: please answer this question. Previously it was answered incorrectly. The Wagner Corporation has a $22 million bond obligation outstanding, which it is considering refunding. Though

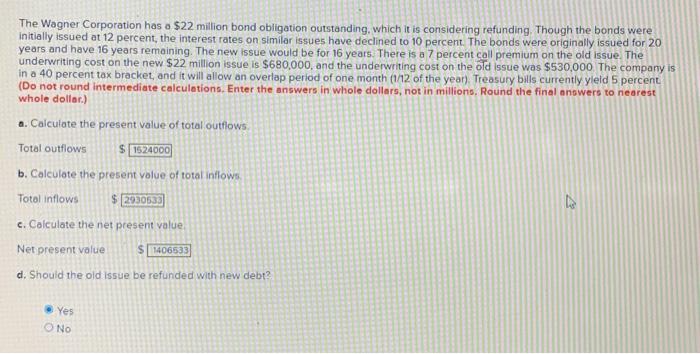

The Wagner Corporation has a $22 million bond obligation outstanding, which it is considering refunding. Though the bonds were Initially issued at 12 percent, the interest rates on similar issues have declined to 10 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 7 percent call premium on the old issue. The underwriting cost on the new $22 million issue is $680,000, and the underwriting cost on the old issue was $530,000 The company is in a 40 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yleld 5 percent (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions, Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows Total outflows $ 1524000 b. Calculate the present value of total inflows Total inflows $ 2930533 c. Calculate the net present value Net present value $1406533 d. Should the old issue be refunded with new debt? Yes NO The Wagner Corporation has a $22 million bond obligation outstanding, which it is considering refunding. Though the bonds were Initially issued at 12 percent, the interest rates on similar issues have declined to 10 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 7 percent call premium on the old issue. The underwriting cost on the new $22 million issue is $680,000, and the underwriting cost on the old issue was $530,000 The company is in a 40 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yleld 5 percent (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions, Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows Total outflows $ 1524000 b. Calculate the present value of total inflows Total inflows $ 2930533 c. Calculate the net present value Net present value $1406533 d. Should the old issue be refunded with new debt? Yes NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts