Question: Please answer this question Problem 4: Mutual Fund Returns |15 points| You are considering investing in a mutual fund's A share class that has a

Please answer this question

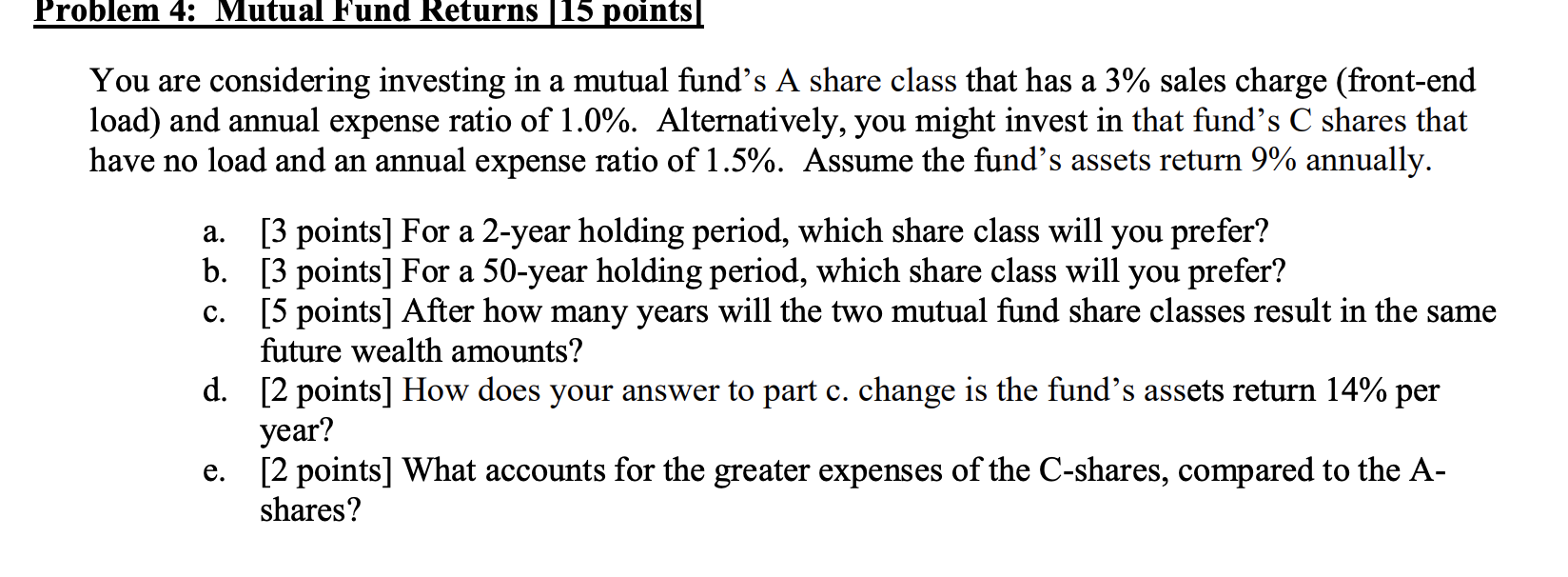

Problem 4: Mutual Fund Returns |15 points| You are considering investing in a mutual fund's A share class that has a 3% sales charge (front-end load) and annual expense ratio of 1.0%. Alternatively, you might invest in that fund's C shares that have no load and an annual expense ratio of 1.5%. Assume the fund's assets return 9% annually. a. [3 points] For a 2-year holding period, which share class will you prefer? b. [3 points] For a 50-year holding period, which share class will you prefer? c. [5 points] After how many years will the two mutual fund share classes result in the same future wealth amounts? (1. [2 points] How does your answer to part 0. change is the fund's assets return 14% per year? e. [2 points] What accounts for the greater expenses of the C-shares, compared to the A- shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts