Question: please answer this question. Question 3 14 Marks (a) Do you think that there are implications of the revaluation increments (upward revaluation) and revaluation decrements

please answer this question.

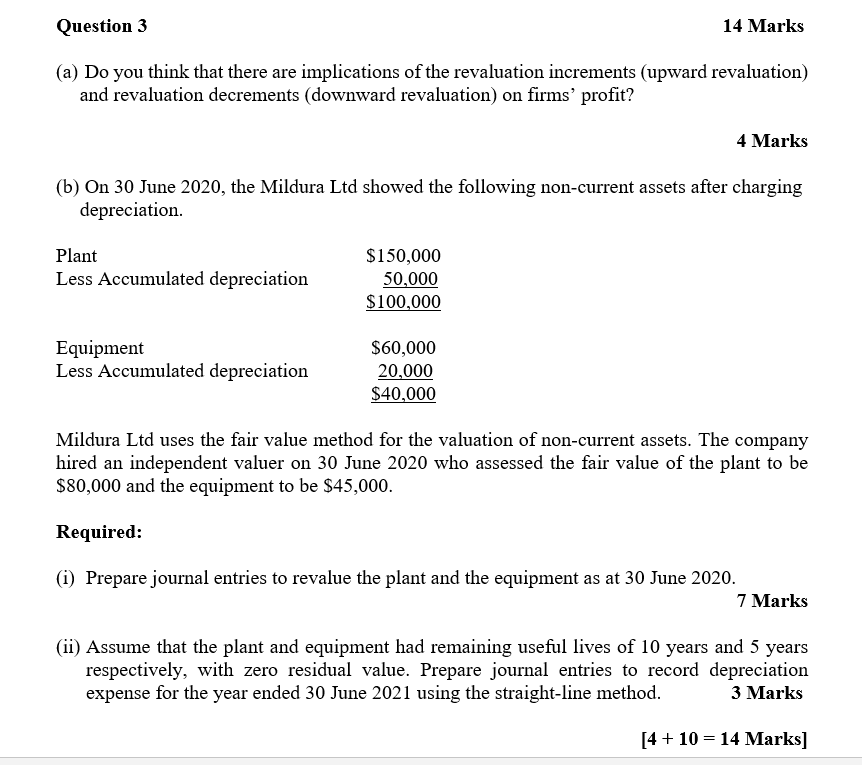

Question 3 14 Marks (a) Do you think that there are implications of the revaluation increments (upward revaluation) and revaluation decrements (downward revaluation) on firms' profit? 4 Marks (b) On 30 June 2020, the Mildura Ltd showed the following non-current assets after charging depreciation. Plant Less Accumulated depreciation $150,000 50,000 $100,000 Equipment Less Accumulated depreciation $60,000 20,000 $40,000 Mildura Ltd uses the fair value method for the valuation of non-current assets. The company hired an independent valuer on 30 June 2020 who assessed the fair value of the plant to be $80,000 and the equipment to be $45,000. Required: (i) Prepare journal entries to revalue the plant and the equipment as at 30 June 2020. 7 Marks (ii) Assume that the plant and equipment had remaining useful lives of 10 years and 5 years respectively, with zero residual value. Prepare journal entries to record depreciation expense for the year ended 30 June 2021 using the straight-line method. 3 Marks [4 + 10 = 14 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts