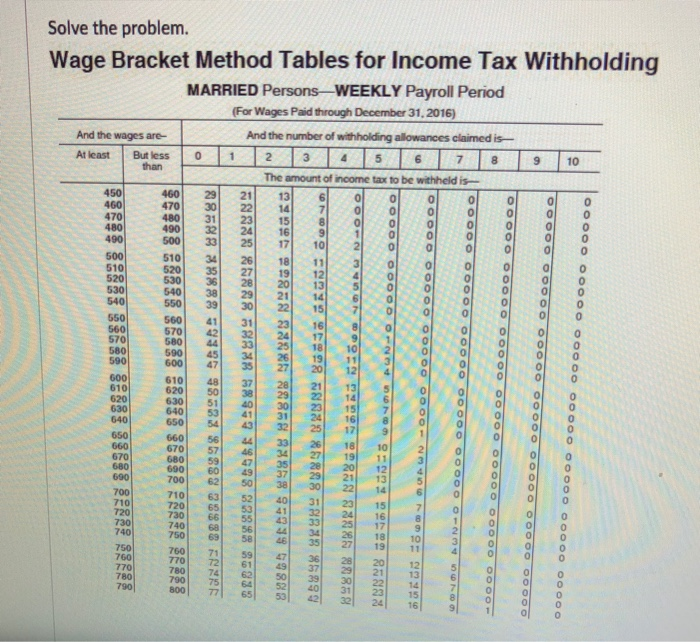

Question: Please answer this question. Solve the problem. Wage Bracket Method Tables for Income Tax Withholding MARRIED Persons-WEEKLY Payroll Period (For Wages Paid through December 31,

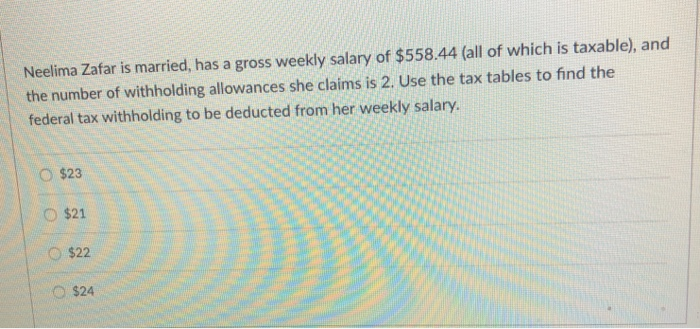

Solve the problem. Wage Bracket Method Tables for Income Tax Withholding MARRIED Persons-WEEKLY Payroll Period (For Wages Paid through December 31, 2016) And the number of withholding allowances claimed is- And the wages are- 6 7 8 9 10 At least 1 But less | 0 | 1 | 2 | 3 | 4 5 The amount of income tax to be withheld is 450 460 470 480 490 460| 29| 21| 13| 61 470 30 22| 14| 01 0 480 31 215 o 490 3224 16 500| 33| 25| 1 101 0 5101 341 261 181 111 520 35 27 19 12 530 3628 2013 510 520 530 540 540 38 29 2114 o 550 39 30 22 15 70 5601 41| 31| 23| 16| 5701 42 32 24| 17 560 570 580 44 33 25 18 02 590| 45 34l 26| 19| 11 6001 47 35| 27| 201 12| 4| 0| 0 6101 48| 37| 28| 21| 13 5 610 620 630 6201 5 381 291 221 14 630 51 40 30 23 57 640 53 41 3124 68 6501 541 431 251 1 9 660 56 44 33 26 1810 6701 5 46 341 2 13] 11 680| 59| 4 351 201 201 12 600| 60| 49| 3 201 21 13 7001 621 501 38 301 2 14 670 0 710 63 2 40 312315 7201 651 53| 41| 32| 24| 16 730 66 55 43 33 25 17 7401 68| 56| 44| 34| 26| 18 750 69 83527 19 7601 711 5 471 361 281 20 7701 7 61| 491 371 291 21 7801 74 621 5 3 30| 22 700 710 740 750 760 770 780 12 13 7901 75| 64 521 401 311 231 15 241 16 8001 771 651 531 421 321 Neelima Zafar is married, has a gross weekly salary of $558.44 (all of which is taxable), and the number of withholding allowances she claims is 2. Use the tax tables to find the federal tax withholding to be deducted from her weekly salary O $23 o $21 O $22 o $24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts