Question: Please answer this question step by step, thank you so much! Umbrella Corp (UC), a pharmaceutical company, is evaluating a 3-year R&D proposal that requires

Please answer this question step by step, thank you so much!

Please answer this question step by step, thank you so much!

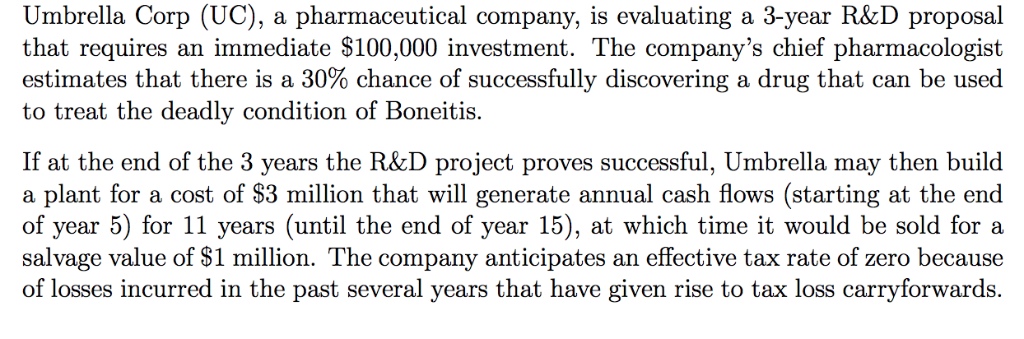

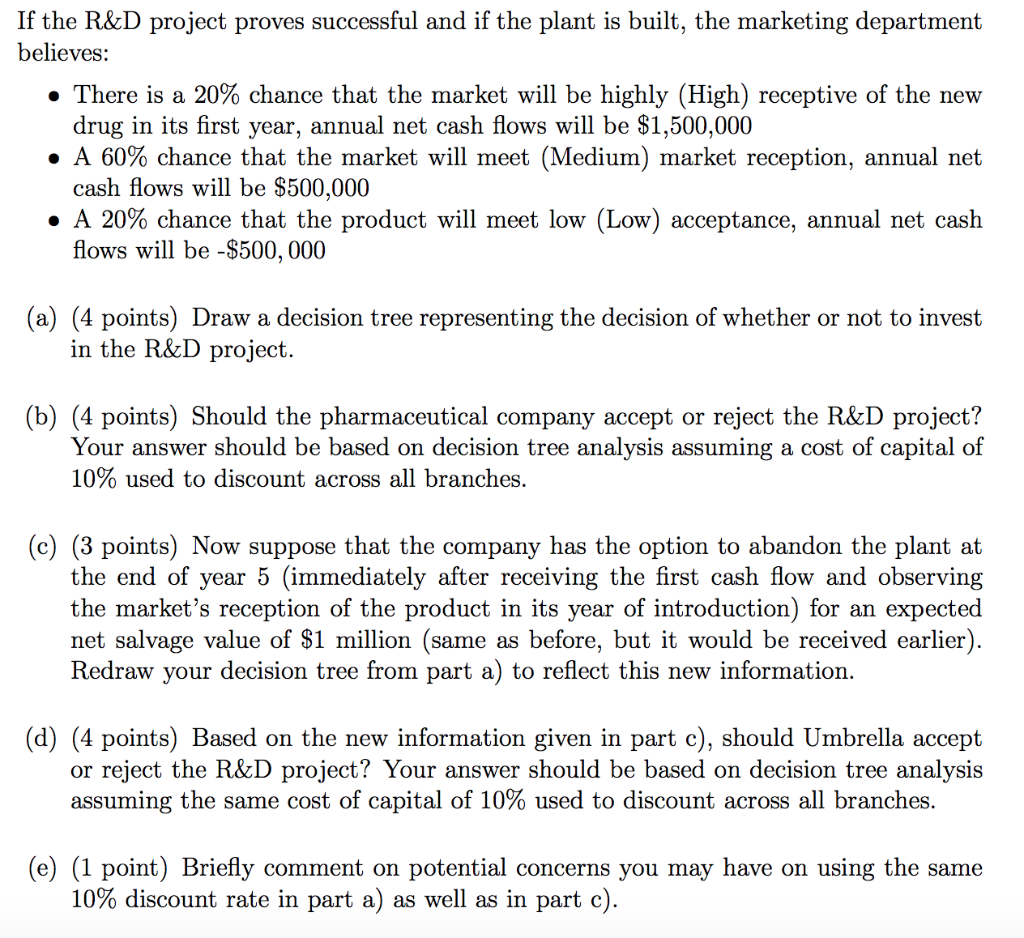

Umbrella Corp (UC), a pharmaceutical company, is evaluating a 3-year R&D proposal that requires an immediate S100,000 investment. The company's chief pharmacologist estimates that there is a 30% chance of successfully discovering a drug that can be used to treat the deadly condition of Boneitis. If at the end of the 3 years the R&D project proves successful, Umbrella may then builo a plant for a cost of S3 million that will generate annual cash flows (starting at the end of year 5) for 11 years (until the end of year 15), at which time it would be sold for a salvage value of $1 million. The company anticipates an effective tax rate of zero because of losses incurred in the past several years that have given rise to tax loss carryforwards. If the R&D project proves successful and if the plant is built, the marketing department There is a 20% chance that the market will be highly (High) receptive of the new A 60% chance that the market will meet (Medium) market reception, annual net A 20% chance that the product will meet low (Low) acceptance, annual net cash believes: drug in its first year, annual net cash flows will be $1,500,000 cash flows will be S500,000 flows will be -$500,000 (a) (4 points) Draw a decision tree representing the decision of whether or not to invest in the R&D project. (b) (4 points) Should the pharmaceutical company accept or reject the R&D project? Your answer should be based on decision tree analysis assuming a cost of capital of 10% used to discount across all branches. (c) (3 points) Now suppose that the company has the option to abandon the plant at the end of year 5 (immediately after receiving the first cash flow and observing the market's reception of the product in its year of introduction) for an expected net salvage value of S1 million (same as before, but it would be received earlier) Redraw your decision tree from part a) to reflect this new information (d) (4 points) Based on the new information given in part c), should Umbrella accept or reject the R&D project? Your answer should be based on decision tree analysis assuming the same cost of capital of 10% used to discount across all branches (e) (1 point) Briefly comment on potential concerns you may have on using the same 10% discount rate in part a) as well as in part c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts