Question: please answer this question THank you please answer this one A project's Internal rate of return (IRR) is the discount rate that forces the PV

please answer this one

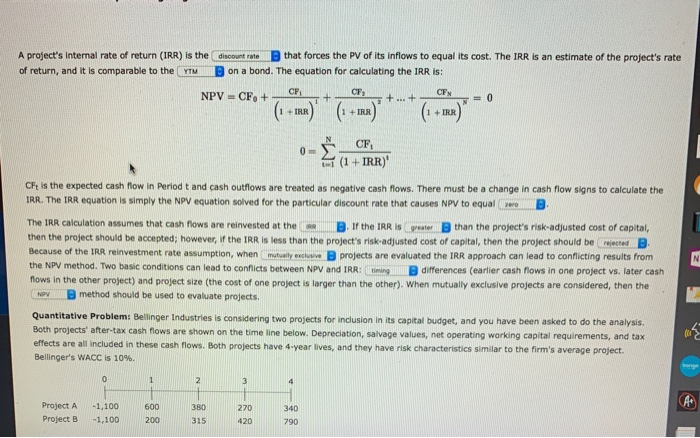

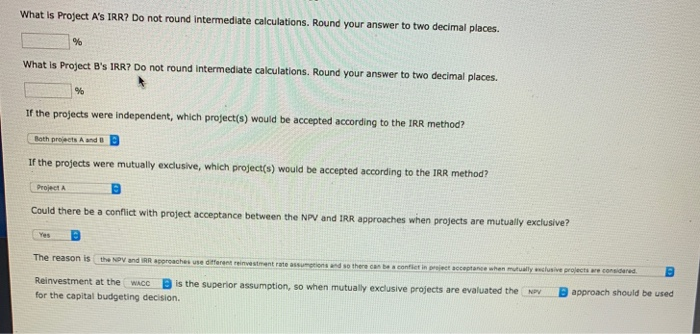

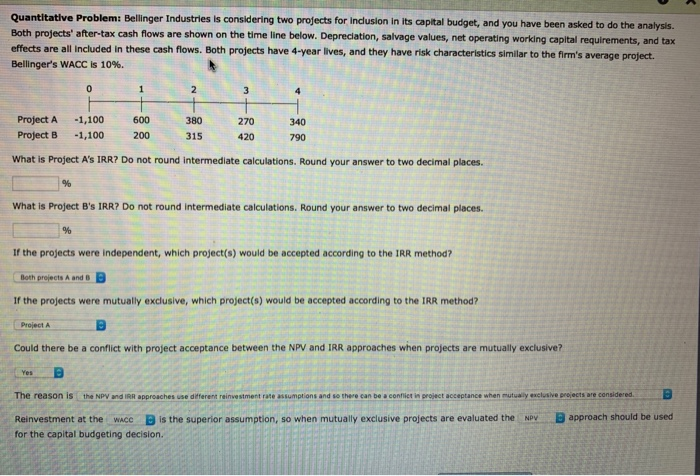

please answer this one A project's Internal rate of return (IRR) is the discount rate that forces the PV of its inflows to equal its cost. The IRR is an estimate of the project's rate of return, and it is comparable to the YTM Bon a bond. The equation for calculating the IRR is: F. + +_CF +...+ CP =0 (1 + r) (1 + x2) (1 + r) 0- CF 21 (1+ IRR) CF is the expected cash flow in Period t and cash outflows are treated as negative cash flows. There must be a change in cash flow signs to calculate the TRR. The IRR equation is simply the NPV equation solved for the particular discount rate that causes NPV to equale The IRR calculation assumes that cash flows are reinvested at the D. If the IRR IS greater than the project's risk-adjusted cost of capital, then the project should be accepted; however, if the IRR is less than the project's risk-adjusted cost of capital, then the project should be rejected B Because of the IRR reinvestment rate assumption, when mutually the projects are evaluated the IRR approach can lead to conflicting results from the NPV method. Two basic conditions can lead to conflicts between NPV and IRR: Timing differences (earlier cash flows in one project vs. later cash flows in the other project) and project size (the cost of one project is larger than the other). When mutually exclusive projects are considered, then the NPVB method should be used to evaluate projects. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Belinger's WACC is 10% 600 Project A Project B -1,100 -1,100 20 200 What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round Intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? The reason is the and IRRO B approach should be used Reinvestment at the WACC is the superior assumption, so when mutually exclusive projects are evaluated the NPV for the capital budgeting decision. Quantitative Problemi Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC Is 10%. Project A Project B -1,100 -1,100 600 200 380 315 270 420 7 340 90 What is Project A's IRR? Do not round Intermediate calculations. Round your answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations, Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? Both projects A and B E If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Project Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? The reason is the NPV and approaches use different reinvestment rate assumptions and so there can be a contin project acceptance when m y exclusive projects are conside approach should be used Reinvestment at the WACC B is the superior assumption, so when mutually exclusive projects are evaluated the NY for the capital budgeting decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts