Question: PLEASE ANSWER THIS QUESTION The current risk-free rate is 4 percent and the market risk premium is 5 percent. You are trying to value ABC

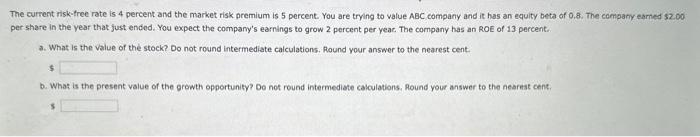

The current risk-free rate is 4 percent and the market risk premium is 5 percent. You are trying to value ABC company and it has an equity beta of 0.8. The company eamed sz. oo per share in the year that just ended. You expect the company's earnings to grow 2 percent per yeac. The company has an ROE of 13 percent. a. What is the value of the stock? Do not round intermediate calculations. Rlound your answer to the nearest cent. b. What is the present value of the growth opportunity? Do not round intermediate calculations, Phound your answer to the nearnat cent. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts