Question: Please answer this question using excel Kinky Copies may buy a high-volume copier. The machine costs $80,000 and this cost can be fully depreciated immediately.

Please answer this question using excel

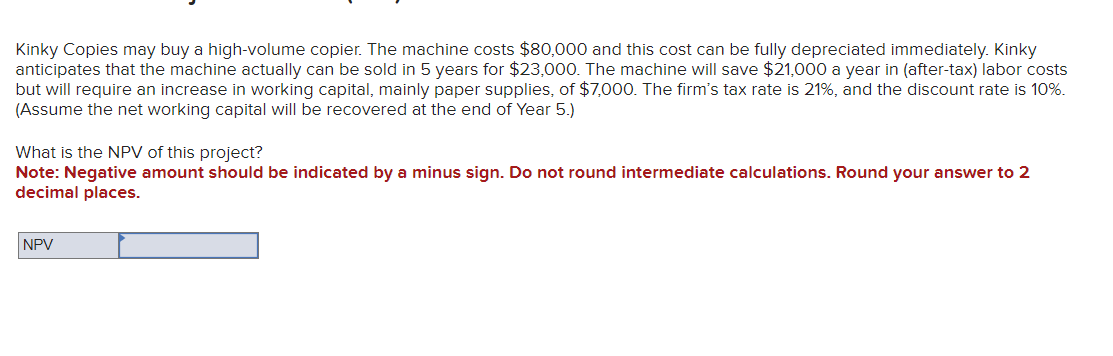

Kinky Copies may buy a high-volume copier. The machine costs $80,000 and this cost can be fully depreciated immediately. Kinky anticipates that the machine actually can be sold in 5 years for $23,000. The machine will save $21,000 a year in (after-tax) labor costs but will require an increase in working capital, mainly paper supplies, of $7,000. The firm's tax rate is 21%, and the discount rate is 10%. (Assume the net working capital will be recovered at the end of Year 5.) What is the NPV of this project? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts