Question: Please answer this question. Way Sulivan worked 59 hours during the week t(Cick the icon to view payroll tax rate information.) Read the requirements Requirement

Please answer this question.

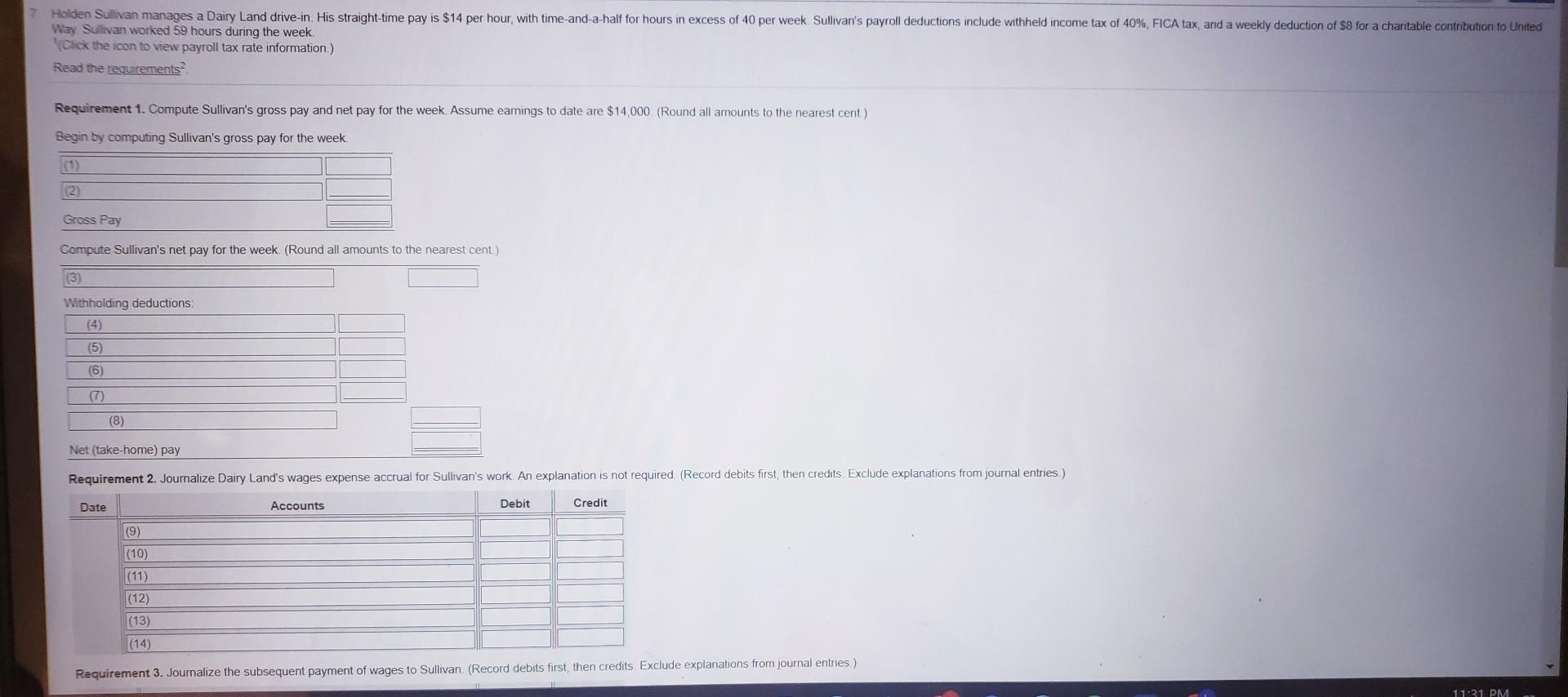

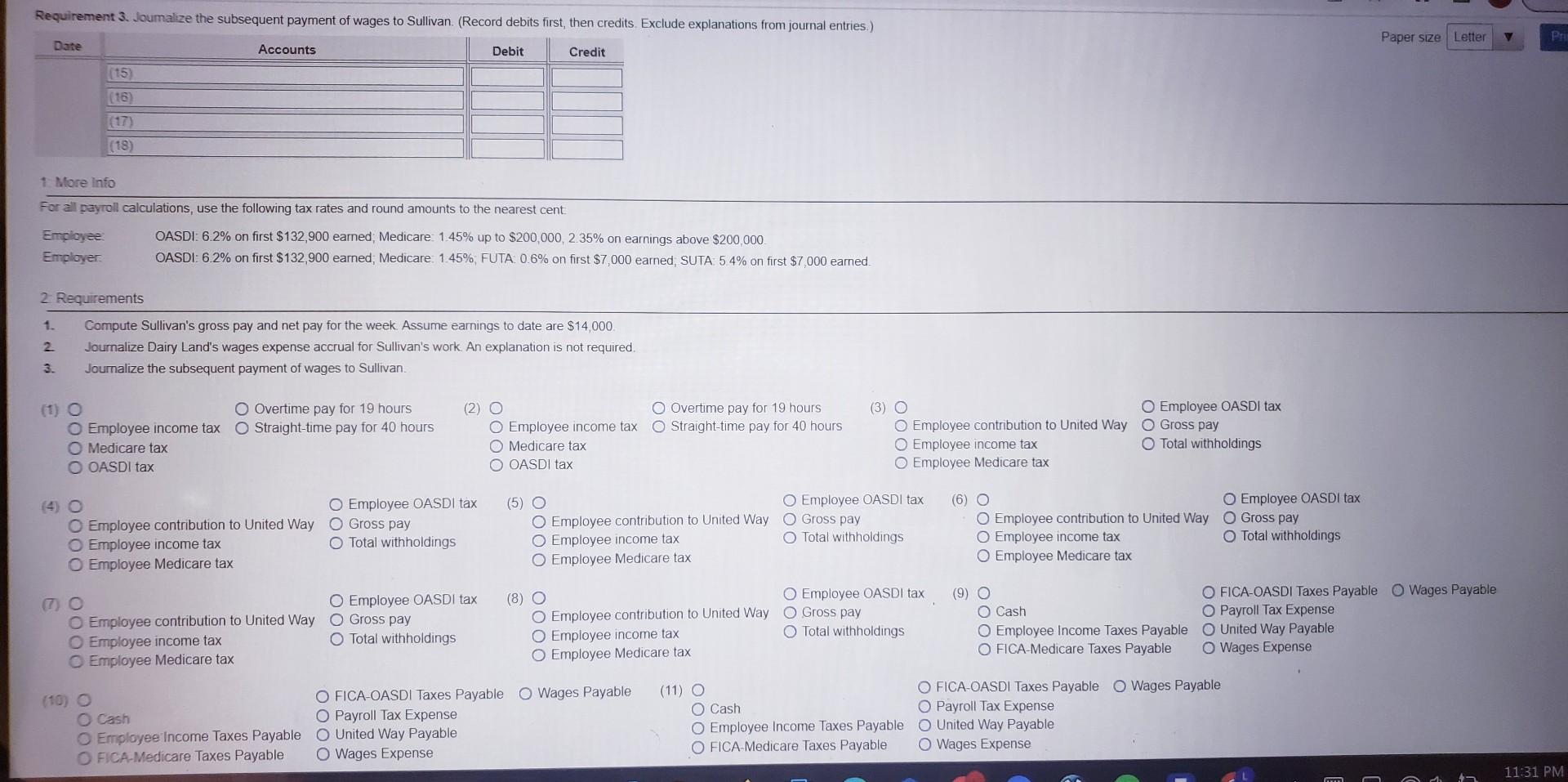

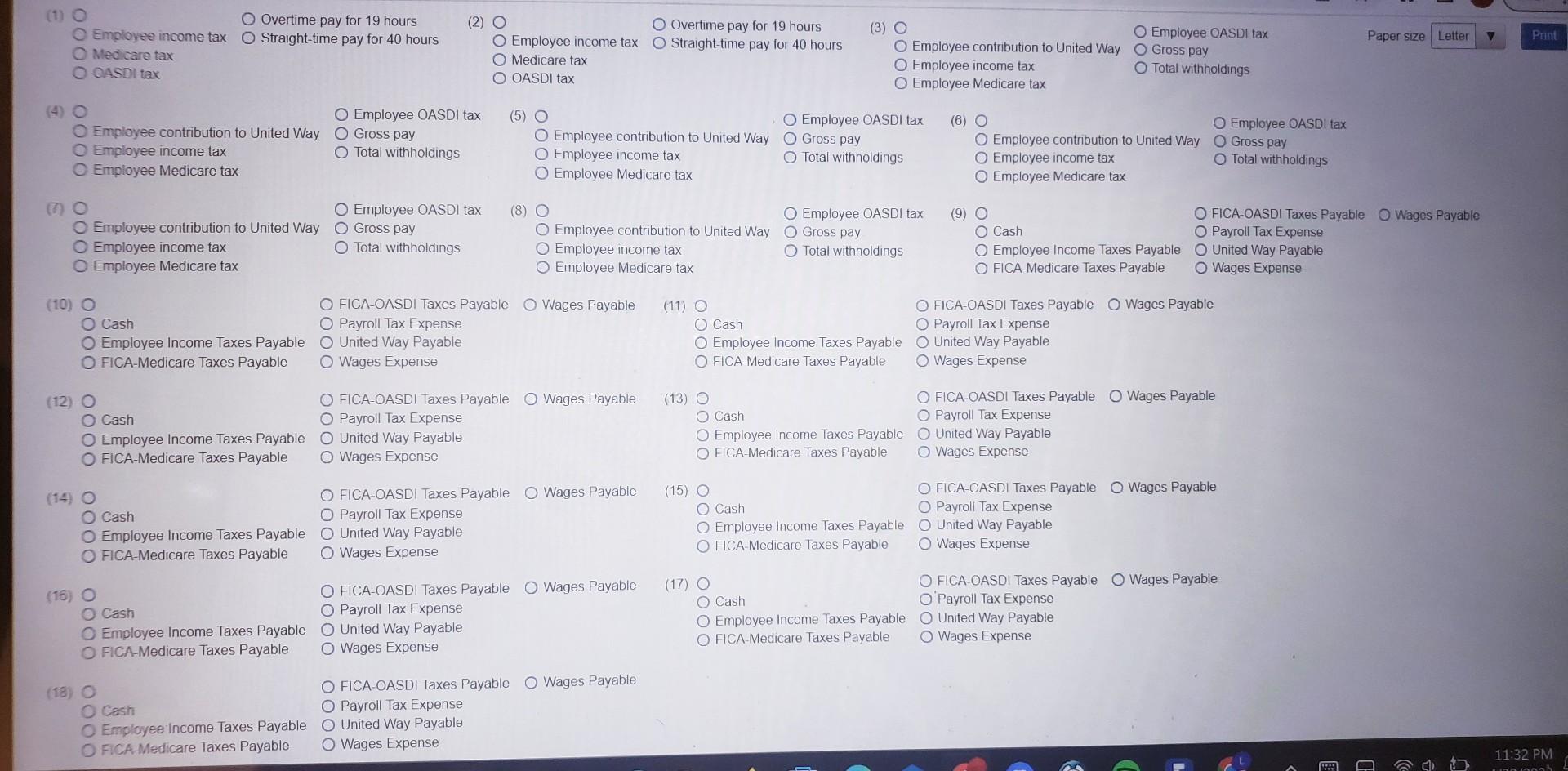

Way Sulivan worked 59 hours during the week t(Cick the icon to view payroll tax rate information.) Read the requirements Requirement 1. Compute Sullivan's gross pay and net pay for the week. Assume eamings to date are $14,000 (Round all amounts to the nearest cent). Begin by computing Sullivan's gross pay for the week. (1) Gross Pay Compute Sullivan's net pay for the week. (Round all amounts to the nearest cent.) (3) Withholding deductions: (8) Net (take-home) pay Requirement 2. Joumalize Dairy Land's wages expense accrual for Sullivan's work An explanation is not required. (Record debits first, then credits. Exclude explanations from journal entries.) Requirement 3. Journalize the subsequent payment of wages to Sullivan. (Record debits first, then credits. Exclude explanations from journal entries) For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee: OASDI: 6.2% on first $132,900 earned; Medicare- 1.45% up to $200,000,2.35% on earnings above $200,000 Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%, FUTA: 0.6% on first $7,000 earned, SUTA: 54% on first $7,000 earned 2. Requirements 1. Compute Sullivan's gross pay and net pay for the week. Assume earnings to date are $14,000. 2. Journalize Dairy Land's wages expense accrual for Sullivan's work. An explanation is not required. 3. Journalize the subsequent payment of wages to Sullivan. (1) (2) (3) Employee contribution to United Way Employee Employee income tax Total withholdings Employee Medicare tax (4) Employee OASDI tax (5) Employee OASDI tax EmployeecontributiontoUnitedWayEmployeeincometaxEmployeeOASDItaxpayTotalwithholdings (6) O Gross pay Employee contribution to United Way Employee Medicare tax Employee Medicare tax Employee OASDI tax (8) Employee OASDI tax FICA-OASDI Taxes Payable Wages Payable Employee contribution to United Way Payroll Tax Expense Employee income tax Employee Medicare tax Total withholdings Employee Income Taxes Payable United Way Payable Wages Expense FICA-OASDI Taxes Payable Wages Payable (11) Payroll Tax Expense Cash Payroll Tax Expense Employee Income Taxes Payable United Way Payable United Way Payable Wages Expense FICA-Medicare Taxes Payable Wages Expense (1) 0 O Overtime pay for 19 hours Employee income tax Straight-time pay for 40 hours (2) OO Overtime pay for 19 hours (3) O Employee OASDI tax Medicare tax Employee incom Employee contribution to United Way Gross pay OASDI tax Employee income tax Total withholdings OASDI tax (4) (7) Employee OASDI tax (8) Employee OASDI tax (9) O FICA-OASDI Taxes Payable Wages Payable Gross pay Gross pay Cash P Payroll Tax Expense Employee income tax Employee income tax Employee Income Taxes Payable United Way Payable Employee Medicare tax Employee Medicare tax Wages Expense (10) FICA-OASDI Taxes Payable Wages Payable (11) 0 FICA-OASDI Taxes Payable Wages Payable Payroll Tax Expense Cash Payroll Tax Expense United Way Payable Employee Income Taxes Payable United Way Payable Wages Expense (12) FICA-OASDI Taxes Payable Wages Payable (13) FICA-OASDI Taxes Payable Wages Payable Payroll Tax Expense United Way Payable CashEmployeeIncomeTaxesPayablePayrollTaxExpenseUnitedWayPayable Wages Expense FICA-Medicare Taxes Payable Wages Expense (14) FICA-OASDI Taxes Payable Wages Payable (15) Cash Payroll Tax Expense Wages Expense \begin{tabular}{ll} & FICA-OASDI Taxes Payay \\ \hline Cash & Payroll Tax Expense \\ Employee Income Taxes Payable & United Way Payable \\ FICA-Medicare Taxes Payable & Wages Expense \end{tabular} (16) FICA-OASDI Taxes Payable Wages Payable (17) FICA-OASDI Taxes Payable Wages Payable 'Payroll Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts