Question: Please answer this question with the Q2 results, link are below Thanks https://www.chegg.com/homework-help/questions-and-answers/-q46180427 Question 3 Using Question 2 information from above, answer each of the

Please answer this question with the Q2 results, link are below Thanks

https://www.chegg.com/homework-help/questions-and-answers/-q46180427

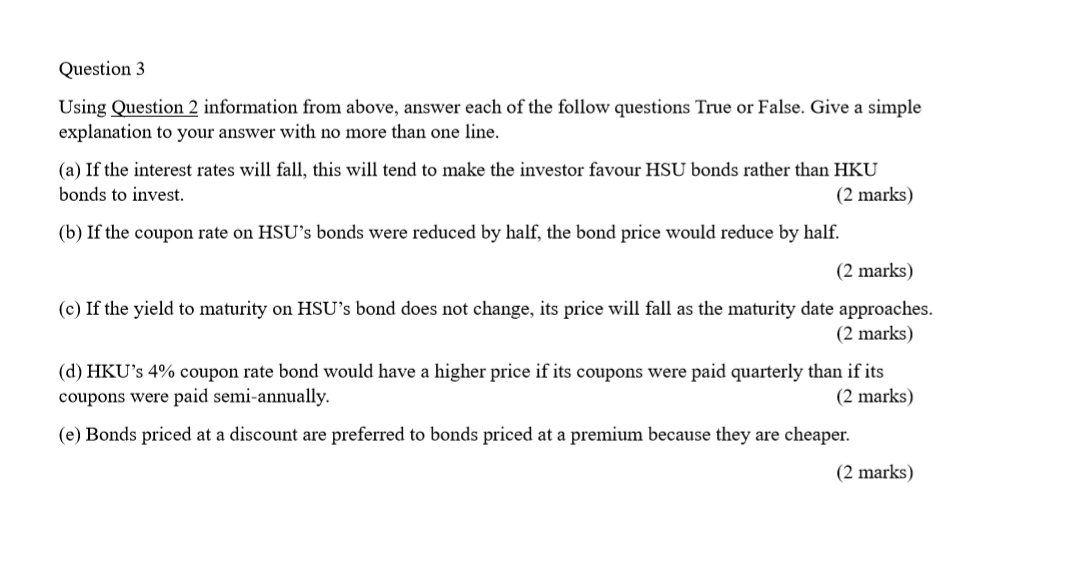

Question 3 Using Question 2 information from above, answer each of the follow questions True or False. Give a simple explanation to your answer with no more than one line. (a) If the interest rates will fall, this will tend to make the investor favour HSU bonds rather than HKU bonds to invest. (2 marks) (b) If the coupon rate on HSU's bonds were reduced by half, the bond price would reduce by half. (2 marks) (c) If the yield to maturity on HSU's bond does not change, its price will fall as the maturity date approaches. (2 marks) (d) HKU's 4% coupon rate bond would have a higher price if its coupons were paid quarterly than if its coupons were paid semi-annually. (2 marks) (e) Bonds priced at a discount are preferred to bonds priced at a premium because they are cheaper. (2 marks) Question 3 Using Question 2 information from above, answer each of the follow questions True or False. Give a simple explanation to your answer with no more than one line. (a) If the interest rates will fall, this will tend to make the investor favour HSU bonds rather than HKU bonds to invest. (2 marks) (b) If the coupon rate on HSU's bonds were reduced by half, the bond price would reduce by half. (2 marks) (c) If the yield to maturity on HSU's bond does not change, its price will fall as the maturity date approaches. (2 marks) (d) HKU's 4% coupon rate bond would have a higher price if its coupons were paid quarterly than if its coupons were paid semi-annually. (2 marks) (e) Bonds priced at a discount are preferred to bonds priced at a premium because they are cheaper. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts