Question: please answer this questions as soon as possible, no need for explanation, i will upvote 12. Which of the following methods allow the companies to

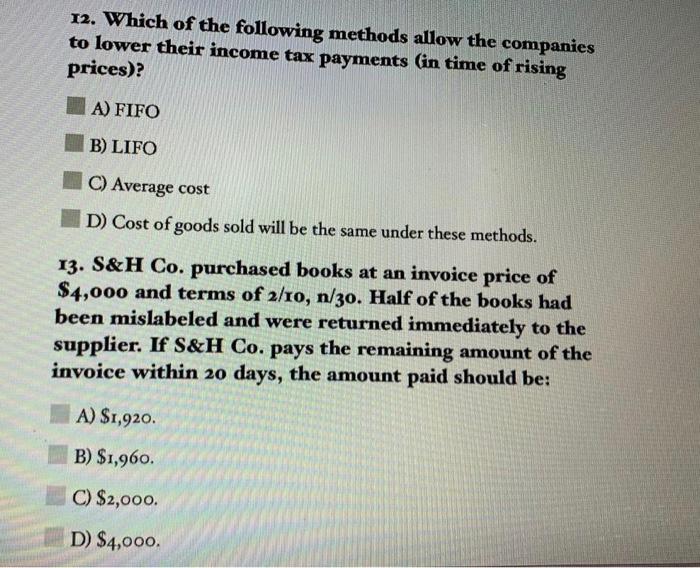

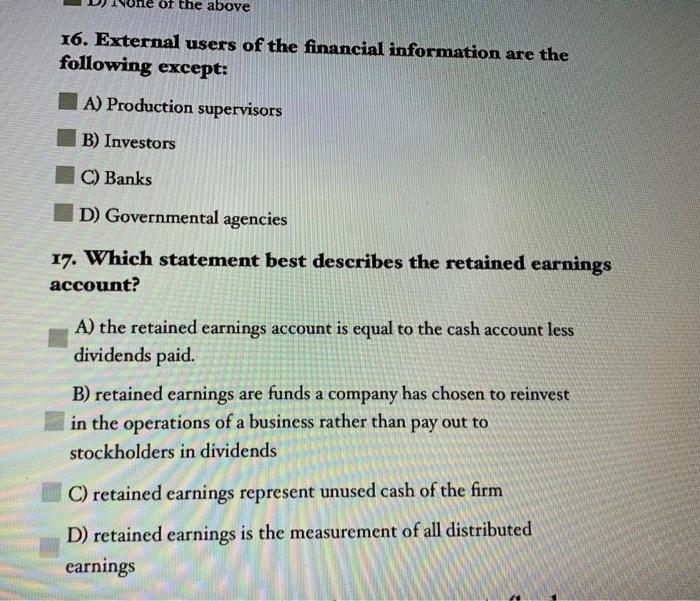

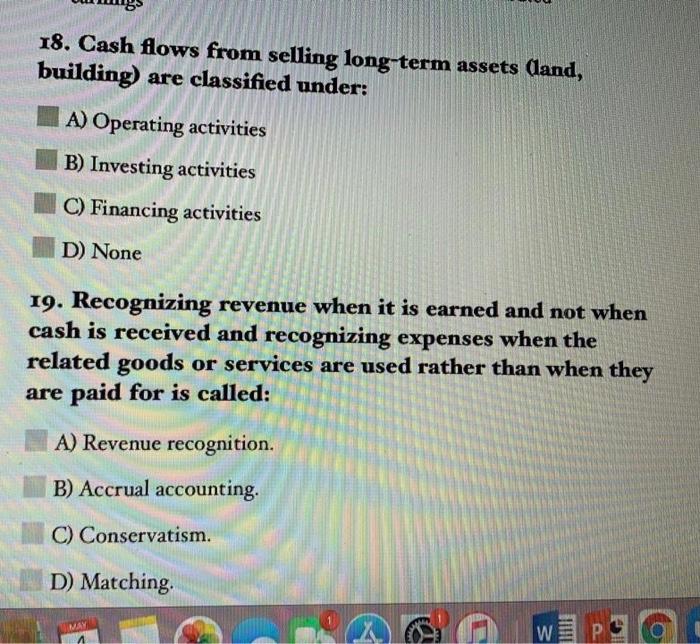

12. Which of the following methods allow the companies to lower their income tax payments (in time of rising prices)? A) FIFO B) LIFO C) Average cost D) Cost of goods sold will be the same under these methods. 13. S&H Co. purchased books at an invoice price of $4,000 and terms of 2/10, n/30. Half of the books had been mislabeled and were returned immediately to the supplier. If S&H Co. pays the remaining amount of the invoice within 20 days, the amount paid should be: A) $1,920. B) $1,960. C) $2,000. D) $4,000. of the above 16. External users of the financial information are the following except: A) Production supervisors B) Investors C) Banks D) Governmental agencies 17. Which statement best describes the retained earnings account? A) the retained earnings account is equal to the cash account less dividends paid. B) retained earnings are funds a company has chosen to reinvest in the operations of a business rather than pay out to stockholders in dividends Cretained earnings represent unused cash of the firm D) retained earnings is the measurement of all distributed earnings 18. Cash flows from selling long-term assets (land, building) are classified under: A) Operating activities B) Investing activities C) Financing activities D) None 19. Recognizing revenue when it is earned and not when cash is received and recognizing expenses when the related goods or services are used rather than when they are paid for is called: A) Revenue recognition. B) Accrual accounting. C) Conservatism. D) Matching MAY wipo a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts