Question: Payroll Assignment - (50 Marks) The following employees are working in the ABC Clinic, they are paid biweekly. Calculate the gross income, net income,

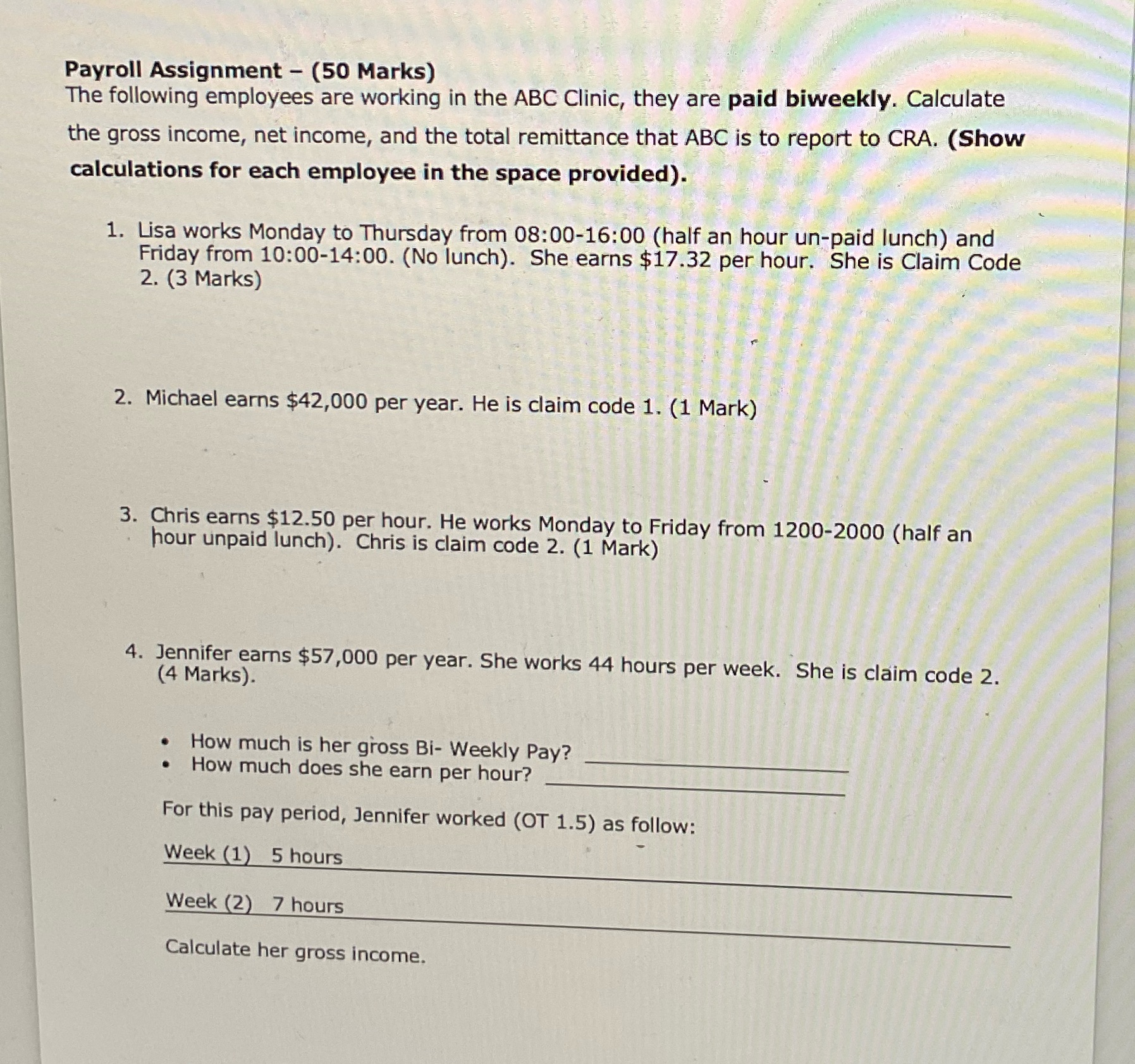

Payroll Assignment - (50 Marks) The following employees are working in the ABC Clinic, they are paid biweekly. Calculate the gross income, net income, and the total remittance that ABC is to report to CRA. (Show calculations for each employee in the space provided). 1. Lisa works Monday to Thursday from 08:00-16:00 (half an hour un-paid lunch) and Friday from 10:00-14:00. (No lunch). She earns $17.32 per hour. She is Claim Code 2. (3 Marks) 2. Michael earns $42,000 per year. He is claim code 1. (1 Mark) 3. Chris earns $12.50 per hour. He works Monday to Friday from 1200-2000 (half an hour unpaid lunch). Chris is claim code 2. (1 Mark) 4. Jennifer earns $57,000 per year. She works 44 hours per week. She is claim code 2. (4 Marks). How much is her gross Bi-Weekly Pay? How much does she earn per hour? For this pay period, Jennifer worked (OT 1.5) as follow: Week (1) 5 hours Week (2) 7 hours Calculate her gross income.

Step by Step Solution

There are 3 Steps involved in it

Employee Details Lisa Works Monday to Thursday from 08001600 half an hour unpaid lunch and Friday fr... View full answer

Get step-by-step solutions from verified subject matter experts