Question: please answer this. thanks in advance A B D E F 25 1 Input Parameters 2 Price $250 3 Capacity 4 Variable Cost $100 5

please answer this. thanks in advance

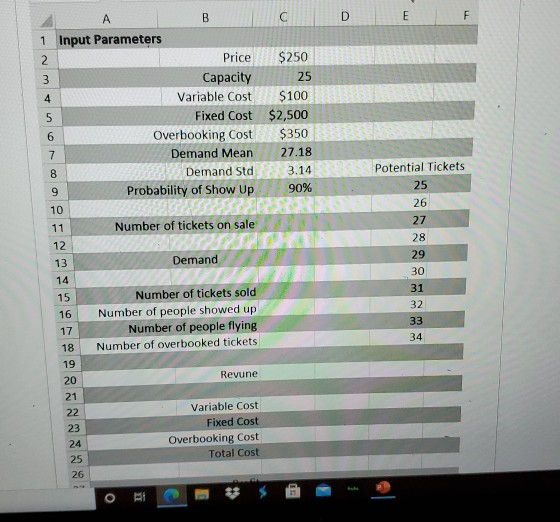

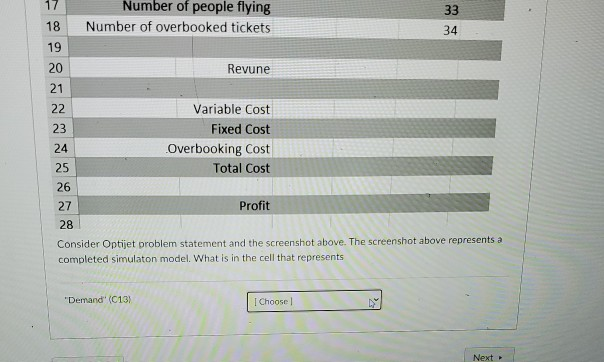

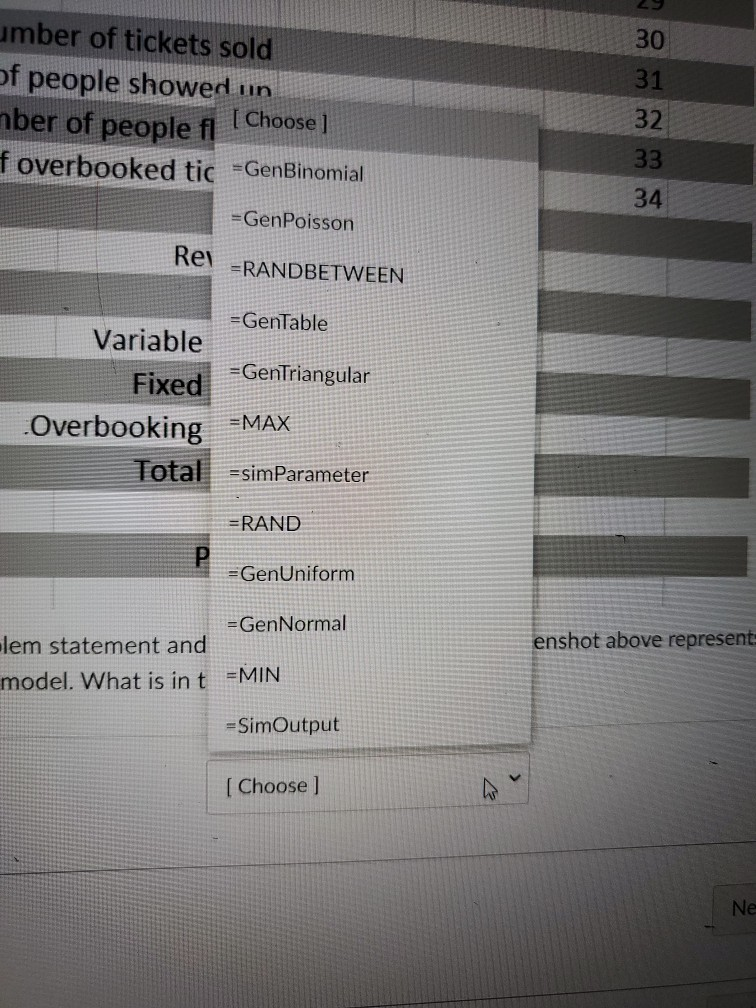

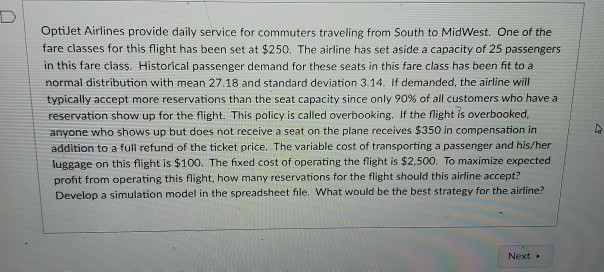

A B D E F 25 1 Input Parameters 2 Price $250 3 Capacity 4 Variable Cost $100 5 Fixed Cost $2,500 6 Overbooking Cost $350 7 Demand Mean 27.18 8 Demand Std 3.14 9 Probability of Show Up 90% 10 11 Number of tickets on sale 12 13 Demand 14 15 Number of tickets sold 16 Number of people showed up 17 Number of people flying 18 Number of overbooked tickets 19 20 Revune 21 22 Variable Cost 23 Fixed Cost 24 Overbooking Cost 25 Total Cost 26 Potential Tickets 25 26 27 28 29 30 31 32 33 34 O BI 17 33 Number of people flying Number of overbooked tickets 18 34 19 Revune 20 21 22 23 Variable Cost Fixed Cost Overbooking Cost Total Cost 24 25 26 27 Profit 28 Consider Optijet problem statement and the screenshot above. The screenshot above represents a completed simulaton model. What is in the cell that represents "Demand (C13) I Choose Next 30 31 umber of tickets sold of people showed un nber of people f1 [ Choose f overbooked tic =GenBinomial 32 33 34 =GenPoisson Rei =RANDBETWEEN =GenTable Variable Fixed =GenTriangular Overbooking =MAX Total =simParameter =RAND =GenUniform enshot above represent =Gen Normal lem statement and model. What is in t =MIN =SimOutput [ Choose ] Ne OptiJet Airlines provide daily service for commuters traveling from South to MidWest. One of the fare classes for this flight has been set at $250. The airline has set aside a capacity of 25 passengers in this fare class. Historical passenger demand for these seats in this fare class has been fit to a normal distribution with mean 27.18 and standard deviation 3.14. If demanded, the airline will typically accept more reservations than the seat capacity since only 90% of all customers who have a reservation show up for the flight. This policy is called overbooking. If the fight is overbooked, anyone who shows up but does not receive a seat on the plane receives $350 in compensation in addition to a full refund of the ticket price. The variable cost of transporting a passenger and his/her luggage on this flight is $100. The fixed cost of operating the flight is $2,500. To maximize expected profit from operating this flight, how many reservations for the flight should this airline accept? Develop a simulation model in the spreadsheet file. What would be the best strategy for the airline? Next A B D E F 25 1 Input Parameters 2 Price $250 3 Capacity 4 Variable Cost $100 5 Fixed Cost $2,500 6 Overbooking Cost $350 7 Demand Mean 27.18 8 Demand Std 3.14 9 Probability of Show Up 90% 10 11 Number of tickets on sale 12 13 Demand 14 15 Number of tickets sold 16 Number of people showed up 17 Number of people flying 18 Number of overbooked tickets 19 20 Revune 21 22 Variable Cost 23 Fixed Cost 24 Overbooking Cost 25 Total Cost 26 Potential Tickets 25 26 27 28 29 30 31 32 33 34 O BI 17 33 Number of people flying Number of overbooked tickets 18 34 19 Revune 20 21 22 23 Variable Cost Fixed Cost Overbooking Cost Total Cost 24 25 26 27 Profit 28 Consider Optijet problem statement and the screenshot above. The screenshot above represents a completed simulaton model. What is in the cell that represents "Demand (C13) I Choose Next 30 31 umber of tickets sold of people showed un nber of people f1 [ Choose f overbooked tic =GenBinomial 32 33 34 =GenPoisson Rei =RANDBETWEEN =GenTable Variable Fixed =GenTriangular Overbooking =MAX Total =simParameter =RAND =GenUniform enshot above represent =Gen Normal lem statement and model. What is in t =MIN =SimOutput [ Choose ] Ne OptiJet Airlines provide daily service for commuters traveling from South to MidWest. One of the fare classes for this flight has been set at $250. The airline has set aside a capacity of 25 passengers in this fare class. Historical passenger demand for these seats in this fare class has been fit to a normal distribution with mean 27.18 and standard deviation 3.14. If demanded, the airline will typically accept more reservations than the seat capacity since only 90% of all customers who have a reservation show up for the flight. This policy is called overbooking. If the fight is overbooked, anyone who shows up but does not receive a seat on the plane receives $350 in compensation in addition to a full refund of the ticket price. The variable cost of transporting a passenger and his/her luggage on this flight is $100. The fixed cost of operating the flight is $2,500. To maximize expected profit from operating this flight, how many reservations for the flight should this airline accept? Develop a simulation model in the spreadsheet file. What would be the best strategy for the airline? NextStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock