Question: Please answer this. The questions are already complete. Scenario 3 Rodger is authorised to provide advice in superannuation, including self-managed superannuation funds (SMSFs), retirement planning,

Please answer this. The questions are already complete.

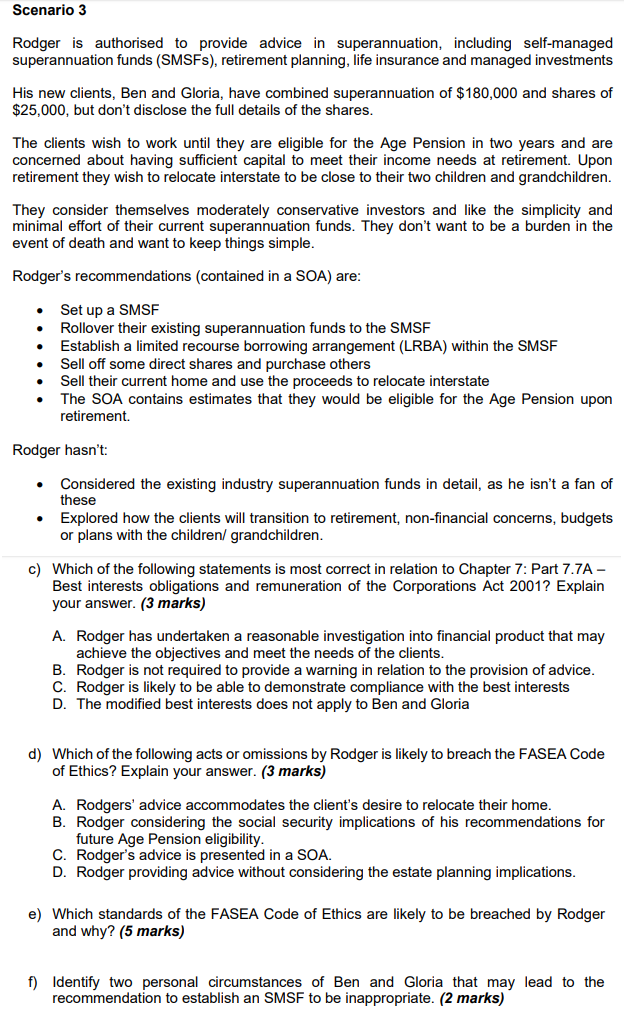

Scenario 3 Rodger is authorised to provide advice in superannuation, including self-managed superannuation funds (SMSFs), retirement planning, life insurance and managed investments His new clients, Ben and Gloria, have combined superannuation of $180,000 and shares of $25,000, but don't disclose the full details of the shares. The clients wish to work until they are eligible for the Age Pension in two years and are concerned about having sufficient capital to meet their income needs at retirement. Upon retirement they wish to relocate interstate to be close to their two children and grandchildren. They consider themselves moderately conservative investors and like the simplicity and minimal effort of their current superannuation funds. They don't want to be a burden in the event of death and want to keep things simple. Rodger's recommendations (contained in a SOA) are: Set up a SMSF Rollover their existing superannuation funds to the SMSF Establish a limited recourse borrowing arrangement (LRBA) within the SMSF Sell off some direct shares and purchase others Sell their current home and use the proceeds to relocate interstate The SOA contains estimates that they would be eligible for the Age Pension upon retirement Rodger hasn't: Considered the existing industry superannuation funds in detail, as he isn't a fan of these Explored how the clients will transition to retirement, non-financial concerns, budgets or plans with the children/ grandchildren. c) Which of the following statements is most correct in relation to Chapter 7: Part 7.7A - Best interests obligations and remuneration of the Corporations Act 2001? Explain your answer. (3 marks) A. Rodger has undertaken a reasonable investigation into financial product that may achieve the objectives and meet the needs of the clients. B. Rodger is not required to provide a warning in relation to the provision of advice. C. Rodger is likely to be able to demonstrate compliance with the best interests D. The modified best interests does not apply to Ben and Gloria d) Which of the following acts or omissions by Rodger is likely to breach the FASEA Code of Ethics? Explain your answer. (3 marks) A. Rodgers' advice accommodates the client's desire to relocate their home. B. Rodger considering the social security implications of his recommendations for future Age Pension eligibility. C. Rodger's advice is presented in a SOA. D. Rodger providing advice without considering the estate planning implications. e) Which standards of the FASEA Code of Ethics are likely to be breached by Rodger and why? (5 marks) f) Identify two personal circumstances of Ben and Gloria that may lead to the recommendation to establish an SMSF to be inappropriate. (2 marks) Scenario 3 Rodger is authorised to provide advice in superannuation, including self-managed superannuation funds (SMSFs), retirement planning, life insurance and managed investments His new clients, Ben and Gloria, have combined superannuation of $180,000 and shares of $25,000, but don't disclose the full details of the shares. The clients wish to work until they are eligible for the Age Pension in two years and are concerned about having sufficient capital to meet their income needs at retirement. Upon retirement they wish to relocate interstate to be close to their two children and grandchildren. They consider themselves moderately conservative investors and like the simplicity and minimal effort of their current superannuation funds. They don't want to be a burden in the event of death and want to keep things simple. Rodger's recommendations (contained in a SOA) are: Set up a SMSF Rollover their existing superannuation funds to the SMSF Establish a limited recourse borrowing arrangement (LRBA) within the SMSF Sell off some direct shares and purchase others Sell their current home and use the proceeds to relocate interstate The SOA contains estimates that they would be eligible for the Age Pension upon retirement Rodger hasn't: Considered the existing industry superannuation funds in detail, as he isn't a fan of these Explored how the clients will transition to retirement, non-financial concerns, budgets or plans with the children/ grandchildren. c) Which of the following statements is most correct in relation to Chapter 7: Part 7.7A - Best interests obligations and remuneration of the Corporations Act 2001? Explain your answer. (3 marks) A. Rodger has undertaken a reasonable investigation into financial product that may achieve the objectives and meet the needs of the clients. B. Rodger is not required to provide a warning in relation to the provision of advice. C. Rodger is likely to be able to demonstrate compliance with the best interests D. The modified best interests does not apply to Ben and Gloria d) Which of the following acts or omissions by Rodger is likely to breach the FASEA Code of Ethics? Explain your answer. (3 marks) A. Rodgers' advice accommodates the client's desire to relocate their home. B. Rodger considering the social security implications of his recommendations for future Age Pension eligibility. C. Rodger's advice is presented in a SOA. D. Rodger providing advice without considering the estate planning implications. e) Which standards of the FASEA Code of Ethics are likely to be breached by Rodger and why? (5 marks) f) Identify two personal circumstances of Ben and Gloria that may lead to the recommendation to establish an SMSF to be inappropriate. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts