Question: Please answer this three questions. TRUE FALSE A forward contract is a private agreement between two parties made over the counter and can be customized

Please answer this three questions.

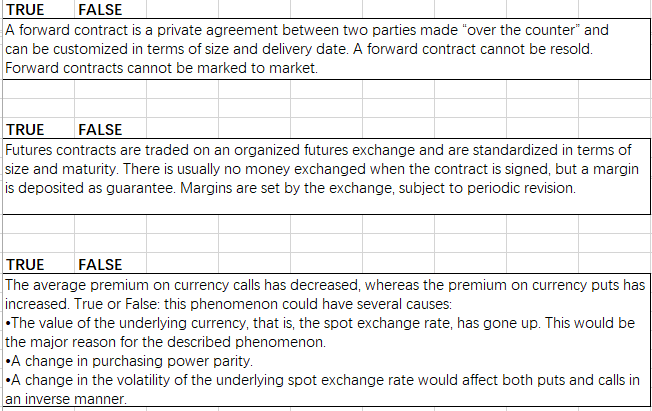

TRUE FALSE A forward contract is a private agreement between two parties made "over the counter" and can be customized in terms of size and delivery date. A forward contract cannot be resold Forward contracts cannot be marked to market. TRUE FALSE Futures contracts are traded on an organized futures exchange and are standardized in terms of size and maturity. There is usually no money exchanged when the contract is signed, but a margin is deposited as guarantee. Margins are set by the exchange, subject to periodic revision TRUE FALSE The average premium on currency calls has decreased, whereas the premium on currency puts has increased. True or False: this phenomenon could have several causes: The value of the underlying currency, that is, the spot exchange rate, has gone up. This would be the major reason for the described phenomenon. A change in purchasing power parity A change in the volatility of the underlying spot exchange rate would affect both puts and calls in an inverse mnanner TRUE FALSE A forward contract is a private agreement between two parties made "over the counter" and can be customized in terms of size and delivery date. A forward contract cannot be resold Forward contracts cannot be marked to market. TRUE FALSE Futures contracts are traded on an organized futures exchange and are standardized in terms of size and maturity. There is usually no money exchanged when the contract is signed, but a margin is deposited as guarantee. Margins are set by the exchange, subject to periodic revision TRUE FALSE The average premium on currency calls has decreased, whereas the premium on currency puts has increased. True or False: this phenomenon could have several causes: The value of the underlying currency, that is, the spot exchange rate, has gone up. This would be the major reason for the described phenomenon. A change in purchasing power parity A change in the volatility of the underlying spot exchange rate would affect both puts and calls in an inverse mnanner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts